Whereas there are not any ensures in Wall Road analysts’ value targets, they could be a nice start line to seek out promising investments. One inventory that lately caught my consideration was e-commerce-focused pet retailer Chewy (NYSE: CHWY).

The inventory at present trades at round $16 per share, however Wall Road analysts are fairly upbeat on the inventory, sustaining a median value goal of $31.62. That suggests a 97% upside potential. Just lately, the corporate obtained up to date purchase scores from analysts Eric Sheridan of Goldman Sachs and Trevor Younger of Barclays, who set value targets of $36 and $30, respectively.

After analyzing Chewy’s current outcomes, together with the technique that administration outlined throughout its investor day in December, I am unable to assist however agree with Wall Road. Down 86% from its all-time highs, Chewy seems like an impressive progress inventory to purchase at its present all-time-low valuation.

The No.1 specialty pet retailer within the U.S.

Regardless of solely being based in 2011, Chewy has grown to account for roughly one-third of the net pet retail market, producing over $11 billion in gross sales over the previous yr. Tripling its gross sales and practically doubling its active-customer base to twenty.3 million since its preliminary public providing (IPO) in 2019, Chewy’s operations have been booming.

Nevertheless, following a pandemic-aided spike that noticed income rise by 50% in 2021, the corporate’s gross sales progress decelerated to simply 8% in its most up-to-date quarter. This dramatic slowdown explains the market’s souring perspective towards the inventory, however quite a few causes for pleasure concerning the enterprise’s progress potential stay.

First, Chewy operates in an extremely resilient $144 billion pet retail trade that’s anticipated to develop by 6% yearly by 2027. Whereas current revenue-growth figures have been dipping, they need to start to stabilize.

To assist quantify the steadiness within the firm’s gross sales figures, think about that 85% of its income comes from non-discretionary consumables and healthcare merchandise. These required (and sometimes repeating) gross sales assist clarify how Chewy generates a powerful 76% of its income from prospects utilizing Autoship, the corporate’s recurring-purchases service. Rising by 13% within the third quarter, Autoship continues to rise quicker than Chewy’s total income progress, offering sticky, constant gross sales.

Second, Chewy’s healthcare unit has continued flourishing, growing from $1 billion in gross sales in 2018 to $3 billion final yr — now equaling practically 30% of complete income. Comprised of pet medicines, insurance coverage, PetMD, telehealth, and administration system for veterinarians, this unit goals to assist the corporate develop into a one-stop store for something pet-related. These healthcare operations are important as they command margins 10 proportion factors larger than the retail unit whereas attracting high-value prospects prepared to go above and past for his or her furry pals.

Capping issues off, Chewy continues to construct out its non-public label and promoting gross sales — two further higher-margin items. At the moment accounting for round 5% of gross sales, these private-label manufacturers are anticipated to develop to fifteen% of the corporate’s income over the long run. Non-public label objects preserve margins seven proportion factors larger than nationwide manufacturers, providing the potential for Chewy to additional juice its backside line.

Equally, the corporate launched its sponsored adverts possibility lower than a yr in the past, which administration believes ought to ship gross-profit margins of round 70% — additional boosting its income.

Regardless of spending on progress areas, margins proceed to enhance

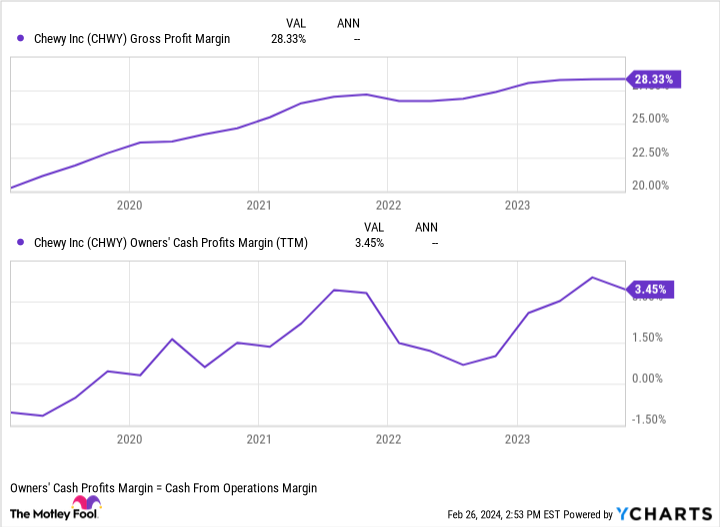

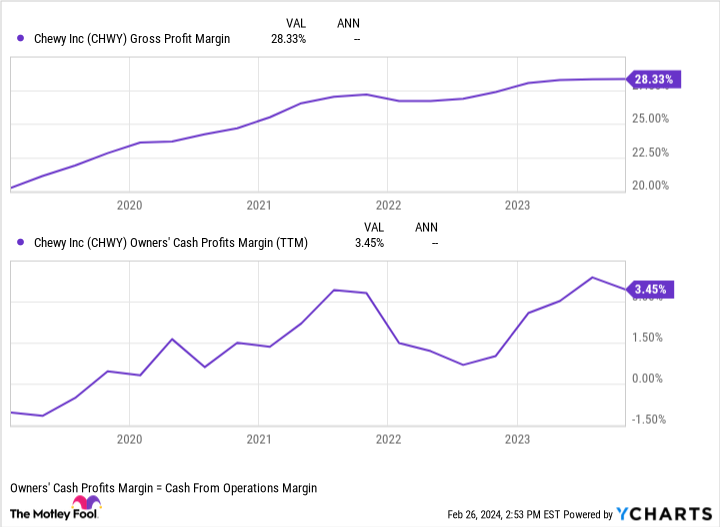

Maybe essentially the most crucial portion of a bullish funding thesis on Chewy is its bettering margins. Propelled by the higher-margin progress areas talked about above in healthcare, private-label manufacturers, and advert gross sales, the corporate is streamlining its operations regardless of testing new progress concepts.

CHWY Gross Revenue Margin information by YCharts.

Steadily growing its gross-profit margin as its logistics inch nearer towards peak efficiencies, Chewy has turned the nook on producing constant constructive money movement from operations (CFO). Even accounting for stock-based compensation, Chewy’s CFO has remained constructive during the last two years, permitting the corporate to fund its progress ambitions in-house.

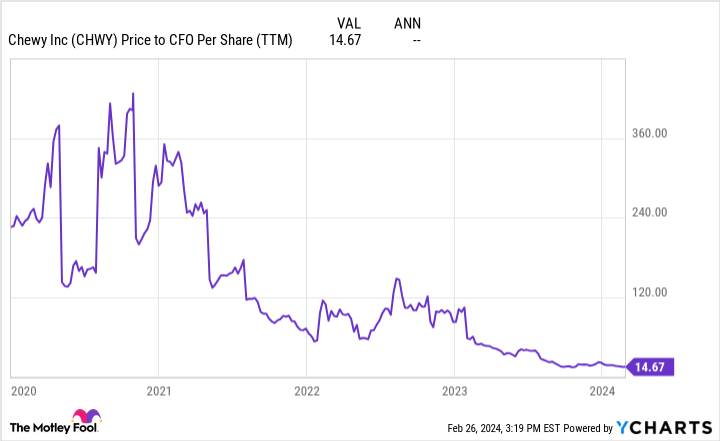

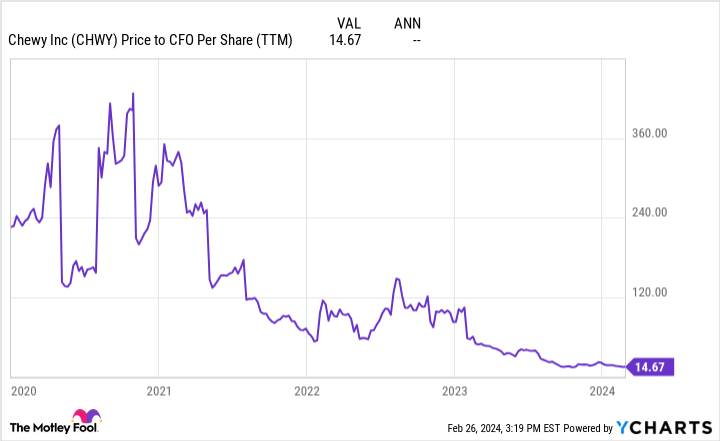

An all-time-low valuation

Most significantly for traders, even with Chewy’s outsized non-discretionary gross sales, promising progress choices, and bettering margins, its price-to-CFO (P/CFO) ratio sits at an all-time low.

This diminutive P/CFO ratio seems enticing, contemplating its behemoth e-commerce peer, Amazon, holds a ratio of twenty-two regardless of being rather more mature. Finest but, Chewy is nowhere close to optimized for max money technology because it solely lately exited its hypergrowth section. With administration anticipating its CFO margin of three.5% to roughly double over the long run as Chewy’s operations attain larger efficiencies, its P/CFO a number of of 15 seems even cheaper.

Combining all these elements — to not point out the corporate’s No. 1 rating on Forrester’s Buyer Satisfaction Index — Chewy seems like a stellar funding so as to add to your portfolio at these discounted costs and maintain for many years.

Do you have to make investments $1,000 in Chewy proper now?

Before you purchase inventory in Chewy, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Chewy wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 26, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Josh Kohn-Lindquist has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Chewy, and Goldman Sachs Group. The Motley Idiot recommends Barclays Plc. The Motley Idiot has a disclosure coverage.

1 Development Inventory Buying and selling at an All-Time-Low Valuation That Might Rise by 97%, In accordance with Wall Road was initially revealed by The Motley Idiot