Usually, buyers searching for dividend development would not look forward to finding it in the actual property funding belief (REIT) sector. However typically there are gems that get ignored as a result of they do not conform to the norms. Rexford Industrial Realty (NYSE: REXR) is simply such a genre-defying inventory. Listed below are three explanation why that is one magnificent high-yield dividend development inventory you will need to contemplate shopping for and holding without end.

1. Rexford’s yield is enticing

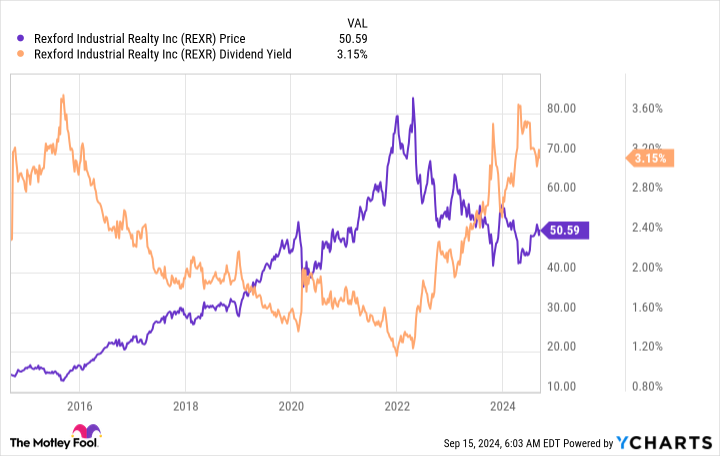

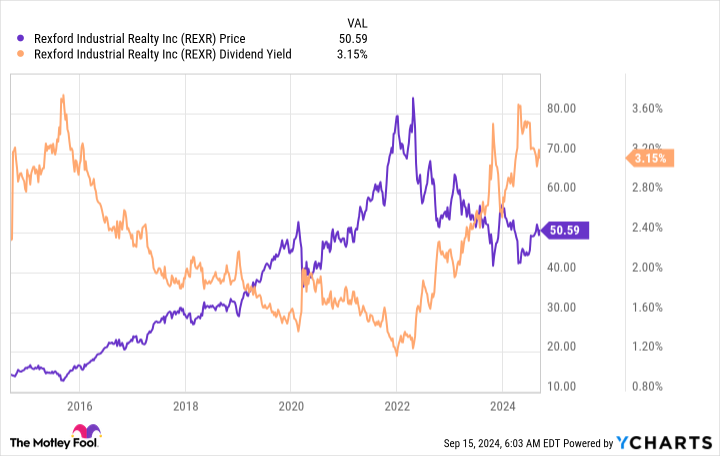

To get the unhealthy information out first, Rexford Industrial’s yield is a little bit beneath common for a REIT. Rexford’s dividend yield is 3.3% whereas the common REIT has a yield of roughly 3.7%. Nevertheless, while you evaluate Rexford to the broader market, it seems loads higher. That 3.3% yield is almost 3 times bigger than the S&P 500 index’s paltry 1.2% yield.

And, due to a dramatic pullback in Rexford’s inventory value, the dividend yield can also be close to its highest ranges of the last decade. So you could find higher-yielding REITs, however Rexford’s yield nonetheless seems pretty enticing on each an absolute foundation and relative to its personal historical past.

2. Rexford’s dividend development is vastly enticing

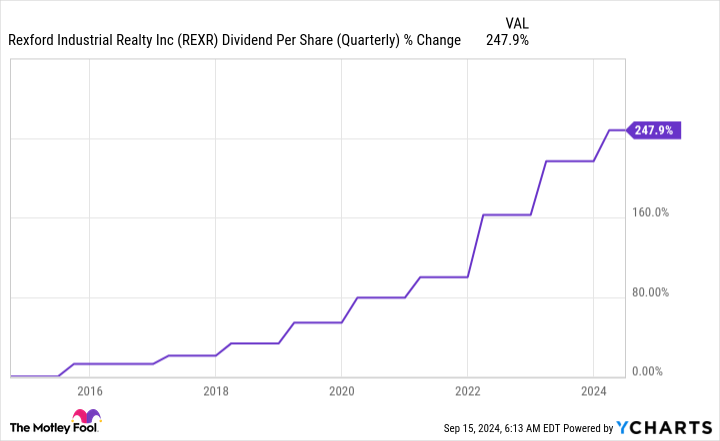

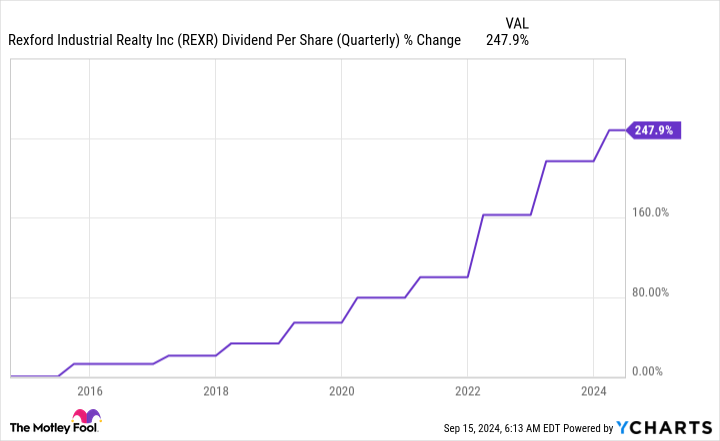

You may’t simply take a look at Rexford Industrial’s yield and name it a day. The REIT’s most spectacular dividend statistic is the speed of dividend development it has achieved over the previous decade. REITs are generally called sluggish and regular growers; a mid-single-digit dividend development fee is normally thought-about fairly good. Rexford’s dividend expanded at an annualized fee of 13% over the previous decade. That may be an enormous quantity for any firm however is downright phenomenal for a REIT.

Whenever you add the dividend development to the yield, it turns into clear that Rexford is a really enticing development and earnings inventory. In truth, over roughly the previous 10 years the dividend has grown from $0.12 per share per quarter (in 2013) to $0.4175 per share (in 2024). That is an almost 250% leap, one thing that virtually any dividend investor would respect.

3. Rexford’s enterprise mannequin is differentiated

Rexford is an industrial REIT, which is not notably particular in any manner. Nevertheless, it has a novel geographic focus that units it other than its friends. Not like most industrial REITs, which concentrate on diversification, Rexford has gone all in on the Southern California market. That is proper — it solely invests in a single area of america. There’s a clear danger on this strategy, however given the corporate’s sturdy dividend historical past, the wager administration has made is paying off.

That is truly not too surprising in the event you step again and look at the Southern California market. It’s the largest industrial market in america and ranks because the No. 4 market globally. Notably, it is a crucial gateway for items coming to North America from Asia. Being an important cog within the international provide chain has resulted in excessive demand, with the Southern California area having a dramatically decrease emptiness fee than the remainder of the nation. Add in provide constraints, and Rexford has been in a position to improve charges on expiring leases in latest quarters drastically.

Add that tailwind to the REIT’s growth plans and acquisitions, and also you get a REIT that appears prone to proceed rewarding buyers very nicely for years to come back.

Dividend development buyers should purchase Rexford whereas they will

So why is Rexford’s inventory down 40% or so from its all time highs? The reply actually boils all the way down to investor sentiment, which bought a bit overheated throughout the coronavirus pandemic as demand for warehouse area elevated together with on-line procuring. Though the joy has worn off, Rexford’s enterprise continues to carry out nicely. In case you are a dividend development investor, it’s best to contemplate shopping for Rexford and holding on to it for a really very long time.

Do you have to make investments $1,000 in Rexford Industrial Realty proper now?

Before you purchase inventory in Rexford Industrial Realty, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Rexford Industrial Realty wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 16, 2024

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Rexford Industrial Realty and Vanguard Actual Property ETF. The Motley Idiot has a disclosure coverage.

1 Magnificent Excessive-Yield Dividend Development Inventory Down 40% to Purchase and Maintain Without end was initially printed by The Motley Idiot