Identification verification specialist Clear Safe (NYSE: YOU) is a shining instance of why it’s usually higher for traders to attend a number of quarters after an organization’s preliminary public providing (IPO) earlier than shopping for its inventory. After it debuted in June 2021 at $31, it spiked above $60 per share in its first few weeks of buying and selling. However since then, it has dropped by almost 70% from its peak.

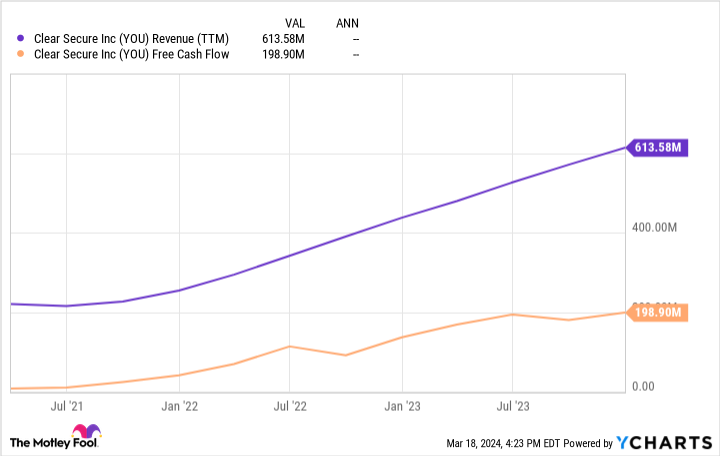

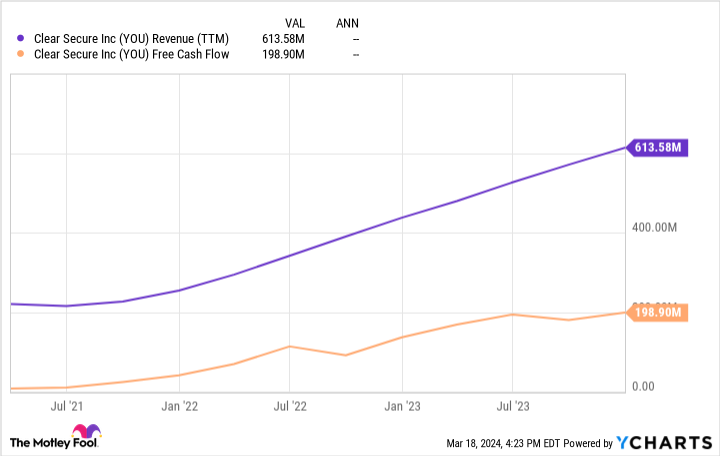

Nonetheless, the fantastic thing about being affected person on this state of affairs is that not solely is the inventory out there at a a lot cheaper price now, however the firm has dramatically improved its operations. It has grown its income by 166% since 2021 and achieved a sturdy 33% free-cash-low (FCF) margin in 2023. Clear Safe additionally pays a dividend that on the present share value yields 1.2%.

With id safety poised to turn into more and more essential in at present’s tech-dense world, here is why Clear Safe is poised to soar larger.

Meet Clear Safe

Based in 2010, Clear Safe now serves 20 million members — a determine that grew by 33% in 2023. Its app lets customers enroll on its platform utilizing their driver’s license (or passport) and a selfie to be biometrically verified in every single place within the Clear ecosystem afterward. For instance, free customers can enter their flight quantity to combine all of their flight’s information (gate numbers, strolling instances, or Uber pick-up timing) and even reserve a devoted time slot to undergo safety at an airport.

Nonetheless, the corporate is extra well-known for the devoted entry lanes it supplies to its 6.7 million Clear Plus members at 56 airports in the US (and 20 extra globally). For $189 a yr, Plus members pace by way of these precedence lanes because of their pre-verified standing. This time-saving profit is taken into account a no brainer worth for thousands and thousands of frequent flyers, which helps clarify its 23% membership development charge within the fourth quarter of 2023.

However that is solely a portion of Clear Safe’s streamlining capabilities on the airport. Not too long ago, the corporate partnered with the Transportation Safety Administration (TSA), launching its TSA PreCheck Enrollment Supplied by Clear, additional permitting flyers to zip by way of the airport.

After finishing their PreCheck enrollment, members pay $1.30 a month to obtain expedited safety screening whereas getting “to maintain their coat and sneakers on and their laptop computer of their bag,” as Chief Government Officer Caryn Seidman-Becker put it. At the moment solely launched in Newark, this new partnership is a major alternative for Clear Safe, as the 2 complementary companies provide immense cross-selling potential as they proceed rolling out in new airports.

Greatest but for traders — Clear Safe’s id community isn’t just for airports. the corporate has precedence lanes at 19 sports activities and leisure arenas. Transferring the corporate’s identity-verification prowess from airports to stadiums and different venues seems to be like a pure development alternative for the corporate. As its two-sided community of members and enterprise companions retains rising, it ought to develop ever extra sturdy, as it is going to turn into extra helpful each for the venues and their clients.

Free money stream galore fuels a rising dividend

As promising as Clear Safe’s development into new airports and verticals is, traders could also be extra impressed with its unbelievable money technology. Boasting a 33% FCF margin, the corporate has not solely reached breakeven, however morphed into a real money cow.

Because of its booming FCF figures (and the proceeds from its IPO), the corporate’s money stability has grown to over $700 million, but it carries a diminutive market capitalization of $1.8 billion.

These stunning totals spotlight that roughly 40% of Clear Safe’s worth is the surplus money sitting on its books — which means it has ample funds for dividends and share repurchases. The corporate solely has to make use of about 17% of its FCF to fund its payout on the present stage, leaving it with loads of capability for dividend hikes.

Moreover, with $125 million remaining on its present share repurchase authorization, administration will probably proceed shopping for again inventory whereas it is buying and selling at a wildly low cost price-to-FCF ratio of 9.

Clear Safe’s deeply discounted valuation

Clear Safe’s valuation can be extra acceptable for a failing inventory, although administration forecasts 30% development for gross sales and FCF in 2024.

This mix of excessive anticipated development charges and a deeply discounted inventory valuation may act like a coiled spring that propels the corporate’s share value upward. Whereas a few of Clear Safe’s low cost pricing may stem from privateness issues tied to the biometric information it shops, the Division of Homeland Safety has licensed its info safety program with the very best doable security ranking.

As with all cybersecurity-related firm, this pristine security ranking is essential to keep up lest the corporate lose the belief of its clients (and thereafter the market) from breaches just like what occurred with its peer, Okta. Nonetheless, because of Clear Safe’s mixture of excessive development charges, growth potential, immense profitability, and low cost valuation, I am blissful to simply accept this added (and unavoidable) little bit of danger and purchase shares of this good dividend inventory.

Must you make investments $1,000 in Clear Safe proper now?

Before you purchase inventory in Clear Safe, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Clear Safe wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 25, 2024

Josh Kohn-Lindquist has positions in Clear Safe. The Motley Idiot has positions in and recommends Clear Safe and Uber Applied sciences. The Motley Idiot has a disclosure coverage.

1 Magnificent Dividend Inventory Down 69% to Purchase Earlier than It Soars was initially revealed by The Motley Idiot