This has been a yr to recollect for shareholders of Palantir Applied sciences (NYSE: PLTR). Buyers endured the ache of the inventory falling to the one digits after the corporate went public. Nevertheless, the technological marvel of synthetic intelligence (AI) breathed life again into the inventory, and the corporate’s repeated quarters of robust efficiency additional fueled market sentiment.

Whereas buyers could understandably fear that the inventory’s 48% transfer since January leaves little meat on the bone, haven’t any worry. Investing typically requires wanting a long time forward, and Palantir could have extra promise than most firms you may encounter.

Right here is why long-term buyers should buy at present and maintain the inventory for many years.

Authorities loyalty underpins Palantir’s enterprise

The web created the digital world we all know at present. Meaning humanity has spent over 20 years creating rising quantities of information at breakneck pace. Roughly 90% of all of the world’s information is from the previous two years. Simply take into consideration how a lot information the world could have in 5, 10, or 25 years!

That is an underrated side of synthetic intelligence (AI), which has emerged as the following evolution of know-how. Information performs an vital position; AI is educated on information, that means organizations with one of the best information and those that do probably the most with it will probably have a aggressive edge.

This straightforward idea is the important thing to understanding Palantir’s large funding potential. The corporate develops and deploys customized information analytics software program through Gotham, Foundry, and AIP platforms. This know-how’s aim is straightforward: seamlessly turning information into actionable, real-time insights.

Palantir could be a conundrum as a result of its complicated product presents little visibility to buyers and outsiders. So, as an alternative, look to who has and continues to lean on Palantir. The U.S. authorities, which flexes its nearly limitless sources to take care of a aggressive edge as a world superpower, has remained loyal to Palantir for over a decade. Palantir’s know-how allegedly helped the U.S. monitor down terrorist Osama bin Laden again in 2011.

The federal government continues to again Palantir at present. Palantir lately acquired a brand new $480 million contract from the Division of Protection. CEO Alex Karp confirmed that the corporate’s know-how is aiding Ukraine in its conflict with Russia. These conditions require cutting-edge instruments, and Palantir’s relevance each then and now ought to give buyers a transparent vote of confidence in how a lot worth its software program brings to the desk.

Unlocking years of upside within the non-public sector

The U.S. authorities and its allies are uniquely outfitted to spend on one of the best of one of the best. That is why it will probably take time for among the authorities’s finest instruments to trickle into the non-public sector. Nevertheless, Palantir is starting to realize momentum with business prospects. That is in the end the place Palantir’s long-term upside lies.

Corporations have begun realizing that AI is essential to compete sooner or later and are scrambling to place themselves accordingly. Palantir launched its AIP platform final spring to assist firms develop and deploy AI purposes. It has been an enormous success. Alex Karp has acknowledged that demand for AIP is unprecedented. Since then, Palantir’s monetary efficiency has given substance to that declare.

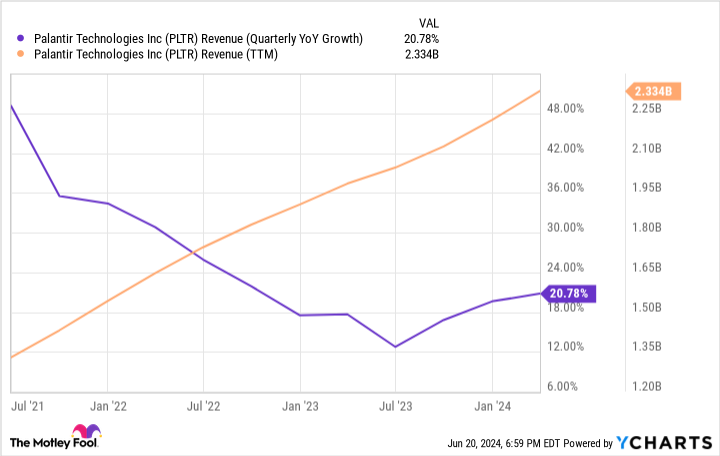

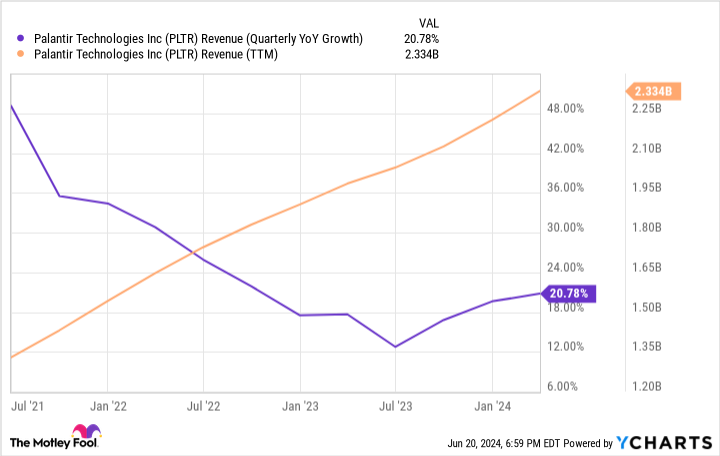

You’ll be able to see under that income development has reaccelerated since AIP launched final yr:

Extra importantly, Palantir’s buyer depend is rising sooner than income, which might sign additional development upside forward as new purposes come on-line. Palantir’s U.S. business buyer depend grew 69% yr over yr in Q1 and stays modest at 262. There are over 20,000 giant companies in the USA alone.

Assume a long time forward

Palantir’s not promoting an off-the-shelf product. It takes time to develop and launch purposes, which signifies that Palantir could by no means exhibit the explosive development of Nvidia. Nevertheless, Palantir seems to be poised for many years of regular double-digit development.

Palantir’s makes use of vary from fraud detection to army operations. Its newest contract with Starlab will see Palantir mannequin a digital clone of an area station to simulate upkeep and take a look at operations. Such versatile know-how makes any firm (giant sufficient to afford the software program) a possible buyer.

Moreover, the corporate is worthwhile based mostly on usually accepted accounting rules (GAAP) and has $3.8 billion in money in opposition to zero debt, making Palantir a candidate to spend years shopping for again inventory and driving funding returns by relentless earnings development.

The place might Palantir be in two or three a long time? Company alternatives alone give Palantir a major runway. The federal government enterprise arguably provides Palantir a excessive ground as effectively. Palantir’s present market cap exceeds $50 billion. Nonetheless, buyers may very well be taking a look at a future mega-cap inventory in the event that they’re prepared to purchase and maintain it for the foreseeable future.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Palantir Applied sciences wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $775,568!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia and Palantir Applied sciences. The Motley Idiot has a disclosure coverage.

1 Good Synthetic Intelligence (AI) Top off 48% in 2024 to Purchase Now and Maintain for A long time was initially revealed by The Motley Idiot