Synthetic intelligence (AI) has captivated buyers throughout the board. From giant institutional monetary companies companies to smaller retail buyers, AI is enjoying a giant position in how cash is shifting these days.

What’s just a little stunning, nonetheless, is that capital seems to be primarily concentrated in a small basket of mega-cap expertise shares. The “Magnificent Seven” is a time period used to collectively describe the world’s largest tech firms — and unsurprisingly, all of them are disrupting AI in some kind.

Maybe essentially the most intriguing member of the Magnificent Seven is semiconductor chief Nvidia. Whereas the corporate seems to have an edge over its friends, buyers ought to perceive that the chip realm has many alternative parts.

In different phrases, not all semiconductor companies are growing merchandise that compete with Nvidia. Actually, many chip firms are working alongside Nvidia and are benefiting because of the corporate’s development.

One chip inventory that I feel is quietly hovering beneath the radar proper now could be Micron Expertise (NASDAQ: MU). Let’s dig into Micron’s enterprise and assess why now appears like a profitable alternative for long-term buyers to scoop up some shares.

How does Micron profit from Nvidia?

Nvidia develops a sequence of refined pc chips referred to as graphics processing items (GPUs). These play a giant position in generative AI functions equivalent to machine studying, coaching giant language fashions (LLMs), and quantum computing.

Whereas Nvidia faces competitors from AMD and Intel, the corporate is estimated to have a minimum of 80% of the AI-powered chip market. Nvidia has constructed its lead over the competitors due to demand for its H100 and A100 merchandise. The corporate has additionally already developed its next-generation line of GPUs, generally known as Blackwell and Rubin.

Micron makes a speciality of reminiscence storage merchandise which are built-in into chips. Micron is not competing with Nvidia. Relatively, the corporate truly works with Nvidia and is benefiting from the demand fueling chips proper now.

Bought out by means of subsequent 12 months

Certainly one of Micron’s core merchandise is known as the Excessive Bandwidth Reminiscence (HBM) 3E, which is layered on Nvidia’s GPUs. The corporate started delivery its HBM3E merchandise throughout this previous spring. Whereas it is nonetheless a brand new product for Micron, the preliminary traction from HBM3E offers buyers loads to be enthusiastic about.

For its fiscal 2024’s third quarter (ended Could 30), Micron generated $6.8 billion in income — up 84% 12 months over 12 months. HBM contributed $100 million through the quarter as shipments started to ramp. Administration acknowledged: “We anticipate to generate a number of hundred million {dollars} of income from HBM in fiscal 2024 and a number of billions of {dollars} in income from HBM in fiscal 2025.”

Moreover, administration actually shocked buyers after they famous that “HBM is bought out for calendar 2024 and 2025, with pricing already contracted for the overwhelming majority of our 2025 provide.”

Is now time to purchase Micron inventory?

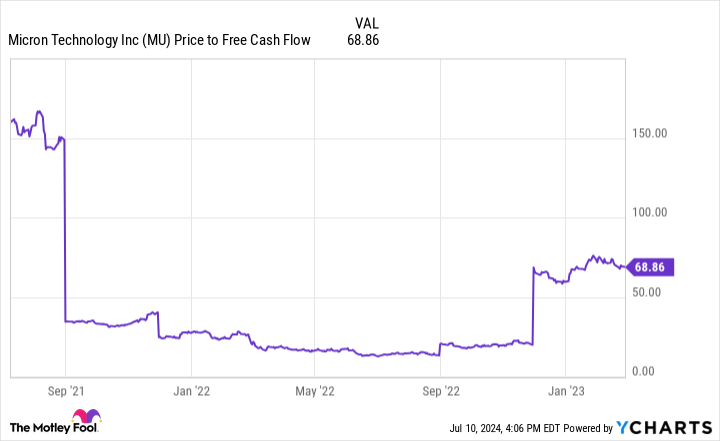

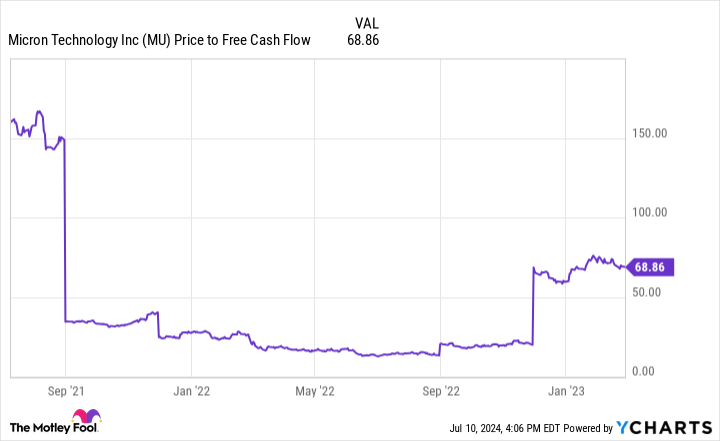

The chart beneath illustrates the price-to-free money circulation (P/FCF) a number of for Micron over the past three years. Though a P/FCF of 68.9 is costly, the a number of is notably decrease than in some prior durations.

Admittedly, the valuation evaluation above could possibly be deceptive. A part of the explanation why Micron’s P/FCF is normalizing is as a result of, like many expertise companies, the corporate is experiencing irregular demand proper now. Because of this, income and margins are accelerating.

Nonetheless, the blemish with Micron revolves round profitability. The corporate inconsistently studies optimistic working revenue, free money circulation, and web revenue. Which means throughout some quarters, the corporate truly posts a web loss.

For the reason that semiconductor area is very cyclical, Micron’s ebbs and flows relating to income aren’t fully stunning. Nonetheless, I am optimistic that the success of the HBM options may also help Micron attain a point of pricing energy because it appears to satisfy provide and demand. In principle, this could assist easy out the corporate’s money circulation and profitability.

For these causes, I feel Micron is well-positioned to proceed benefiting from the AI growth and the particular demand developments surrounding chip companies. Furthermore, on condition that its newest innovation is already bought out by means of subsequent 12 months, I feel it is apparent that the corporate’s merchandise are well-received.

Whereas shares of Micron aren’t essentially dust low-cost, I see the inventory as a compelling purchase for long-term buyers on the lookout for alternate options to Nvidia.

Must you make investments $1,000 in Micron Expertise proper now?

Before you purchase inventory in Micron Expertise, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Micron Expertise wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $791,929!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 8, 2024

Adam Spatacco has positions in Nvidia. The Motley Idiot has positions in and recommends Superior Micro Units and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and quick August 2024 $35 calls on Intel. The Motley Idiot has a disclosure coverage.

Neglect Nvidia: 1 Different Unstoppable Semiconductor Inventory to Purchase As an alternative was initially revealed by The Motley Idiot