Apple is probably the most worthwhile firm on the planet proper now with a market capitalization of $3.4 trillion, but it surely’s carefully adopted by two different tech giants, Microsoft (NASDAQ: MSFT) and Nvidia (NASDAQ: NVDA). It is value noting that each Microsoft and Nvidia have taken turns changing into the world’s most respected firm this 12 months, however Apple has managed to regain the highest spot, because of a latest surge within the inventory value.

Nonetheless, if we examine Apple’s prospects to these of Nvidia and Microsoft for the following 5 years, it will not be shocking to see them changing into extra worthwhile than the iPhone maker. Under is a have a look at the the reason why.

1. Microsoft

Microsoft’s market cap of $3.3 trillion signifies that it is strikingly near Apple proper now. Extra importantly, Microsoft is clocking sooner development than Apple, a development that is more likely to proceed over the following 5 years, because of the rising adoption of synthetic intelligence (AI) in a number of markets.

As an example, Microsoft’s income within the third quarter of fiscal 2024 (which ended on March 31) elevated 17% 12 months over 12 months to $61.9 billion. In the meantime, Apple’s fiscal 2024 second-quarter income (for the three months ended March 30) was down 4% 12 months over 12 months to $90.8 billion. This stark distinction within the efficiency of the 2 tech giants is essentially attributable to AI.

Whereas Microsoft is capitalizing on a number of AI-driven development developments comparable to cloud computing, private computer systems (PCs), and office collaboration instruments, Apple has been late to the AI smartphone market. Microsoft’s Clever Cloud section reported a 21% year-over-year enhance in income in fiscal Q3 to $26.7 billion, pushed by the rising utilization of its cloud-based AI companies.

The corporate identified that its Azure cloud enterprise obtained a lift of seven proportion factors, because of AI. The cloud-based AI companies market is forecast to generate $647 billion in income in 2030, clocking a compound annual development price of almost 40% by way of the top of the last decade, and Microsoft is sitting on a probably giant incremental income alternative on this market.

Additionally, Microsoft Azure’s 25% share of the cloud computing market signifies that it is well-placed to faucet this multibillion-dollar AI alternative. However this is not the place the AI-driven catalysts finish for Microsoft. The corporate’s Copilot generative AI chatbot, which serves each particular person and enterprise customers, is witnessing wholesome adoption.

For instance, Microsoft’s Copilot for GitHub, a developer platform utilized by greater than 100 million customers, boasted of 1.8 million paid subscribers on the finish of March. In the meantime, the enterprise adoption of Copilot for office productiveness stays stable. Within the phrases of CEO Satya Nadella:

This quarter, we made Copilot out there to organizations of all sorts and sizes from enterprises to small companies, almost 60% of the Fortune 500 now use Copilot and we’ve got seen accelerated adoption throughout industries and geographies with corporations like Amgen, BP, Cognizant, Koch Industries, Moody’s, Novo Nordisk, Nvidia, and Tech Mahindra buying over 10,000 seats.

Microsoft is charging $30 per person per 30 days from enterprise prospects for its Copilot. The person plan is priced at $20 per person per 30 days. So the corporate is already monetizing the AI-assistant market, which is predicted to develop eightfold over the following decade and generate nearly $167 billion in income in 2033.

The above AI-related catalysts point out why Microsoft’s annual earnings are anticipated to develop at 16% a 12 months for the following 5 years in comparison with Apple’s projected development price of 10%. This might finally assist Microsoft inventory ship extra upside and grow to be extra worthwhile than Apple in the long term.

2. Nvidia

Nvidia is presently the third-largest firm on the planet, with a market cap of $3 trillion. Shares of the semiconductor specialist have surged a outstanding 745% for the reason that starting of 2023 because the likes of Microsoft and different tech giants have been seeking to get their arms on its AI graphics processing items (GPUs) to coach and deploy AI fashions and companies.

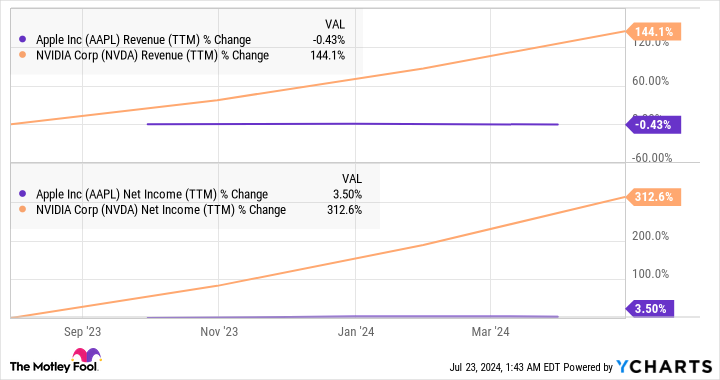

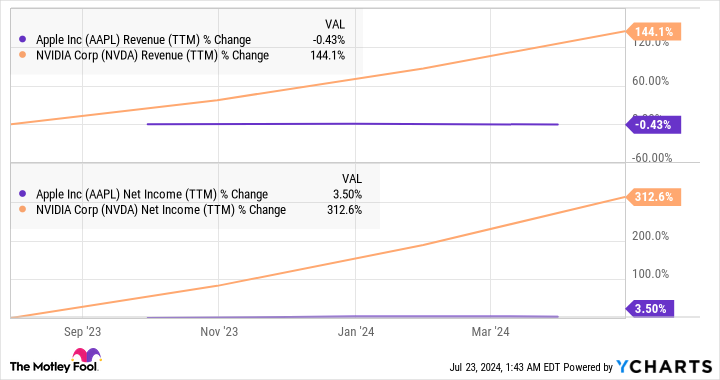

Extra importantly, Nvidia controls over 90% of the AI chip market. This terrific market share is the rationale behind its excellent development in latest quarters, leading to a a lot better monetary efficiency than Apple.

With the worldwide AI chip market estimated to develop tenfold within the subsequent 10 years to grow to be a $300 billion market, there is a good probability that Nvidia’s excellent development will proceed. In response to some analysts, the corporate’s information middle income alone might soar to $280 billion over the following 4 years from $47.5 billion within the earlier fiscal 12 months.

Throw in further catalysts, such because the restoration within the PC market because of the adoption of AI-enabled PCs (which has began lifting Nvidia’s gaming enterprise), and it is easy to see why analysts are estimating Nvidia’s earnings to extend at 46% a 12 months for the following 5 years. That is considerably sooner than the expansion Apple is predicted to ship over the identical interval.

After all, Apple might get a shot within the arm, because of the emergence of AI smartphones, however buyers ought to notice that the corporate is working in a really aggressive market. Within the second quarter of 2024, Apple’s smartphone market share stood at 15.8%, down from 16.6% in the identical quarter in 2023. Its shipments grew just one.5% 12 months over 12 months as in comparison with the general smartphone-market’s development of 6.5%.

It is simple to see why Nvidia’s development is predicted to be sooner because it leads the AI chip market, whereas Apple operates in a crowded house the place rivals have acted with alacrity in leaping onto the AI bandwagon. As such, the potential for Nvidia overtaking Apple’s market share over the following 5 years, because of its sooner bottom-line development, cannot be dominated out, and AI goes to play a central position in serving to the semiconductor firm obtain that.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $692,784!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 22, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, BP, Microsoft, Moody’s, and Nvidia. The Motley Idiot recommends Amgen, Cognizant Expertise Options, and Novo Nordisk and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Prediction: 2 Synthetic Intelligence (AI) Shares That May Be Value Extra Than Apple 5 Years From Now was initially printed by The Motley Idiot