In case you’re holding shares of Walgreens Boots Alliance (NASDAQ: WBA) in hopes of it turning round promptly, I believe that now’s the time to chop your losses on the struggling pharmacy chain and allocate your capital elsewhere. Here is why.

A typical investing thesis for this inventory is now useless

One of many standards that may assist an investor resolve when to promote a inventory is whether or not the investing thesis they shaped as a rationale for getting the inventory continues to be legitimate.

Let’s assume you got Walgreens inventory 10 years in the past, anticipating it to be a protected inventory that generates regular and rising dividend earnings, and modest share-price appreciation. You could have additionally anticipated that its line of enterprise, offering retail pharmacy companies, would maintain up comparatively nicely over time even when the world modified lots.

However that thesis hasn’t performed out as deliberate.

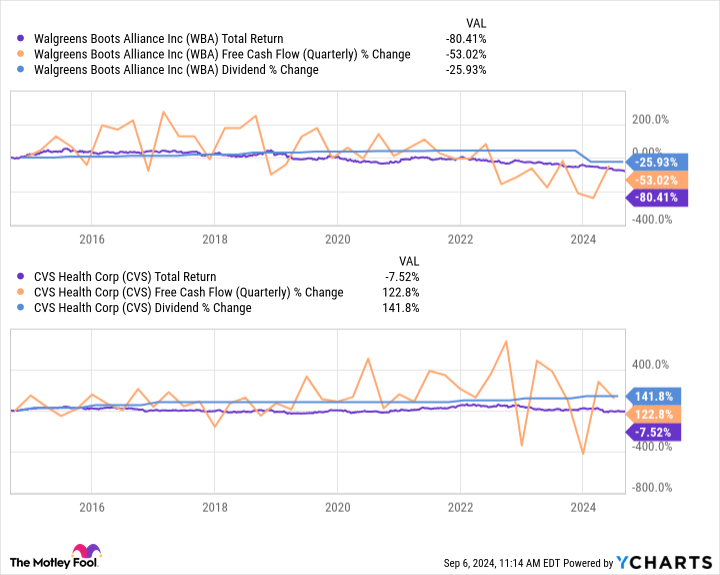

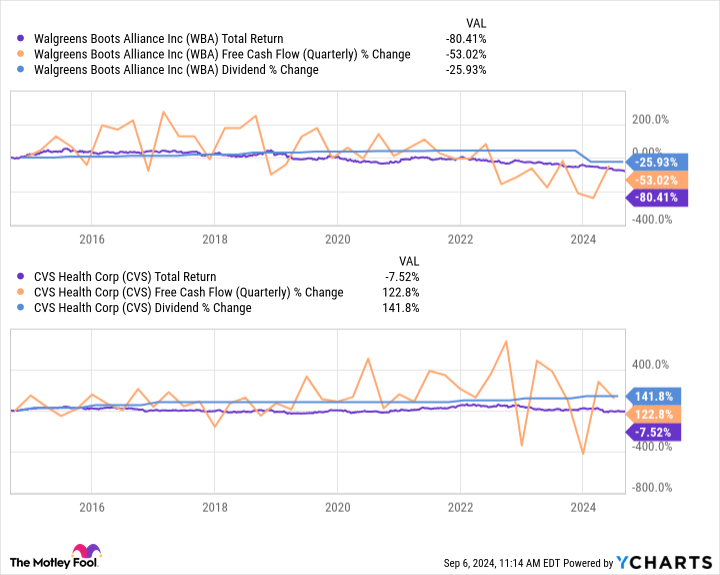

Up to now 10 years, the full return of the inventory has declined by simply over 80%. In the identical interval, quarterly free money circulate (FCF) has dwindled by 53% to only $327 million. In early January of this 12 months, Walgreens slashed its quarterly dividend by 48% in comparison with the prior quarter, to $0.25 per share.

And within the trailing-12-month interval alone, the corporate spent almost $27 billion on debt reimbursement, denying the usage of that capital for progress initiatives or for returning it to shareholders.

So, to recap: It wasn’t a protected funding, it did not provide constant dividend earnings, and although individuals nonetheless must go to a pharmacy to get their prescriptions, that issue apparently hasn’t been related to preserving the inventory’s worth.

Moreover, it’s not the case that the pharmacy business as an entire has struggled, which might at the very least be a comfort for the inventory’s underperformance. Walgreens’ greatest competitor, CVS Well being, noticed the full return of its shares decline by round 4% within the final 10 years whereas its quarterly FCF and dividend soared. Check out this chart:

So what’s sinking Walgreens? Its core prescription-filling section continues to carry up comparatively nicely, increasing the variety of prescriptions (excluding immunizations) stuffed by 1.7% 12 months over 12 months as of its fiscal third quarter (which ended Might 31).

However gross sales of nonprescription healthcare items are softening, as are prescription reimbursements from insurers. The increase the corporate bought because the economic system reopened in 2021 is now gone. Extra importantly, its bid to diversify into offering main care is dear and though not a money-burner any extra, continues to be nowhere near contributing sufficient to prop up the highest or backside line.

There isn’t any concrete hope for salvation on the horizon. The one path ahead within the close to time period shall be for Walgreens to proceed promoting off its investments and different belongings to service its debt, whereas trimming working prices and pushing its most worthwhile segments ahead. Such strikes might trigger it to go away some income on the desk. And its whole belongings will doubtless proceed to shrink, which can drag the share worth down extra.

Even in case you’re affected person, it is time to promote

It is true that Walgreens might salvage itself over the subsequent decade or extra. Ultimately its main care section might be a formidable revenue heart. And its retail pharmacy section might develop into environment friendly once more, with sufficient time.

However there is not a lot proof of these processes getting very far past the beginning line but. Nor are shareholders obligated to hold round after their investing thesis is invalidated, whatever the exact causes.

Due to this fact, I believe the perfect transfer is to promote the inventory now. Even in case you’re optimistic a few restoration — and it is onerous to see why in the meanwhile — extra downward motion of the inventory might be looming. It is safer to again out now, after which return later in case you detect the seedlings of a restoration.

Do you have to make investments $1,000 in Walgreens Boots Alliance proper now?

Before you purchase inventory in Walgreens Boots Alliance, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Walgreens Boots Alliance wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $652,404!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 9, 2024

Alex Carchidi has no place in any of the shares talked about. The Motley Idiot recommends CVS Well being. The Motley Idiot has a disclosure coverage.

1 Healthcare Inventory to Promote Now and By no means Look Again was initially revealed by The Motley Idiot