Even in case you’re not an investor that repeatedly swings for the fences, you’ve got possible dreamed of hitting a proverbial grand slam that will get your portfolio over the seven-figure hump.

The factor is, such trades aren’t as unusual as you would possibly assume. You simply have to seek out the suitable firm in the suitable enterprise on the proper second. Time will maintain the remaining.

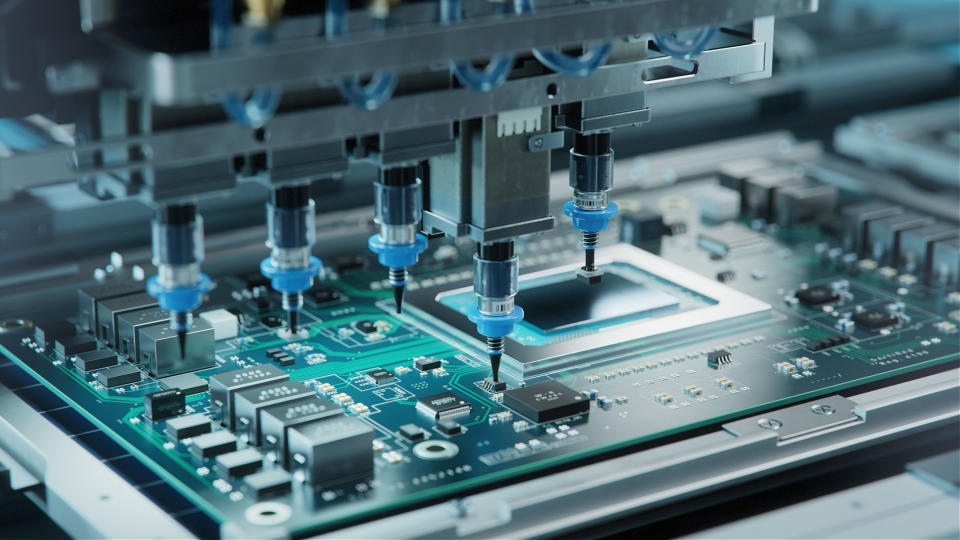

On that be aware, there’s one explicit expertise inventory that is not solely already turned many affected person buyers into millionaires, however can proceed doing so sooner or later. That is Nvidia (NASDAQ: NVDA). This is a better have a look at why it has been such a winner so far, and why it is poised to proceed minting millionaires going ahead.

Nvidia, up shut and private

You have in all probability already acquainted with the corporate, however Nvidia hasn’t all the time been the titan it’s at the moment. It has, nonetheless, all the time been a profitable cutting-edge expertise participant.

The corporate was based again in 1993… simply when the private laptop period was simply getting began. It wasn’t till 1995, nonetheless, when it modified the panorama of the PC enterprise endlessly. That is when Nvidia debuted the world’s first-ever mainstream consumer-oriented graphics processing card. This tech made private computer systems rather more participating, largely by making them high-powered video gaming consoles. The remaining, as they are saying, is historical past. Leveraging its main place within the graphics card house, Nvidia has since grown from its comparatively small 1999 public providing to the $1.5 trillion powerhouse it’s at the moment. From again then to now, Nvidia inventory’s soared to the tune of 150,000%. Wow!

Granted, most buyers possible did not persist with the inventory that complete time. The corporate’s been by way of ups and downs which might have shaken a number of of even the staunchest of shareholders out.

However, any shareholders in a position to persist with their positions within the inventory for any significant size of time through the firm’s existence have achieved very, very properly for themselves. Definitely a lot of them have change into millionaires with some assist from Nvidia.

However, the social gathering’s not over but.

Synthetic intelligence is the subsequent large development engine

Nvidia’s first couple of many years had been all about graphics processing playing cards. The subsequent couple, nonetheless, will not be. Synthetic intelligence is its subsequent large development engine and can stay so for a protracted whereas.

Because it seems, the identical fundamental laptop structure utilized in graphics playing cards is completely suited to AI purposes. It does not must deal with extremely complicated calculations. It simply must concurrently deal with mountains and mountains of digital knowledge very quickly. Recognizing this, in 2012 Nvidia started experimenting with purpose-built AI processors utilizing its graphics card tech. The 2016 launch of its DGX-1 system marked the world’s first-ever deep-learning supercomputer, dropping the corporate proper into the center of the then-brewing synthetic intelligence evolution. It was an excellent transfer too. AI now accounts for round three-fourths of the group’s income and is answerable for the lion’s share of its income development.

The synthetic intelligence social gathering is simply getting began although. Establishments are solely simply now beginning to see the complete potential of proudly owning their very own AI platforms. UIPath‘s CEO Robert Enslin lately opined that “Corporations want to consider how one can apply AI and automation to all elements of their enterprise,” for example, concluding that “All firms have to be tech firms.”

The businesses he is talking of do not appear to disagree both. Even cosmetics model L’Oreal‘s chief govt Nicolas Hieronimus believes “We’re a tech firm. We’re a magnificence firm, however we’re a tech firm,” as he defined at this yr’s annual Shopper Electronics Present held earlier this month.

On this vein, Priority Analysis expects the AI {hardware} enterprise to develop at a yearly tempo of greater than 24% between now and 2030, reaching a price of $250 billion within the last yr of that stretch. The software program sliver of the synthetic intelligence market — which Nvidia additionally serves — is projected to swell from round $200 billion per yr now to greater than $1 trillion in 2032, once more in response to Priority Analysis.

Already answerable for the overwhelming majority of the synthetic intelligence {hardware} market, Nvidia is positioned to seize its fair proportion of the market’s development.

Simply settle in for the lengthy haul

The backdrop is bullish to make certain. Nvidia’s the main identify in one of many market’s hottest long-term development alternatives, in spite of everything. Threat is low and the potential reward is excessive.

There’s one footnote so as to add to the Nvidia story although. That’s, Nvidia is a well-liked, well-watched inventory that dishes out a substantial amount of volatility. Shares additionally are usually priced at a wealthy valuation, exacerbating that volatility. And these aren’t restricted to short-term swings. Nvidia inventory can actually ebb and movement for some time, even when issues are clearly going properly for the corporate.

Most veteran buyers perceive, nonetheless, they will want to stay plugged into mega-trends for years on finish in the event that they need to change into millionaires. This reality is not going to alter for Nvidia’s shareholders anytime quickly both.

The factor is, it is well worth the wait.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 22, 2024

James Brumley has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia and UiPath. The Motley Idiot has a disclosure coverage.

1 Know-how Inventory That Has Created Millionaires, and Will Proceed to Make Extra was initially printed by The Motley Idiot