Corporations like Alphabet, Microsoft, and Nvidia take in plenty of consideration within the synthetic intelligence (AI) race — the primary two as a result of they spend money on public-facing merchandise, like ChatGPT (Microsoft) and the generative AI chatbot Gemini (Alphabet). And within the case of Nvidia, that is as a result of its indispensable chips and the inventory’s unimaginable efficiency.

However remember about what’s backstage. A lot of smaller, lesser-known firms additionally play key roles in AI improvement. Let’s find out about one in every of them.

Why are knowledge facilities essential?

Nvidia’s current success is because of its knowledge middle income, which reached $22.6 billion final quarter, an astounding 427% year-over-year development fee. Why are knowledge facilities such a giant deal? Information facilities are essential infrastructure that retailer, handle, and course of huge quantities of knowledge. They permit cloud-based functions, e-commerce, and far more.

Listed here are some enjoyable knowledge middle information:

-

There are over 10,000 knowledge facilities globally, with greater than 5,300 within the U.S.

-

The common knowledge middle is round 100,000 sq. ft. Whereas some are small, these constructed by hyperscalers like Amazon, Alphabet, and Microsoft can occupy greater than 1 million sq. ft.

-

The most important U.S.-based knowledge middle, checking in at 4.6 million sq. ft, is positioned in Oregon and operated by Meta Platforms.

-

Specialists count on greater than 120 hyperscale facilities to come back on-line yearly for a decade. One plan, reported by Reuters, is a Microsoft and OpenAI (the creator of ChatGPT) partnership for a $100 billion mission dubbed Stargate.

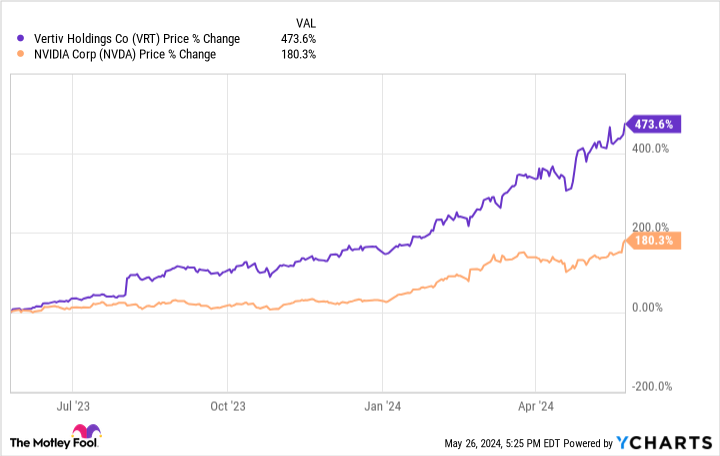

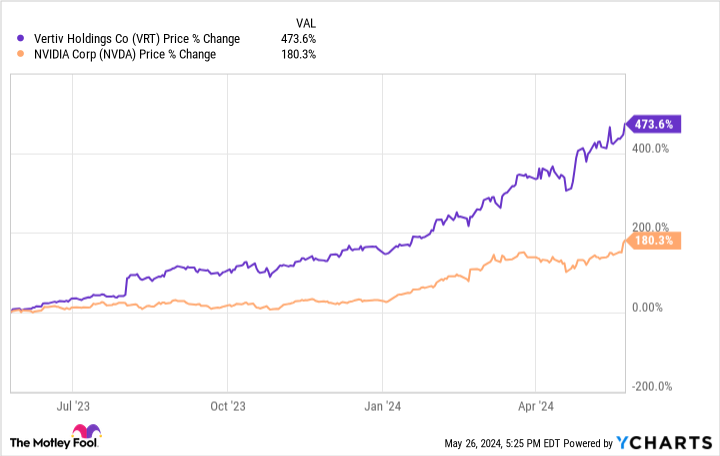

These huge complexes aren’t simply empty vessels with servers stacked inside. They require infrastructure equivalent to racking, enclosures, energy methods, temperature administration elements, switches, software program, and upkeep. Vertiv Holdings (NYSE: VRT) is a number one provider of this infrastructure, and the elevated demand made it one of many market’s hottest shares over the previous 12 months, as proven beneath.

Is Vertiv Holdings inventory a purchase?

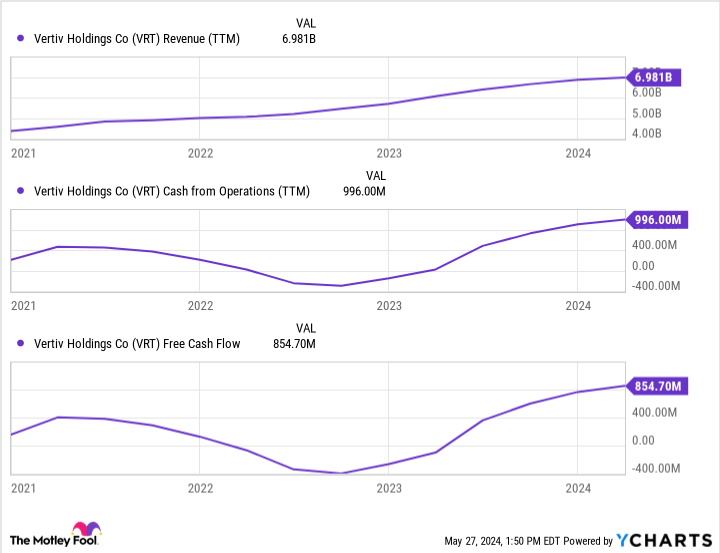

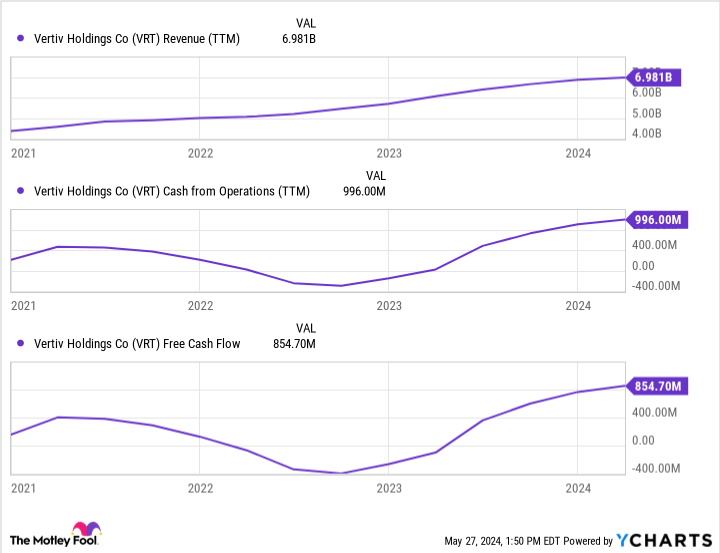

The query is whether or not there’s fuel left within the tank. 2023 was an enormous 12 months for Vertiv. Income rose 20% to $6.9 billion, and margins expanded. Vertiv reported gross and working margins of 35% and 13%, respectively, in comparison with 28% and 4% in 2022. Increasing margins present that Vertiv has pricing energy within the trade as a result of ballooning demand. Additionally they present that the corporate’s enterprise mannequin will turn out to be much more worthwhile because it scales.

Working money movement and free money movement additionally skyrocketed, as proven beneath.

The corporate used $600 million of its money to repurchase inventory within the first quarter of 2024 at a median worth of $66 per share, exhibiting Vertiv’s confidence that its inventory was undervalued. The inventory trades for simply over $100 per share now.

Gross sales for Q1 hit $1.6 billion, an 8% development fee. The expansion does not appear spectacular on the floor; nonetheless, the corporate’s order quantity grew by 60%. Which means prospects positioned 60% extra orders than within the earlier 12 months, and this income will likely be acknowledged in future quarters.

Vertiv additionally reported a book-to-bill ratio of 1.5. Which means for each $1 of gross sales billed to a buyer, Vertiv acquired $1.50 in new orders. Each metrics point out important, sustained development, reinforcing the demand uptrend in knowledge middle infrastructure.

The most important threat for traders in Vertiv is the inventory’s valuation. Its ahead price-to-earnings ratio is close to 45, which appears excessive. However that is not the complete story. Working earnings quadrupled in 2023 over 2022, shifting from $223 million to $872 million, and diluted earnings rocketed from a adverse $0.04 to a constructive $1.19 per share. Vertiv additionally raised its full-year 2024 steering in Q1. In This autumn 2023, the corporate forecast a 23% development in working earnings for 2024. Final quarter, it upped this to twenty-eight%.

Vertiv appears to be like like a superb long-term funding, given its secular tailwinds and worthwhile enterprise mannequin.

Must you make investments $1,000 in Vertiv proper now?

Before you purchase inventory in Vertiv, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for traders to purchase now… and Vertiv wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $671,728!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Could 28, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Bradley Guichard has positions in Alphabet, Amazon, Nvidia, and Vertiv. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

1 AI Inventory Outpaced Nvidia by Almost 300%; Is It Nonetheless a Robust Purchase? was initially printed by The Motley Idiot