Vitality Switch (NYSE: ET) is providing buyers an ultra-high 8% distribution yield. Enterprise Merchandise Companions (NYSE: EPD) has a yield of seven.2%. Though each hail from the midstream power sector, they don’t seem to be interchangeable investments. This is why lower-yielding Enterprise is value shopping for hand over fist and most will in all probability be higher off avoiding Vitality Switch.

The issue with Vitality Switch

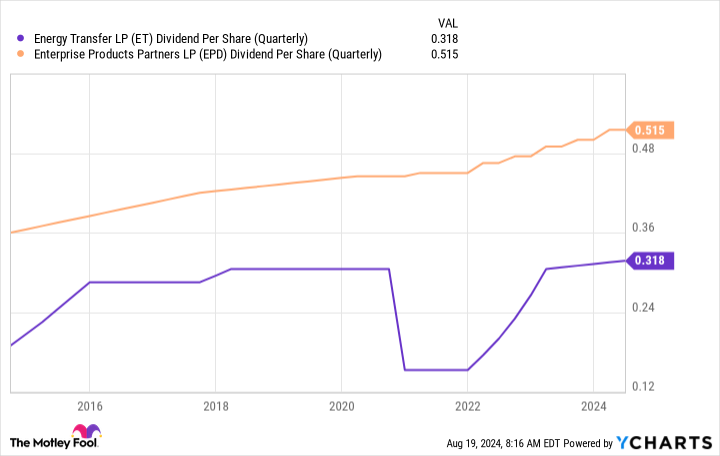

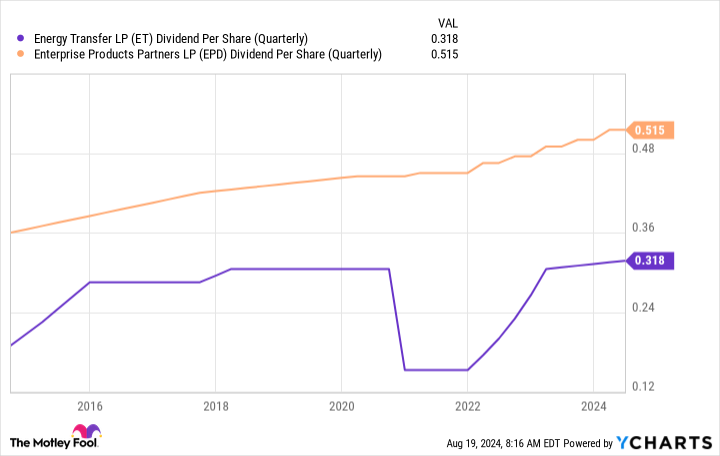

When power costs plunged early within the coronavirus pandemic, Vitality Switch reduce its distribution 50%. That 2020 distribution reduce was, maybe, justified by the uncertainty the world confronted on the time, nevertheless it definitely was not the distribution final result the buyers had been hoping for. And whereas the grasp restricted partnership’s (MLP) distribution has began to rise once more and is definitely increased than it was earlier than the reduce, buyers that care about revenue consistency should not ignore the selection that administration made in 2020. It opens up the very actual danger that the following power trade downturn will result in the identical final result.

Nonetheless, a distribution reduce within the face of power trade adversity is comprehensible. What’s tougher to clarify with Vitality Switch is the failed 2016 settlement to purchase Williams Firms. Vitality Switch initiated the deal, however an power downturn resulted within the MLP getting chilly toes. Vitality Switch then labored to scuttle the deal, claiming that consummating it might require taking over an excessive amount of debt, reducing the dividend, or each. The trouble to get out of the settlement included issuing convertible securities, which is the place the actual drawback is available in.

The CEO purchased a big portion of the convertible securities on the time. The safety would have successfully protected the CEO from the impression of a dividend reduce if the deal went by way of as deliberate whereas leaving unitholders to really feel the complete brunt of a reduce. It was an advanced affair, however that is a top-level, and unsettling, view. That CEO, Kelcy Warren, is now “simply” the chairman of the board, so there’s nonetheless good motive to be frightened about what occurred practically a decade in the past.

General, if you’re in search of a dependable revenue stream, Vitality Switch might be not the place to look.

Enterprise Merchandise Companions continues to place unitholders first

Enterprise Merchandise Companions is one other giant North American midstream MLP. Nevertheless it does not have the identical distribution negatives hanging over it. For starters, it is elevated its distribution yearly for 26 consecutive years. Secondly, it has managed to make common acquisitions with out resorting to aggressive ways in an effort to finish a transaction earlier than it has been accomplished.

However what’s fascinating right here is that Enterprise is not resistant to the impression of power downturns. Whereas its enterprise is basically fee-based, 2016 was a comparatively robust 12 months, and so was 2020. The enterprise saved on chugging alongside regardless of momentary weak spot, and the distribution was raised regardless of that weak spot. A key issue there’s the conservative nature of Enterprise’s administration, with the distribution backed by an investment-grade steadiness sheet and a robust distribution protection ratio (at the moment distributable money movement covers the distribution by 1.7 instances).

There’s additionally a protracted historical past of unitholder-friendly choices to think about. For instance, in 2002 Enterprise lowered its incentive distribution rights by 50%, liberating up more money to pay unitholders on the expense of the overall accomplice. In 2007, administration slowed distribution progress so it may make investments extra closely in enterprise enlargement to extend long-term returns. In 2011, the MLP eradicated incentive distributions and acquired its normal accomplice, successfully changing into a self-governing entity. And in 2018 Enterprise labored to turn out to be a self-funding enterprise so it would not should situation as many dilutive items sooner or later.

Follow the one you possibly can belief

It is not an thrilling funding, however Enterprise has clearly regarded out for unitholders in a method that Vitality Switch hasn’t. In case you are attempting to stay off of the revenue your portfolio generates, dependable Enterprise, regardless of a barely decrease yield, is prone to be the higher choice than Vitality Switch over the lengthy haul.

Must you make investments $1,000 in Vitality Switch proper now?

Before you purchase inventory in Vitality Switch, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Vitality Switch wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $792,725!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 26, 2024

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot recommends Enterprise Merchandise Companions. The Motley Idiot has a disclosure coverage.

1 Extremely-Excessive-Yield Vitality Inventory to Purchase Hand Over Fist and 1 to Keep away from was initially revealed by The Motley Idiot