The S&P 500 (SNPINDEX: ^GSPC) market index set a contemporary all-time excessive this week, closing Friday’s buying and selling at 4,838. That is 35% above the market backside in October 2022, which marked the top of the final bear market.

Because of the odd methods bull and bear market definitions work, it’s now protected to say that this can be a correct bull market; it wasn’t official till proper now nevertheless it arguably began 15 months in the past.

Bullish market circumstances have lasted a mean of three years over every within the final century. The common inventory market acquire when the following bearish swing comes alongside stands at 114% over the identical evaluation interval. Rising 35% in a yr and alter is a wonderful begin, however this bull run will most likely have the legs for a a lot bigger acquire.

These market temperament classes will not be laborious and quick guidelines, in fact. They’re extra like useful guidelines of thumb that point out statistical tendencies. Historical past does not repeat itself, nevertheless it usually rhymes. Subsequently, I feel Wall Avenue is prone to stroll down this well-trodden pathway for some time, as historic patterns point out.

As such, it is best to have loads of time to money in on the contemporary bull market by investing in high-octane progress shares on the rise. The market circumstances are ripe for a protracted worth enhance, particularly because the Fed is getting a deal with on the inflation disaster. Given these optimum market circumstances, I extremely advocate wanting into Roku (NASDAQ: ROKU) and CrowdStrike Holdings (NASDAQ: CRWD). These hypergrowth tech shares have fingers in all the fitting pies, they usually seem like no-brainer buys at this juncture.

CrowdStrike’s double-edged AI sword

Constructing on this bullish market backdrop, CrowdStrike strikes me (pun meant!) as a protected guess on the dual alternatives of synthetic intelligence (AI) and cybersecurity.

This firm analyzes and mitigates safety threats with the assistance of machine studying instruments. CrowdStrike advantages from the event on new AI applied sciences, making use of contemporary insights to its safety programs on the fly. On the similar time, advances in AI analysis alsogives hackers extra instruments, rising the necessity for stronger safety shields. It is a win-win state of affairs the place CrowdStrike performs either side of the evolving AI subject’s upsides and disadvantages.

This distinctive positioning within the ever-evolving AI panorama provides CrowdStrike a aggressive edge. With its revolutionary AI functions, exemplified by the AI chatbot Charlotte in its Falcon system, CrowdStrike is not simply retaining tempo with cybersecurity tendencies — it is setting them and difficult others to maintain up.

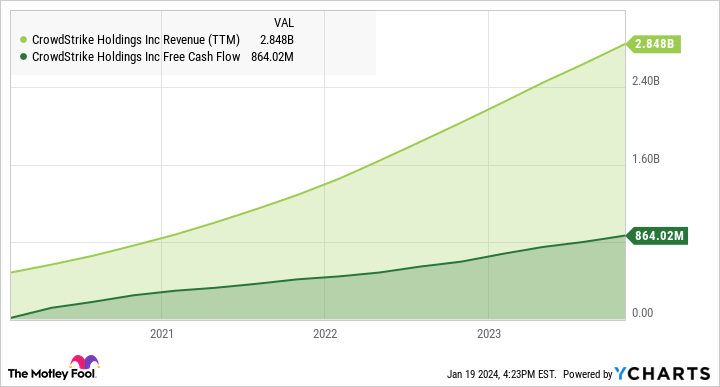

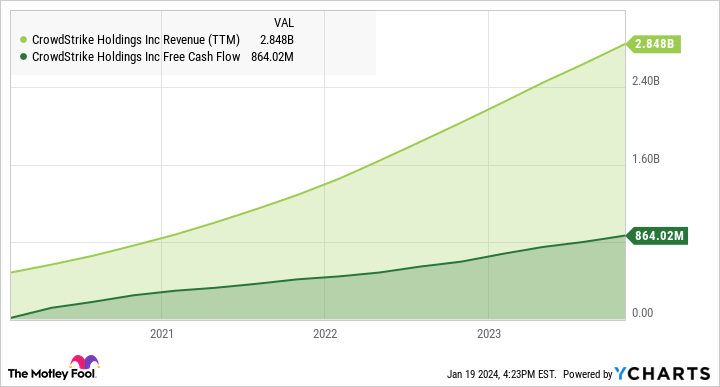

It reveals in CrowdStrike’s monetary reviews. Revenues and free money flows will not be solely rising quick, however the progress is accelerating in latest quarters:

After all, traders have embraced CrowdStrike’s AI-driven progress. The inventory rose 188% over the past 52 weeks, boosting its valuation to a lofty 24.5 instances trailing gross sales. In contrast, the common price-to-sales ratio of the S&P 500 stands at 2.6 proper now, and that is thought-about a traditionally wealthy a number of within the first place.

So CrowdStrike is not an inexpensive inventory however you get what you pay for — a market-leading knowledgeable within the thriving cybersecurity market, utilizing fashionable AI instruments to maintain hackers at bay. For traders seeking to capitalize on the intersection of AI and cybersecurity, CrowdStrike presents a compelling alternative proper now. It is a dear inventory nevertheless it needs to be value each penny as the corporate’s progress prospects proceed to broaden.

Roku’s hidden progress rockets

Many traders are fast to brush off Roku because the media-streaming platform knowledgeable is not worthwhile in the meanwhile. I imply, the corporate has eked out $102 million of free money flows within the final 4 quarters, based mostly on $3.4 billion in top-line revenues, however its backside line added as much as an $868 million web loss over the identical interval and retains diving decrease.

Nonetheless, it is best to know that Roku primarily volunteered for these rock-bottom earnings. When rivals and challengers to its dominant market place battled inflation with larger costs, Roku stored its worth tags and royalty charges regular. It is an costly tactic, but in addition an efficient one. The corporate boasted 75.8 million energetic accounts in November’s third-quarter replace — a 34% enhance from 56.4 million accounts two years earlier. Quarterly gross sales rose from $680 million to $912 million over that span.

International rival Samsung‘s (OTC: SSNL.F) gross sales fell 18% decrease in the identical interval. It isn’t an apples-to-apples comparability, given the Korean tech and electronics conglomerate’s big selection of services, however Samsung’s drooping income line serves as a stark distinction to Roku’s large progress.

Market makers largely left Roku bleeding in a Wall Avenue ditch two years in the past, and regardless of a 73% worth acquire within the final 52 weeks, the inventory nonetheless trades 82% under the all-time highs from the summer season of 2021.

The worldwide urge for food for user-friendly streaming platforms ought to rise once more as this bull market performs out. On the similar time, the promoting market’s prolonged downturn ought to swing again to spectacular demand, permitting Roku to gather dramatically richer revenues in 2024 and past.

Bear in mind, the corporate has moved on from its previously heavy reliance on system gross sales to concentrate on extra profitable software program licenses and advert gross sales as a substitute. And the market has given Roku roughly zero credit score for this game-changing technique shift up to now. I can not wait to see what the inventory would possibly do when the refreshed economic system begins to pay dividends.

This thrilling progress inventory has no enterprise buying and selling at merely 3.7 instances gross sales and 82% under its document highs. But, right here we’re. I feel you will be kicking your self should you do not seize a number of shares of this undervalued progress rocket earlier than this bull market actually takes off.

Must you make investments $1,000 in CrowdStrike proper now?

Before you purchase inventory in CrowdStrike, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for traders to purchase now… and CrowdStrike wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 16, 2024

Anders Bylund has positions in Roku. The Motley Idiot has positions in and recommends CrowdStrike and Roku. The Motley Idiot has a disclosure coverage.

2 Hypergrowth Tech Shares to Purchase in 2024 and Past was initially revealed by The Motley Idiot