Shares of World Industrial (NYSE: GIC) have gotten off to a tough begin to this point in 2024, with the corporate’s share value sliding 33% from its 52-week highs.

The New York-based firm distributes upkeep, restore, and operations (MRO) merchandise to a diversified base of over 400,000 industrial prospects — a lot of them small and medium-size companies (SMBs). The corporate has seen natural gross sales development gradual over the past two years, with these extra weak prospects battling inflation and better rates of interest.

Nevertheless, after the latest share value decline, it might be a major time to think about shopping for shares of the regular distributor. This is why.

World Industrial’s success in its area of interest

Whereas it’s almost unattainable to keep away from cyclicality within the industrial sector, World Industrial’s give attention to the MRO merchandise area of interest makes it barely extra constant over time. The corporate sells a wide selection of merchandise wanted for on a regular basis operations, together with storage and shelving, materials dealing with, janitorial and upkeep, security and safety, furnishings and work benches, pallet carts, and extra.

Principally, World Industrial sells any massive and ponderous MRO merchandise that you can think of — and because of the repeat purchases inherent in all these merchandise (over a number of years), the corporate’s 90% buyer satisfaction price retains these recurring transactions flowing in. It has been specializing in making the shopping for course of as simple as potential for purchasers — totally 60% of its gross sales are generated on its e-commerce channel.

What actually units World Industrial aside as an funding, nonetheless, is that it generates 50% of its gross sales from private-label merchandise. This stuff have a tendency to provide margins which can be 15% to twenty% larger than nationwide manufacturers, making them vastly necessary to the corporate.

Cheaper than branded merchandise, these private-label choices are sometimes no-brainer alternatives for purchasers, as most MRO merchandise are standardized, and a model title is not important. This personal label area of interest grew by 16% yearly over the past 5 years, and continues to steer World Industrial’s development.

The corporate presently accounts for less than 2% of the extremely fragmented SMB MRO market, so its development story ought to nonetheless be in its early chapters — particularly because it strikes into new product verticals like healthcare, hospitality, and pneumatics.

Whereas World Industrial’s natural gross sales development solely clocked in round 4% to five% over the past two quarters as its SMB prospects reined in spending and industrial spending remained tender, its latest acquisition of Indoff may reignite development. Producing a return on invested capital (ROIC) of 28% over the past 12 months, the corporate has confirmed able to creating outsize income in comparison with its debt and fairness.

This is why I feel including Indoff to its operations may enhance these ROIC figures.

Integrating the $73 million Indoff acquisition

In 2023, World Industrial paid $73 million to accumulate Indoff, a business-to-business distributor of business interiors, materials dealing with merchandise, and different MRO merchandise. Recording gross sales of $180 million in 2022, Indoff’s valuation at acquisition was a mere 0.4 instances gross sales, and it instantly lifted World Industrial’s income by roughly 15%.

Whereas Indoff’s gross margin of 23% is effectively beneath World Industrial’s 34% mark, its mission administration and set up capabilities assist the mixed firm develop the service choices it has accessible for its prospects within the MRO business.

In only one 12 months of Indoff’s integration, its gross revenue margin has already improved by 150 foundation factors. Greatest but, this margin ought to proceed rising as World Industrial brings its e-commerce capabilities over to Indoff whereas additionally rising the acquired firm’s suite of private-label merchandise.

Although World Industrial’s earnings per share (EPS) has dipped barely because the acquisition attributable to normal integration prices, the corporate ought to see EPS restart its development over the subsequent few quarters as these synergies proceed bettering. This future EPS development might be one thing for buyers to observe intently within the coming months.

Why purchase World Industrial now?

At the moment, World Industrial shares commerce with a price-to-earnings (P/E) ratio of 17 and a price-to-free-cash-flow (P/FCF) ratio of 14.

By comparability, the S&P 500 index trades at a median of 25 instances earnings. Utilizing a reduced money circulation mannequin, we will discover that the corporate solely must develop by 4% yearly over the subsequent decade to justify its present share value. With the corporate having grown gross sales by 8% yearly over the past 5 years, this required development price of 4% appears extraordinarily manageable.

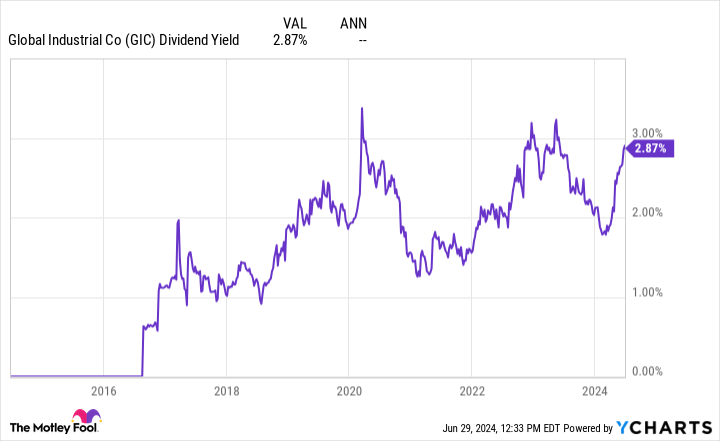

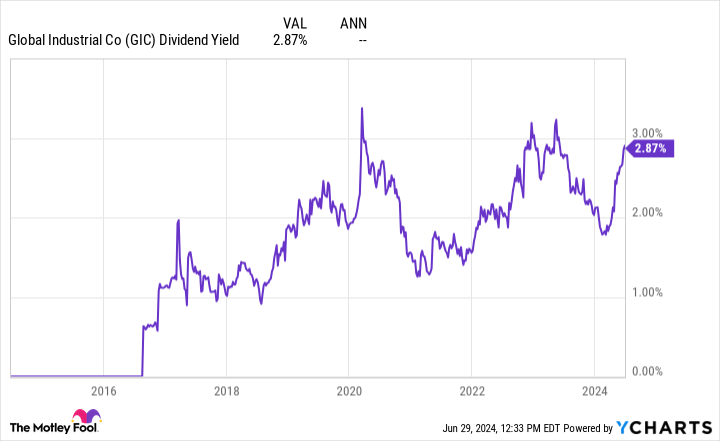

Greatest but for buyers, World Industrial’s dividend yield of two.9% sits close to all-time highs. And regardless of rising its investor-friendly dividend by 14% yearly over the past 5 years, it solely makes use of 46% of its internet earnings to fund these funds, leaving an extended runway for future payout will increase.

Finally, the market has World Industrial priced to barely hold tempo with inflation. However, World Industrial’s success in its steady area of interest, its sturdy ROIC paired with a shrewd urge for food for acquisitions, and its rapidly rising dividend make the corporate a wonderful inventory to purchase at its discounted value and maintain without end.

Do you have to make investments $1,000 in World Industrial proper now?

Before you purchase inventory in World Industrial, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and World Industrial wasn’t considered one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $751,670!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 2, 2024

Josh Kohn-Lindquist has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

1 Magnificent Dividend Inventory Down 33% to Purchase and Maintain Endlessly was initially revealed by The Motley Idiot