The U.S. economic system has a centurylong historical past of manufacturing the world’s most beneficial firms:

-

United States Metal turned the world’s first $1 billion firm in 1901.

-

Normal Motors rode the automotive manufacturing growth to grow to be the primary $10 billion firm in 1955.

-

Normal Electrical constructed a conglomerate promoting a variety of merchandise from aircraft engines to family home equipment, and it turned the world’s first $100 billion enterprise in 1995.

-

Apple achieved a $1 trillion valuation in 2018 following the unbelievable success of gadgets just like the iPhone.

Microsoft, Nvidia, Amazon, Meta Platforms, and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) have since joined Apple within the trillion-dollar membership.

In actual fact, Apple, Microsoft, and Nvidia have every graduated to the ultra-exclusive $3 trillion degree, however I believe another firm is about to affix them.

Alphabet is the tech conglomerate behind Google, YouTube, Waymo, DeepMind, and a number of different subsidiaries. It is a acknowledged chief within the fast-growing synthetic intelligence (AI) area, which may very well be its ticket to a $3 trillion valuation by the tip of 2025.

Alphabet is presently valued at $2.3 trillion, so traders who purchase the inventory immediately may earn a acquire of 32% if it does be a part of the likes of Apple, Microsoft, and Nvidia.

Alphabet is reworking is legacy enterprise with AI

Alphabet is at a crossroads. The corporate generates greater than half of its income from Google Search, which has a 91% market share within the web search trade. Nevertheless, AI chatbots like ChatGPT provide a extra handy technique to straight entry data, and so they can produce it immediately. Microsoft even struck a take care of OpenAI final 12 months to make use of ChatGPT in its Bing search engine in an try and disrupt Google.

However Google Search has been the window to the web for many years, so Alphabet arguably has extra priceless knowledge with which to construct AI fashions than every other tech big. It launched its personal chatbot known as Bard final 12 months, which developed to grow to be a household of multimodal fashions known as Gemini. They’ll interpret and produce textual content, photos, movies, and even laptop code.

Plus, Alphabet simply launched AI Overviews to the standard Google Search expertise. They’re text-based responses that seem on the prime of the search outcomes, saving customers from sifting by internet pages to seek out solutions to their queries. Alphabet says the reference hyperlinks included in AI Overviews obtain extra clicks than those who seem in conventional search outcomes, which may drive extra promoting income and ease issues over Google shedding its dominance.

Plus, the Gemini fashions are creating a number of different alternatives to generate AI income. Google Workspace customers can now add Gemini for an extra month-to-month subscription charge, which is able to assist increase their productiveness in functions like Google Docs, Sheets, and Gmail.

Moreover, the Gemini fashions are actually accessible on Google Cloud, so builders can use them (together with greater than 130 others from third events) to construct their very own AI functions. It is a large price saver for companies in comparison with creating a big language mannequin (LLM) from scratch, which takes time, truckloads of information, and substantial monetary assets.

Strong monetary progress

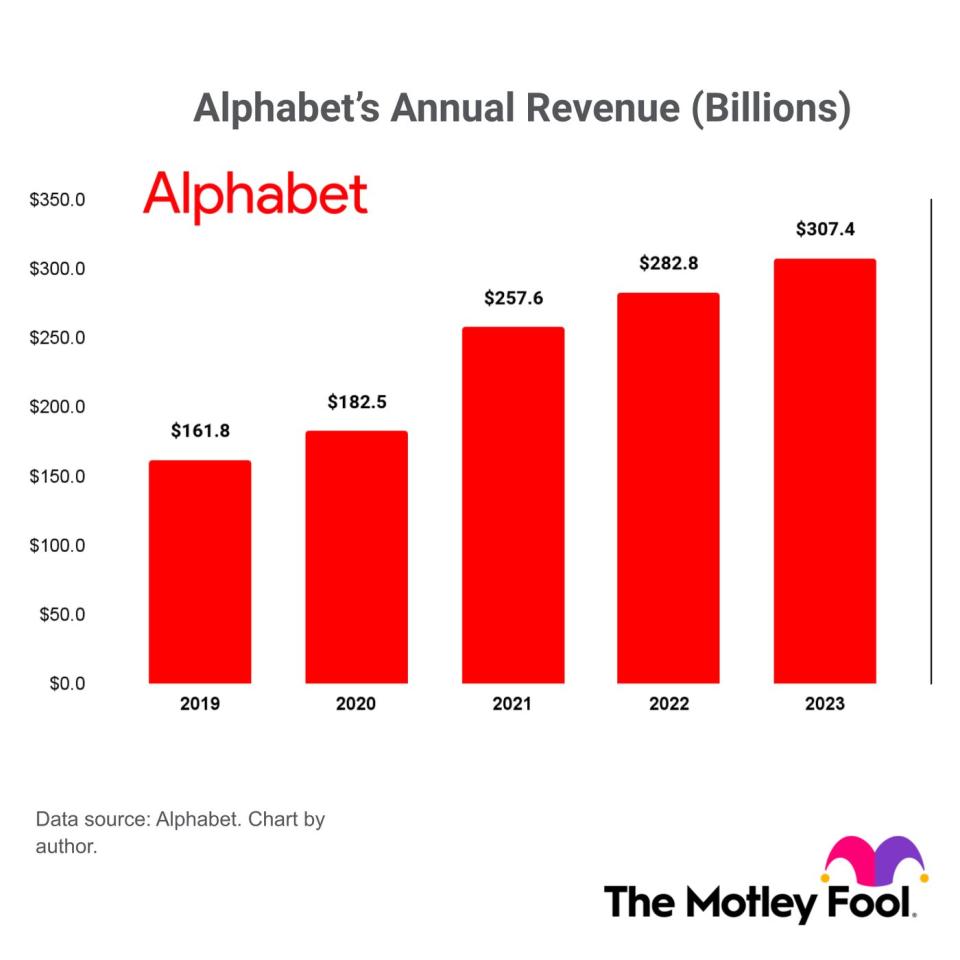

Within the 5 years between 2019 and 2023, Alphabet income grew at a compound annual price of 13.7%, bringing in a report $307.4 billion final 12 months alone:

The corporate kicked off 2024 with an above-trend income bounce of 15% within the first quarter (12 months over 12 months). It included a 14.3% improve in Google Search income alone, which was the quickest tempo in nearly two years. YouTube’s income growth accelerated to twenty.8%, and Google Cloud remained the fastest-growing a part of the enterprise, with gross sales hovering by 28.4%.

Improved market circumstances have been an enormous assist, following a painful stoop within the promoting trade all through 2022 and 2023 as a consequence of unsure financial circumstances. However Alphabet may expertise even quicker progress within the second half of this 12 months, as a result of the U.S. Federal Reserve is forecast to chop rates of interest 3 times within the coming months. It may immediate companies to spend extra money on advertising as they attempt to attain a client with extra {dollars} of their pocket.

Alphabet’s (mathematical) path to the $3 trillion membership

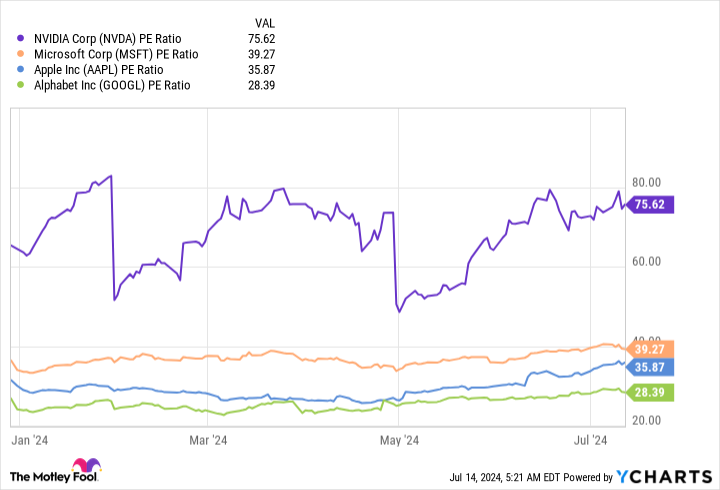

Alphabet generated $6.52 in earnings per share over the past 4 quarters, and based mostly on its present inventory worth of $185.01, it trades at a price-to-earnings (P/E) ratio of 28.3.

That is cheaper than the 32.7 P/E ratio of the Nasdaq-100 index, so Alphabet is technically undervalued relative to its friends within the tech sector.

It additionally makes Alphabet less expensive than all three members of the $3 trillion membership, which commerce at a median P/E ratio of fifty.2 (which is closely skewed by Nvidia’s lofty valuation):

I do not assume it might be acceptable for Alphabet’s P/E to rise to 50.2, but when it did, that may worth the corporate at over $4 trillion. Nevertheless it may rise to the common P/E ratio of Apple and Microsoft (37.6), which might be sufficient to put Alphabet within the $3 trillion membership.

However even when Alphabet does not expertise any a number of growth (an increase in its P/E ratio), it may be a part of the $3 trillion membership inside the subsequent 18 months solely based mostly on the expansion of its enterprise.

How? Wall Avenue expects the corporate to ship $8.61 in earnings per share in 2025, inserting Alphabet inventory at a ahead P/E ratio of 21.5. Which means its shares should rise 32% between every now and then simply to keep up their present P/E ratio of 28.3. That acquire will likely be sufficient to worth the corporate at $3 trillion.

I am not the one one who thinks Alphabet is a good worth on the present worth. The corporate expanded its share repurchase program by a whopping $70 billion earlier this 12 months, which implies it’s going to periodically purchase chunks of its personal inventory to return cash to shareholders.

In abstract, Alphabet has a couple of path into the unique $3 trillion membership, and traders who purchase the inventory immediately may earn a pleasant acquire alongside the best way.

Do you have to make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Alphabet wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $787,026!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 15, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Anthony Di Pizio has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends Normal Motors and recommends the next choices: lengthy January 2025 $25 calls on Normal Motors, lengthy January 2026 $395 calls on Microsoft, and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

1 Unstoppable Inventory Set to Be part of Nvidia, Apple, and Microsoft within the $3 Trillion Membership was initially revealed by The Motley Idiot