Usually, worth searching amongst shares which have plummeted greater than 70% at any given level of their historical past may be harmful. Historical past means that profitable shares hold profitable and that traders could be higher off “watering their flowers and digging up their weeds.”

Nevertheless, there are exceptions to this notion.

Take Paycom (NYSE: PAYC) and its human capital administration (HCM) software-as-a-service (SaaS) options, for instance. The inventory is at present 70% off its excessive. In 2019, the upstart firm had gross sales of roughly $600 million and a share value of round $170. Right this moment, the corporate’s share value is identical, but income has mainly tripled.

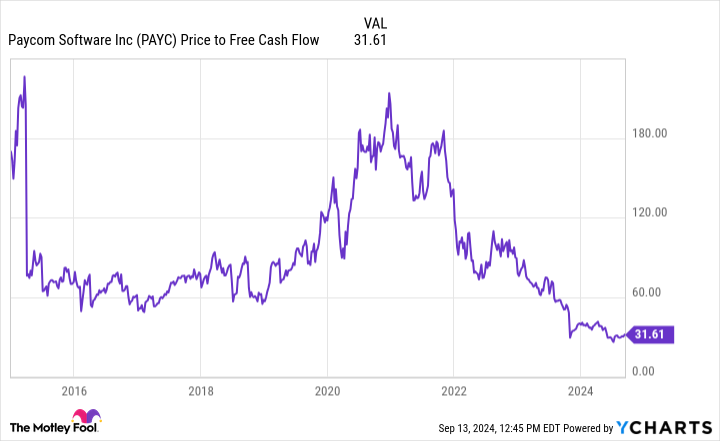

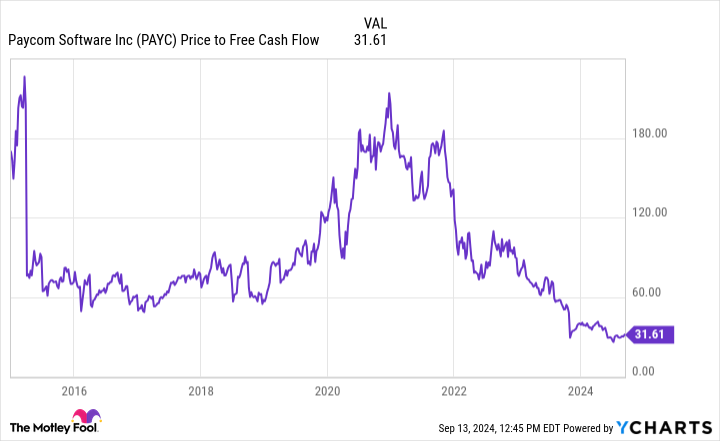

This incidence, paired with Paycom’s resilient free money circulation era, leaves the corporate now buying and selling at what might show to be a once-in-a-decade valuation. Whereas the market stays unsure in regards to the firm’s progress story, this is the case for purchasing and holding Paycom endlessly.

Why Paycom’s present progress slowdown is not a doomsday state of affairs

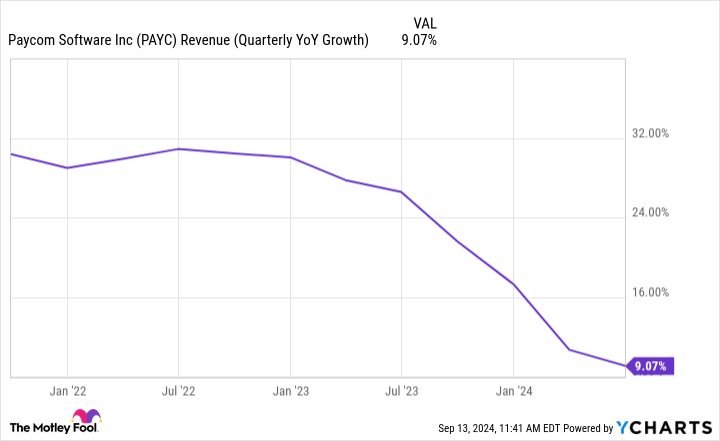

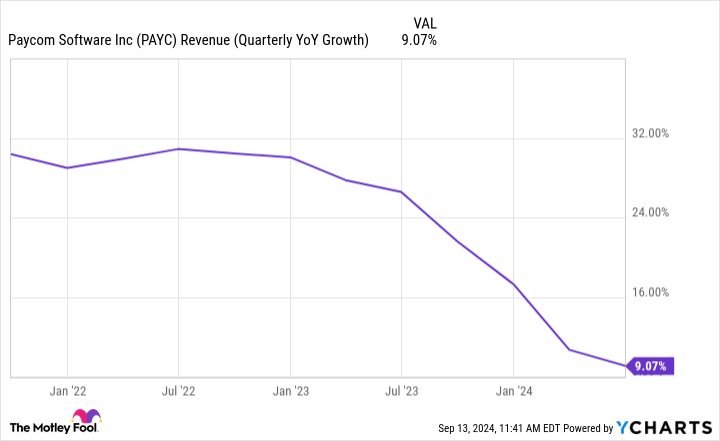

The first cause for Paycom’s declining share value comes from its decelerating gross sales progress price.

Whereas a slowdown like that is regarding, administration has argued {that a} first rate portion of this drop stems from the introduction of its Beti payroll processing platform in late 2021. By empowering workers to handle their very own payroll, Beti identifies and fixes many frequent errors previous to an organization processing its funds, decreasing the variety of payroll reruns wanted.

Clearly, that is incredible for Paycom’s prospects, with one shopper stating that it was capable of lower its payroll division by half because of Beti’s time-saving worth. Nevertheless, previous to Beti, Paycom generated gross sales from rerunning payrolls for its prospects any time there have been errors. In brief, the corporate’s profitable new product is cannibalizing an current base of gross sales, slowing progress.

Finally, traders who assume in a long time, not quarters, ought to welcome this trade-off between cannibalizing current gross sales and giving prospects the perfect merchandise whereas holding them as blissful as doable. Due to this deal with buyer satisfaction, Paycom’s Web Promoter Rating (NPS) of 67 simply beats these of its payroll processing friends Paychex, Workday, and ADP, which have respective scores of -14, 31, and -10. An organization’s NPS makes use of a -100 to 100 scale, with a rating above 0 exhibiting that extra prospects would advocate a product to their associates than would not. This implies Paycom’s merchandise are beloved.

Greatest but for traders, there have been a few indicators within the firm’s second-quarter earnings name signaling that this slowing gross sales progress could possibly be coming to an finish. Founder and CEO Chad Richison stated that the corporate offered 24% extra items in Q2 yr over yr, which is extra promising than Paycom’s 9% gross sales progress within the quarter could point out. Along with these promising figures, Richison introduced that “July begins are up 40% from a income perspective,” exhibiting that increased gross sales progress could possibly be incoming within the third quarter.

Moreover, with Beti just lately launching in Canada, Mexico, the U.Okay., and Eire, Paycom might see additional progress forward because it expands to purchasers with world operations.

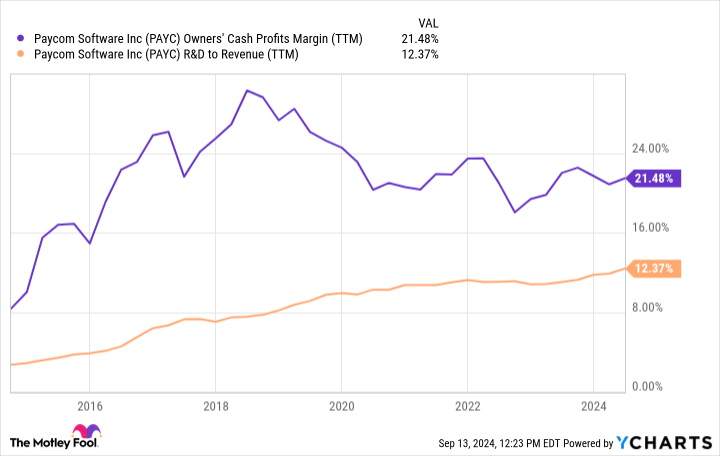

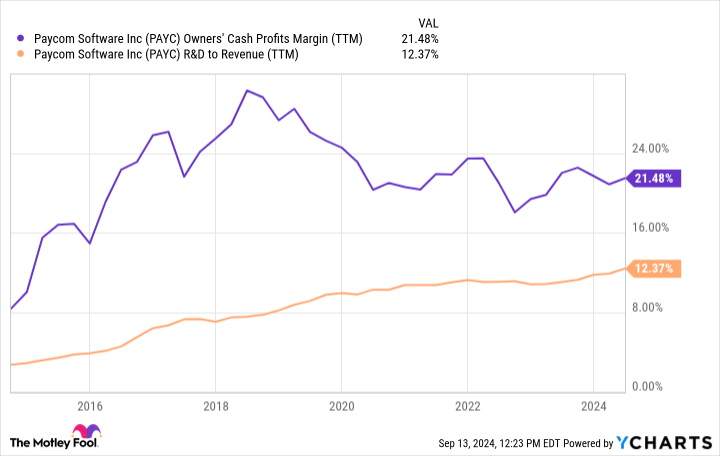

Rising money era regardless of rising R&D spending

My favourite factor about Paycom is that it stays laser-focused on innovating and holding its prospects as blissful as doable. By rising its spending on analysis and improvement (R&D) over time, the corporate continues to ramp up the automation capabilities throughout its product suite. Regardless of this elevated R&D spend, Paycom’s free money circulation (FCF) era has confirmed to be extremely resilient.

By delivering automated choices like GONE, the corporate’s new time-off requests device, Paycom has constantly confirmed that its new choices generate sufficient worth to offset the price of the R&D wanted to create them. Referring to the worth that GONE brings to its purchasers, the corporate defined: “Every handbook time-off assessment or approval can price an organization a mean of $30.92, in keeping with a November 2023 Ernst & Younger examine commissioned by Paycom.”

Sustaining its standing as a real money cow whereas rising spending on R&D makes Paycom a powerful candidate to turn out to be a top-tier compounder over the lengthy haul.

Paycom’s potential once-in-a-decade valuation

As promising as Paycom’s progress prospects and automatic merchandise look, the corporate continues to commerce at a once-in-a-decade low price-to-FCF ratio.

Anchored by a steadiness sheet that is house to $346 million in money and $0 in long-term debt, administration has begun shopping for again shares at these decrease costs and now has a $1.5 billion share buyback plan approved. In comparison with the corporate’s market cap of $9.7 billion, this buyback authorization might go a great distance towards serving to Paycom’s share value flip round.

Final however not least, Paycom pays a 0.9% dividend, but it surely has but to lift it after beginning it six quarters in the past. Whereas a dividend improve could be good for traders, administration could also be extra centered on shopping for again shares at as we speak’s costs.

Finally, I believe Paycom’s gross sales progress could possibly be poised to show round over the subsequent couple of years. This rebound, paired with Paycom’s historical past of profitably innovating its merchandise, leaves me very happy to choose up shares at this once-in-a-decade valuation and maintain them for the long run.

Must you make investments $1,000 in Paycom Software program proper now?

Before you purchase inventory in Paycom Software program, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and Paycom Software program wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $729,857!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 9, 2024

Josh Kohn-Lindquist has positions in Paycom Software program. The Motley Idiot has positions in and recommends Paycom Software program and Workday. The Motley Idiot has a disclosure coverage.

A As soon as-in-a-Decade Alternative: 1 Tremendous Progress Inventory Down 70% to Purchase and Maintain Endlessly was initially printed by The Motley Idiot