Superior Micro Units‘ (NASDAQ: AMD) synthetic intelligence (AI)-fueled rally has come to a screeching halt in 2024. Shares of the chipmaker are down 29% because the starting of March, after they have been buying and selling at a 52-week excessive, and the corporate’s newest outcomes aren’t going to assist arrest the slide.

AMD launched first-quarter 2024 outcomes on April 30, and buyers pressed the panic button. Let’s examine why that was the case.

Outcomes weren’t robust sufficient to justify AMD’s costly valuation

AMD reported Q1 income of $5.47 billion, a rise of simply 2% from the year-ago interval. The corporate’s non-GAAP earnings additionally elevated at a tepid tempo of simply 3% 12 months over 12 months to $0.62 per share throughout the quarter. Analysts have been in search of $0.62 per share in earnings on $5.48 billion in income, which suggests AMD barely met the bottom-line estimate and didn’t fulfill the income expectation.

The steerage did not encourage a lot confidence both. AMD expects second-quarter income to land at $5.7 billion, which might be a year-over-year improve of simply 6%. Although the Q2 income forecast factors towards a slight acceleration in AMD’s progress, Wall Road was anticipating barely larger income of $5.73 billion.

For a inventory that is buying and selling at an costly 218 instances trailing earnings, AMD wanted to ship a lot stronger progress to justify its wealthy a number of. The corporate managed to try this in two of its enterprise segments, that are already reaping the advantages of the proliferation of AI, however weak point within the different two enterprise segments weighed on its monetary efficiency.

Extra particularly, AMD’s gaming income was down 48% 12 months over 12 months to $922 million. This steep decline was a results of poor demand for AMD’s semi-custom chips, that are deployed in gaming consoles from Microsoft and Sony, in addition to weak gross sales of the corporate’s gaming graphics playing cards. The weak point on this section is not shocking, as gross sales of private computer systems (PCs), the place gaming graphics playing cards are deployed, have been weak final 12 months.

Moreover, the video gaming market was flat final 12 months. Nonetheless, market analysis agency Newzoo is forecasting an enchancment in console gross sales this 12 months. So AMD might witness a gradual enchancment in its gaming income because the 12 months progresses.

Then again, the corporate’s income from the embedded section fell 46% 12 months over 12 months to $846 million. AMD’s embedded processors are deployed in a number of industries starting from automotive to industrial to networking to storage, amongst others. AMD factors out that clients are working by their current stock on this market, which explains why the demand for its embedded chips has remained weak of late.

Nonetheless, AMD claims that its design win momentum within the embedded market stays strong, which implies that its embedded processors have been chosen for deployment into extra merchandise sooner or later. As soon as these merchandise go into manufacturing, AMD ought to ideally witness an enchancment within the demand for its embedded processors, particularly contemplating that the corporate claims that its new choices are able to tackling AI workloads sooner than the previous-generation processors.

This brings us to the 2 segments the place AMD is clocking spectacular progress now because of the rising adoption of AI, and that are prone to drive a strong acceleration within the firm’s progress sooner or later.

These companies are benefiting large time from AI adoption

AMD reported document income of $2.3 billion within the knowledge middle enterprise final quarter, a stellar improve of 80% over the year-ago interval. The corporate attributed this eye-popping progress to the booming demand for its AI GPUs (graphics processing items) in addition to server processors.

The chip big factors out that shipments of its MI300X AI accelerators are ramping up strongly, a pattern that is prone to proceed as there are “greater than 100 enterprise and AI clients actively creating or deploying MI300X.” AMD has already offered $1 billion value of those chips prior to now two quarters, and now expects to complete the 12 months with $4 billion in income from gross sales of information middle GPUs.

That factors towards an enchancment within the firm’s quarterly income run fee from the info middle GPU market. It’s also value noting that AMD offered $400 million value of its AI accelerators within the fourth quarter of 2023 when its new AI chips began occurring sale. Additionally, the corporate’s $4 billion income forecast from this section for 2024 is double its unique expectation of $2 billion, and was larger than the $3.5 billion income forecast it issued in January this 12 months.

So AMD’s potential income pipeline from gross sales of AI chips is rising at a pleasant tempo, suggesting that its knowledge middle enterprise might proceed rising going ahead.

In the meantime, AMD’s income within the shopper enterprise was additionally up a powerful 85% over the year-ago quarter to $1.4 billion. The corporate is now witnessing a pleasant turnaround within the demand for its PC processors because of this market’s restoration, in addition to the rising demand for AI-enabled PCs. The corporate is providing devoted AI accelerators on its CPUs, which locations it in a pleasant place to capitalize on the incoming AI PC growth. Within the phrases of CEO Lisa Su:

We see AI as the largest inflection level in PCs because the web with the flexibility to ship unprecedented productiveness and value good points. We’re working very carefully with Microsoft and a broad ecosystem of companions to allow the following technology of AI experiences powered by Ryzen processors with greater than 150 ISVs on monitor to be creating for AMD AI PCs by the top of the 12 months.

With market analysis agency Canalys anticipating AI PC shipments to extend at an annual fee of 44% by 2028, buyers can anticipate AMD’s shopper enterprise to ship strong progress within the coming years.

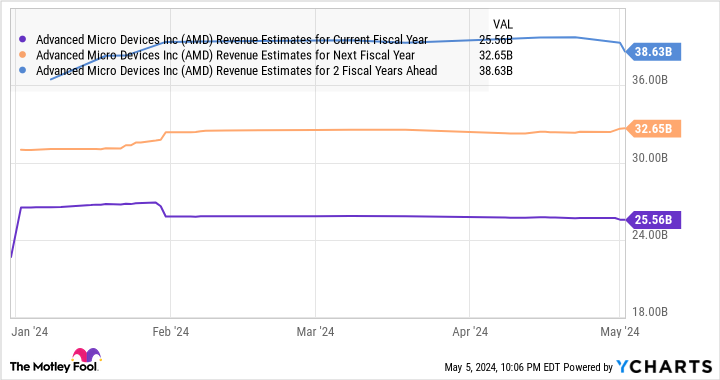

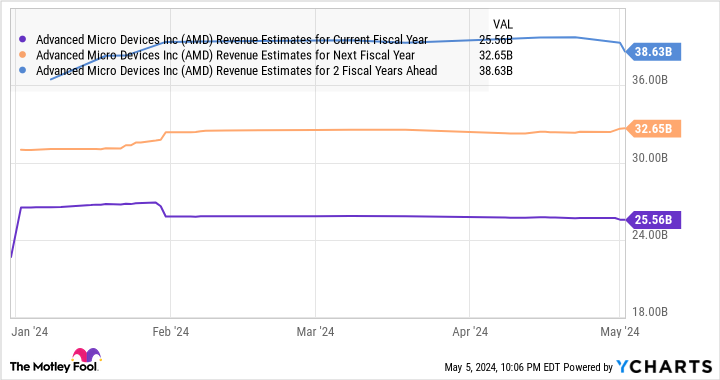

In all, the info middle and the shopper enterprise produced 67% of the corporate’s prime line final quarter. They’re in nice well being proper now and are able to transferring the needle in a much bigger means for AMD because of AI-related catalysts. Throw in a possible turnaround within the different two segments, and it’s straightforward to see why AMD’s top-line progress is predicted to achieve momentum in 2025 and 2026 following an estimated improve of 13% this 12 months from final 12 months’s stage of $22.7 billion.

Even higher, analysts are forecasting AMD’s earnings to extend at an annual fee of 25% for the following 5 years. Which will certainly occur because of the catalysts mentioned above, which implies that AMD’s earnings might hit $8.09 per share on the finish of 2028 (utilizing its 2023 earnings of $2.65 per share as the bottom).

AMD has a five-year common ahead earnings a number of of 33. Multiplying that with the projected earnings in 2028 factors towards a inventory value of $267, a possible improve of 78% from present ranges. That is why buyers would do effectively to make use of AMD’s pullback as a shopping for alternative, as this AI inventory might grow to be a winner in the long term as soon as it begins rising at a sooner tempo.

Must you make investments $1,000 in Superior Micro Units proper now?

Before you purchase inventory in Superior Micro Units, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Superior Micro Units wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $564,547!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Could 6, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

1 Synthetic Intelligence (AI) Inventory Down 29% to Purchase Proper Now Earlier than It Soars 78% was initially revealed by The Motley Idiot