A battle is brewing in an under-followed a part of the synthetic intelligence (AI) trade: chip design software program. A number of merger and acquisition offers have been introduced, and a mega-merger is pending between digital design automation (EDA) chief Synopsys (NASDAQ: SNPS) and Ansys (NASDAQ: ANSS). Shortly after that was introduced, the second EDA software program suite, Cadence Design Programs (NASDAQ: CDNS), revealed its new supercomputing platform for simulating digital programs.

Not desirous to get left behind, Japanese chip producer Renesas (OTC: RNECY) introduced its intention to amass smaller EDA software program supplier Altium (OTC: ALMF.F). Is one thing huge brewing within the AI market?

Renesas appears to be like for a software program increase

Renesas is an built-in gadget producer, an organization that each designs and manufactures semiconductors. It is a hybrid enterprise mannequin that has been making a comeback lately. Moreover Japan rising as a high vacation spot for manufacturing within the East, Renesas can thank the electrical automobile (EV) revolution for its resurgence, in addition to a myriad of different extra mature manufacturing processes (not modern chips for issues like information heart AI) for chips in industrial and energy purposes.

Amongst another smaller acquisitions to bolster its energy chip portfolio, I wrote final yr about Renesas’ cope with Wolfspeed (NYSE: WOLF) to buy silicon carbide (SiC) wafers to be used in next-gen purposes like EV motors.

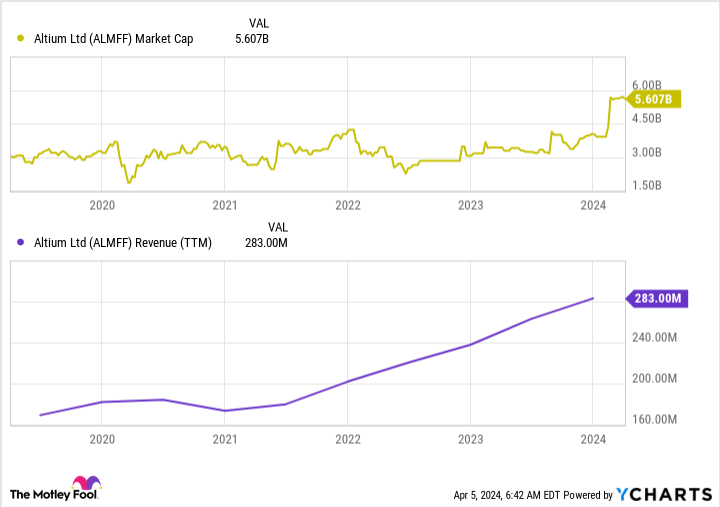

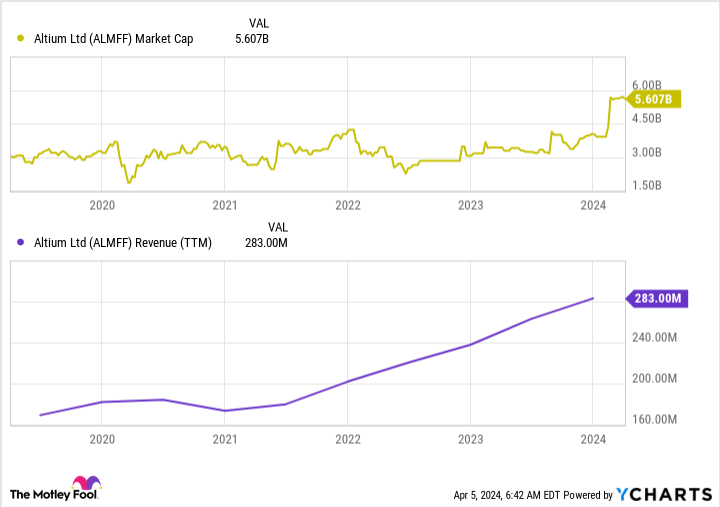

However the buy of Altium, a small competitor to the EDA software program giants Synopsys and Cadence, is one thing else totally. Tiny Australia-based Altium (which, notably, counts Wolfspeed as a chip design buyer) generated income of simply $139 million in U.S. {dollars} within the first half of its present 2024 fiscal yr. And but Renesas can be shelling out A$9.1 billion ($6 billion in U.S. {dollars}, utilizing alternate charges on April 5, 2024). That is a hefty value premium.

Renesas’ said rationale is to spice up the software program and digital device capabilities it affords its purchasers, as a lot of these prospects (automakers, for instance) are non-techies who could need assistance implementing next-gen electronics.

An enormous wave of AI coming?

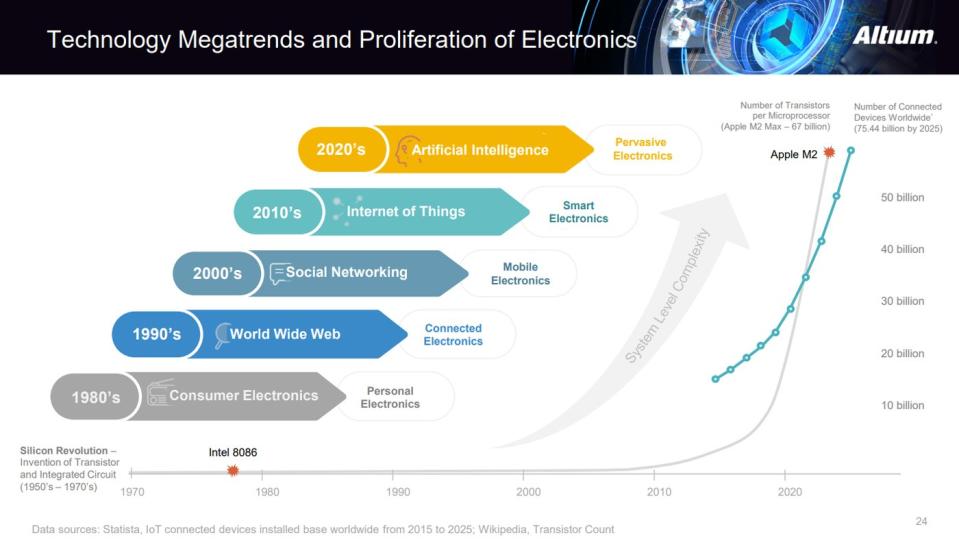

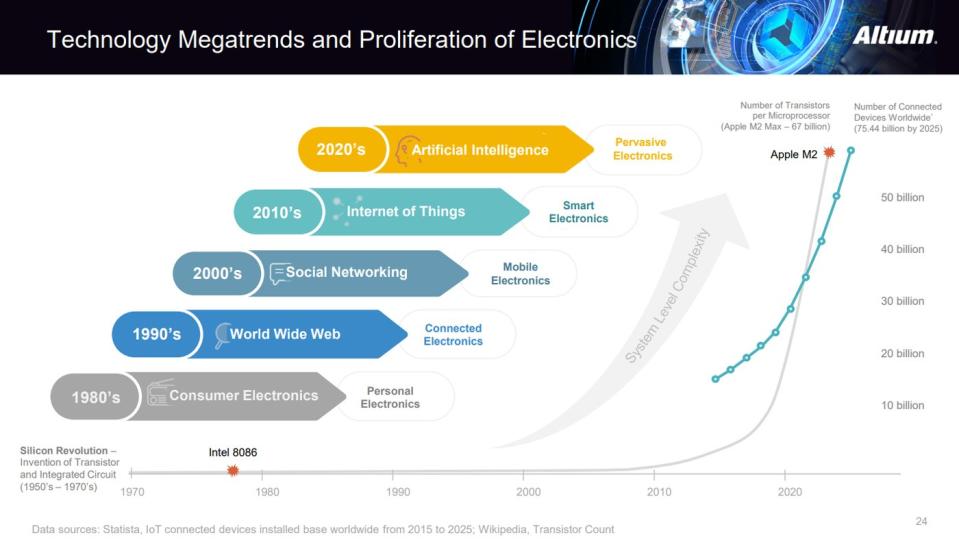

As of proper now, Nvidia‘s (NASDAQ: NVDA) information heart AI programs are all the craze as firms wish to use their information to “practice” new AI programs. However within the decade to observe, all of these AI programs might want to go someplace to ensure that customers to learn from their creation.

That is possible the place Renesas sees large alternative by buying Altium, and competing with Synopsys and Cadence in electronics system design. Semiconductor manufacturing firms have a pathway to sustained development due to buyer curiosity in embedding clever computing programs throughout a broad ecosystem of units, from vehicles to automated manufacturing facility tools to sensible residence units.

All that new AI embedded in units themselves, relatively than housed in information facilities, goes to wish way more refined {hardware}. It is also going to wish extra energy-efficient {hardware}, like the kind Renesas has been engaged on (once more, with the Wolfspeed deal). Renesas may safe itself a seat on the desk for years to come back by combining not simply the chips, but additionally the software program, to make these AI units a actuality.

Renesas could possibly be a hidden development inventory within the AI race. Shares commerce for about 13 instances trailing 12-month earnings and free money movement, a possible discount if it could possibly preserve constructing a head of steam in its semiconductor manufacturing and design enterprise for autos, industrial tools, and shopper electronics.

Do you have to make investments $1,000 in Renesas Electronics proper now?

Before you purchase inventory in Renesas Electronics, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Renesas Electronics wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $539,230!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 4, 2024

Nicholas Rossolillo and his purchasers have positions in Cadence Design Programs, Nvidia, and Synopsys. The Motley Idiot has positions in and recommends Altium, Cadence Design Programs, Nvidia, Synopsys, and Wolfspeed. The Motley Idiot recommends Ansys. The Motley Idiot has a disclosure coverage.

1 Chip Manufacturing Inventory Making a Massive Guess on AI was initially revealed by The Motley Idiot