Amazon is likely one of the best-performing shares of all time. The e-commerce and know-how big is up over 1,000x since going public by profiting from the large client shift from in-person to on-line procuring (amongst different issues).

It’s nonetheless an amazing enterprise, however at a market capitalization of $1.9 trillion it’s extremely unlikely to duplicate the returns of the final couple of a long time. This can be disappointing for brand spanking new traders who’ve missed the boat on most of Amazon’s positive aspects. However what if I advised you traders might personal shares within the subsequent Amazon out of East Asia?

Enter Coupang (NYSE: CPNG). The South Korean e-commerce big is taking its house nation by storm and increasing to new markets. Here is why it may very well be a once-in-a-generation funding alternative at at this time’s value.

The Amazon of South Korea

Based in 2010 as a Groupon clone, Coupang pivoted to copying Amazon‘s enterprise mannequin however catered to the South Korean market. It has a whole lot of similarities to Amazon’s retail operations — a subscription membership, vertically built-in delivery, video streaming — in addition to issues that assist it win within the small Asian nation. For instance, it permits clients to go away reusable return bins exterior their doorways to return packages, that are picked up by Coupang drivers.

It’s these kind of buyer worth propositions which have elevated Coupang as a number one e-commerce platform in South Korea. Final quarter, it generated $7.1 billion in income, up 23% 12 months over 12 months on a overseas foreign money impartial foundation and excluding its acquisition of Farfetch. With the expansion of its third-party market for different e-commerce retailers, gross revenue is rising a lot faster and was up 27% final quarter excluding Farfetch.

These progress charges are a lot quicker than your entire e-commerce market in Coupang. There’s round $500 billion in retail spending in South Korea annually, giving Coupang a whole lot of runway to develop if it could persuade extra clients to undertake its providing for issues like meals supply and groceries.

Growth into Taiwan?

Coupang has loads of runway left to develop in South Korea, however this isn’t a large market like america or China. Fortunately, administration is forward-thinking and has been testing other ways to develop into different Asian areas with rich sufficient customers who can spend cash on an e-commerce platform. It just lately landed on Taiwan as a spot for main funding.

Within the area, it’s organising infrastructure to duplicate the vertically built-in providing it has in South Korea and seeing robust preliminary progress. Income in Coupang’s “growing choices” phase grew 143% 12 months over 12 months excluding Farfetch, with most progress coming from Taiwan. The market is small and unprofitable proper now however with near 25 million folks dwelling on the island nation, there’s a huge alternative for Coupang to develop its e-commerce platform exterior of Korea.

The inventory is reasonable for affected person traders

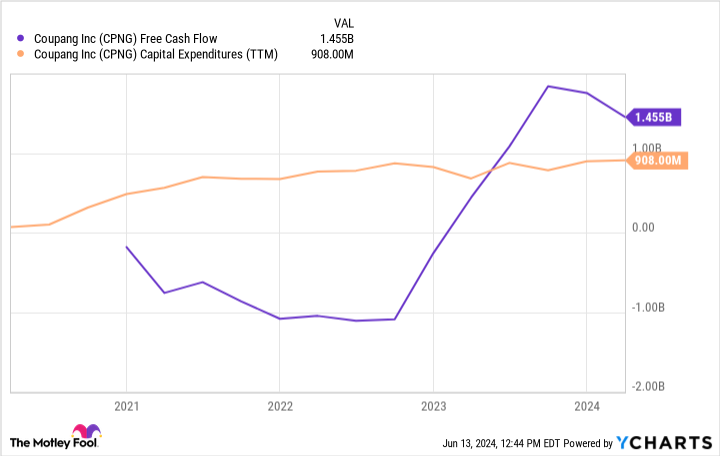

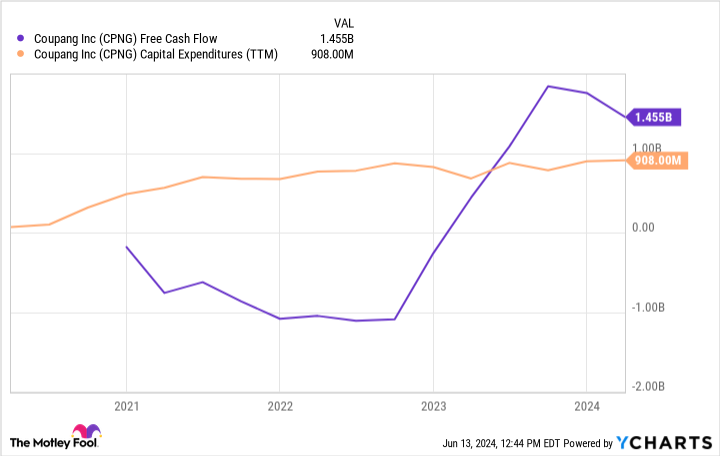

Right now, Coupang trades at a market capitalization of $38 billion. During the last 12 months, it has generated $1.45 billion in free money move for a trailing price-to-free-cash-flow (P/FCF) ratio of 26, which is near the market common. Nonetheless, I believe the inventory is ready as much as ship better-than-market returns over the subsequent 5 years and past.

First, the corporate’s free money move is depressed because of all the expansion capital expenditures during the last 12 months, particularly in Taiwan. It has spent near $1 billion on new infrastructure over that point. Additionally it is rising quicker than the market common with 30%-plus gross revenue progress. That stage of progress is not going to proceed without end, however I believe the corporate is poised to develop at a double-digit fee for a few years into the longer term.

At an earnings a number of across the market common, I believe Coupang is an affordable inventory for affected person traders keen to carry for the long run.

Do you have to make investments $1,000 in Coupang proper now?

Before you purchase inventory in Coupang, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Coupang wasn’t one in every of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $808,105!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Brett Schafer has positions in Amazon and Coupang. The Motley Idiot has positions in and recommends Amazon and Coupang. The Motley Idiot recommends United Parcel Service. The Motley Idiot has a disclosure coverage.

A As soon as-in-a-Era Funding Alternative: 1 Excessive-Development E-Commerce Inventory to Purchase Now and Maintain Endlessly was initially printed by The Motley Idiot