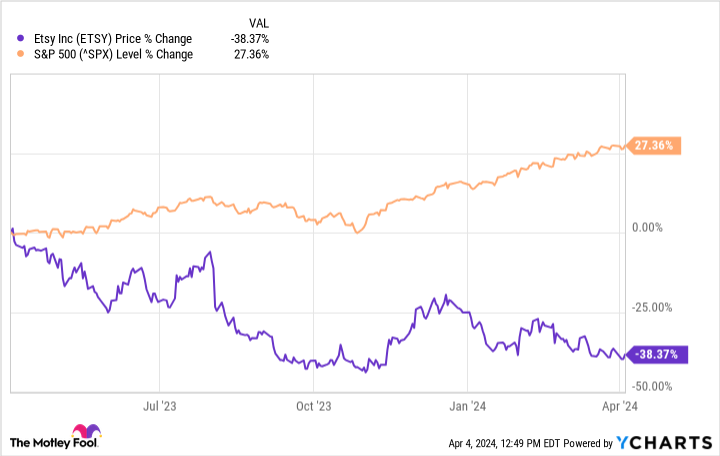

It may be laborious to search out glorious shares to purchase on the dip in a bull market, however it is not unattainable. E-commerce specialist Etsy (NASDAQ: ETSY) is one glorious candidate. The net retailer was extremely profitable within the early days of the pandemic, however its shares have been southbound since late 2021. Etsy’s shares are down by 38% previously 12 months alone. Regardless of the corporate’s points, long-term buyers ought to strongly contemplate placing their hard-earned cash into this firm. Let’s discover out extra.

Zooming out helps quite a bit

A number of main companies dominate the e-commerce market. Carving out a profitable area of interest on this subject is not straightforward. Nonetheless, Etsy has efficiently achieved so by focusing totally on classic and handmade items. Specialization has its perks. It has allowed Etsy to turn out to be the go-to platform for the sorts of merchandise it sells. Shoppers would relatively not need to type by way of hundreds of thousands of utterly irrelevant objects earlier than discovering what they’re on the lookout for.

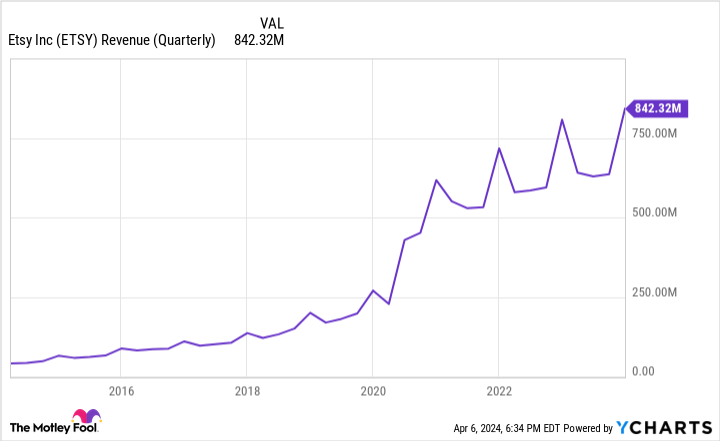

It is telling that the majority customers on Etsy agree that the platform carries objects which might be tough to search out elsewhere, in line with surveys the corporate ran on its web site. That is been an vital issue driving Etsy’s income increased. Though it hasn’t grown as quick because it did throughout the early pandemic years, Etsy has delivered distinctive top-line development over the previous 9 years since its 2015 IPO.

Etsy’s latest slowdown is partly because of financial situations. Classic items aren’t low cost, or important to individuals’s lives. When customers are strapped for money, these are exactly the sorts of merchandise they’re the most probably to forgo. However financial points do not final ceaselessly. And even a few of the most profitable companies on this planet are considerably inclined to financial cycles. Etsy’s income development ought to bounce again as issues get higher.

Loads of room to develop

E-commerce appears ubiquitous now, however the trade remains to be rising, one thing analysts challenge will proceed for the foreseeable future. It is simple to know why. E-commerce permits for a a lot bigger pool of potential consumers and sellers. Folks have been historically constrained inside comparatively small geographical limits in the event that they wished to buy or promote sure objects. Now, customers can order merchandise from totally different international locations and have them delivered to their doorsteps comparatively shortly.

Many e-commerce leaders profit from the community impact — that’s, the worth of their platform will increase with use. Etsy additionally falls beneath this class. The corporate’s huge community of sellers on the lookout for the sorts of classic and handmade items it provides attracts extra consumers, and vice versa. The significance of this dynamic can hardly be overstated. It ought to permit Etsy to stay a frontrunner within the subject since newcomers will discover it laborious to crack its community impact.

The corporate ended 2023 with about 9 million lively sellers, a 21% year-over-year improve. Etsy’s lively consumers on the finish of the 12 months grew by 1.5% to 96.5 million. True, Etsy does have some opponents, however it has been in a position to succeed even within the crowded e-commerce market, and due to its strong moat, it ought to proceed doing so. Etsy estimates that it has captured only a 2% share of its complete addressable market. If the corporate may even double that complete within the subsequent 5 years, its high and backside traces will steadily transfer in the precise route.

So there stays large whitespace forward for the corporate. Traders ought to look previous Etsy’s latest points, particularly as its shares proceed to lag the broader market. Initiating a place now might result in large returns in 10 years.

Do you have to make investments $1,000 in Etsy proper now?

Before you purchase inventory in Etsy, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Etsy wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $539,230!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 8, 2024

Prosper Junior Bakiny has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Etsy. The Motley Idiot has a disclosure coverage.

1 Inventory Down 38% to Purchase and Maintain for 10 Years was initially printed by The Motley Idiot