It wasn’t way back that almost each electrical automobile (EV) inventory was hovering in worth. In 2021, for instance, business hype was at a fever pitch. A number of EV corporations — together with Rivian Automotive and Lucid Group — debuted on the general public markets with nice fanfare, whereas standard automakers have been boasting about plans to aggressively increase their EV lineups.

Quite a bit has modified since then. And after a steep business sell-off, it is time to go discount purchasing. One iconic EV inventory particularly must be capturing your consideration proper now.

Is that this well-known EV inventory lastly a discount?

Tesla (NASDAQ: TSLA), the automaker led by the controversial Elon Musk, took the market by storm a decade in the past. It is taken without any consideration by some at the moment, however it needed to show to a skeptical client base that EVs may very well be stunning, dependable, and downright enjoyable.

Its multibillion-dollar investments into its charging community, in the meantime, spurred international demand for a automobile class that, no less than on the time, nonetheless had a better complete possession value than standard internal-combustion alternate options.

Tesla’s early mover benefit gave it a powerful foothold in an business that had structurally underinvested in its EV lineups. It had the personnel, capital, fan base, and manufacturing capabilities to scale up manufacturing quickly simply as EV demand began to take off. From 2018 to 2022, as an example, gross sales grew by an astounding 357%.

However then a curious factor occurred. EV gross sales within the U.S. continued to climb, however slower than anticipated. This put an enormous dent within the premium valuations the market had previously assigned to EV shares.

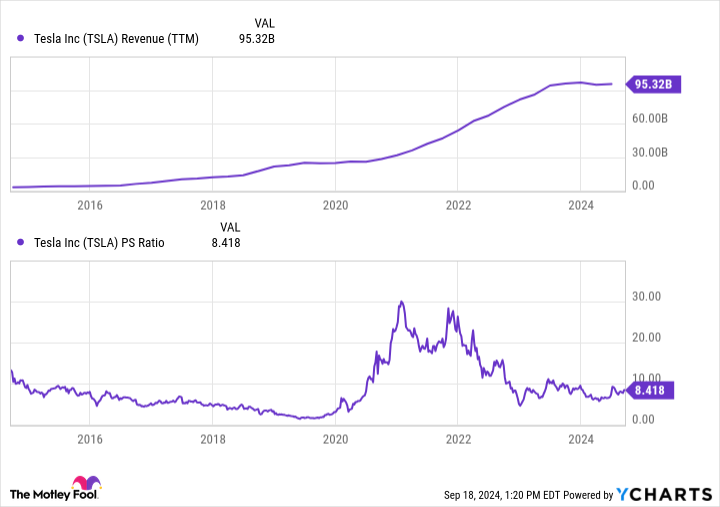

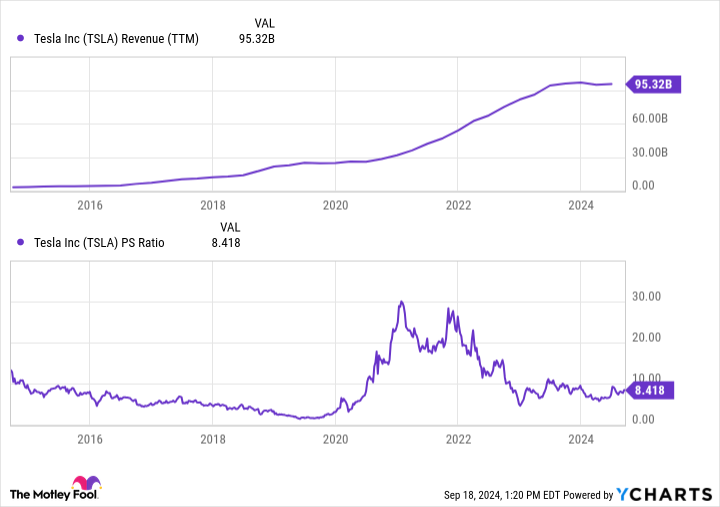

From 2022 to 2024, for instance, Tesla’s valuation fell from practically 30 instances gross sales to below 10 instances gross sales — a two-thirds discount over 24 months. Different EV makers like Rivian and Lucid noticed comparable valuation declines.

Extra just lately, Tesla’s income base has not solely flattened, however has additionally declined in sure quarters. To be honest, the inventory continues to be comparatively costly at 8.4 instances gross sales. However in case you have been ready to purchase into this iconic EV inventory, this may very well be your probability. One statistic particularly ought to get you excited.

Tesla continues to be the king of EVs

Whereas Tesla is concerned in different enterprise ventures, together with photo voltaic power and battery storage, greater than 90% of its income base continues to be tied up in its automotive phase. Its future will likely be made or damaged primarily based on the success of this enterprise, and most of its valuation is expounded to its destiny.

It is essential to remember the fact that it nonetheless instructions a dominant share of the U.S. EV market. Varied estimates peg it with a 50% to 80% market share.

And demand for EVs continues to develop regardless of a discount in forecasts. Over the following 5 years, home EV gross sales are actually anticipated to develop by greater than 10% yearly, with business income for EVs within the U.S. surpassing $150 billion by 2029.

Globally, EV gross sales are anticipated to prime $1 trillion by 2029. That is excellent news contemplating Tesla has a projected 39.4% market share globally, larger than the following eight opponents mixed.

Put merely, the EV market continues to be Tesla’s to lose. It has extra capital, extra brand-name recognition, and extra manufacturing capability than every other competitor. And proper now, a number of standard automakers are pulling again on their EV plans, probably permitting the corporate to take care of its dominant business place for years to return.

We’d look again at 2024 as a transparent outlier in Tesla’s long-term development trajectory. Gross sales are anticipated to say no by 8.2% this yr. However in 2025, analysts expect a rebound, with income leaping by 15.8%.

Is the inventory nonetheless costly at 8.4 instances gross sales? Completely. However its long-term promise stays intact, and the present valuation is a relative discount in comparison with years previous.

In case you consider in EVs long run, it is onerous to not guess on the present business chief, even when there are some near-term challenges on the highway forward. It might be a speculative guess, however buyers who’ve been eyeing Tesla for years whereas ready for a pullback ought to contemplate a small funding. If shares proceed to say no, it may very well be a first-rate alternative for dollar-cost averaging.

Must you make investments $1,000 in Tesla proper now?

Before you purchase inventory in Tesla, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Tesla wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 16, 2024

Ryan Vanzo has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a disclosure coverage.

1 No-Brainer Electrical Car (EV) Inventory to Purchase With $200 Proper Now was initially printed by The Motley Idiot