Low cost shares find yourself low-cost for a motive, which is likely one of the onerous truths of worth investing. You normally need to be prepared to go towards the grain and purchase out of favor shares regardless of the market’s considerations. Proper now Rexford Industrial (NYSE: REXR) and Toronto-Dominion Financial institution (NYSE: TD) are on the outs, however that is left them each with traditionally excessive dividend yields. Now’s the time to behave. This is why.

Rexford is targeted on a pretty market

On the subject of warehouses, Southern California is pretty distinctive. It’s the largest industrial market in the USA. It might be the fourth-largest industrial market on the earth when you had been to interrupt it out from the broader United States, and it’s over twice the scale of the next-largest U.S. market, New York and New Jersey.

Regardless of its measurement, it has a decrease emptiness price than the opposite main U.S. markets. It’s provide constrained, with demand for housing typically resulting in older industrial belongings being transformed to homes or flats, amongst different issues. And, as if that weren’t sufficient, there’s restricted new development of business belongings. All in all, Southern California is a really engaging place to personal industrial belongings, which is why Rexford Industrial is targeted on the area.

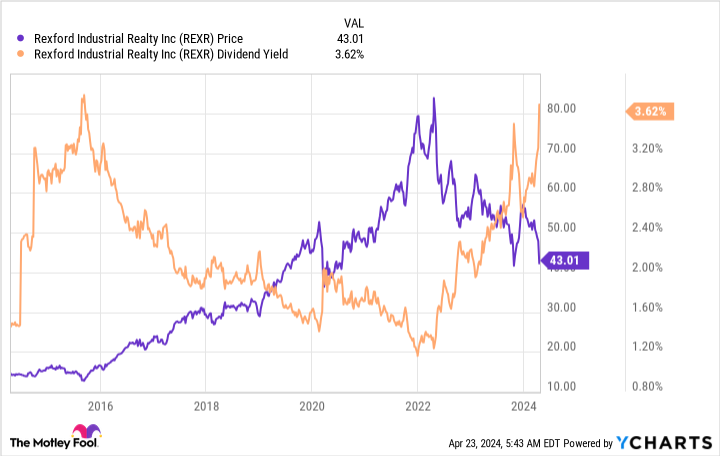

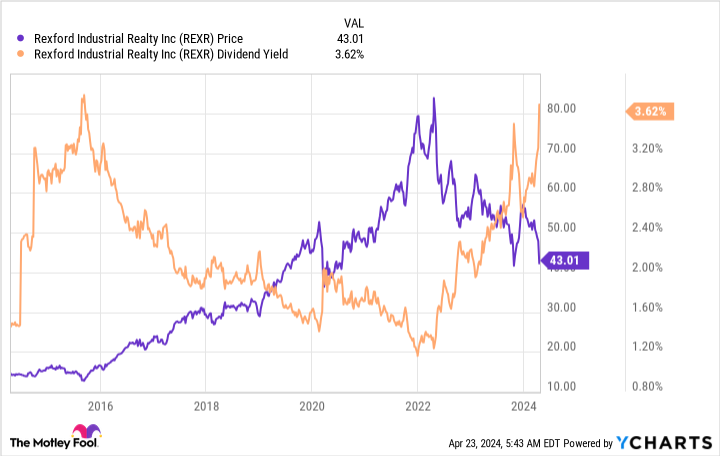

The actual property funding belief (REIT) simply introduced stable first-quarter 2024 outcomes, with funds from operations up 20.3%. Nevertheless, buyers are frightened by the truth that rental will increase are beginning to decelerate from the blistering sizzling tempo skilled over the past couple of years. The corporate barely elevated its full-year steerage, however shares nonetheless cratered, pushing the yield up towards 10-year highs.

This can be a shopping for alternative for long-term buyers. Notably, Rexford believes that redevelopment and repositioning of current properties are going to be the principle drivers of progress between 2024 and 2026. That is constructed into the portfolio already, so there is not any motive to consider the REIT cannot get it completed. Whereas the dividend yield is modest at 3.8%, the dividend has been elevated at a speedy 15% or so annualized price over the previous decade, with greater progress charges in more moderen years. If you’re a dividend progress investor, Rexford appears to be like each low-cost and engaging in the present day.

Toronto-Dominion Financial institution has some headwinds to take care of

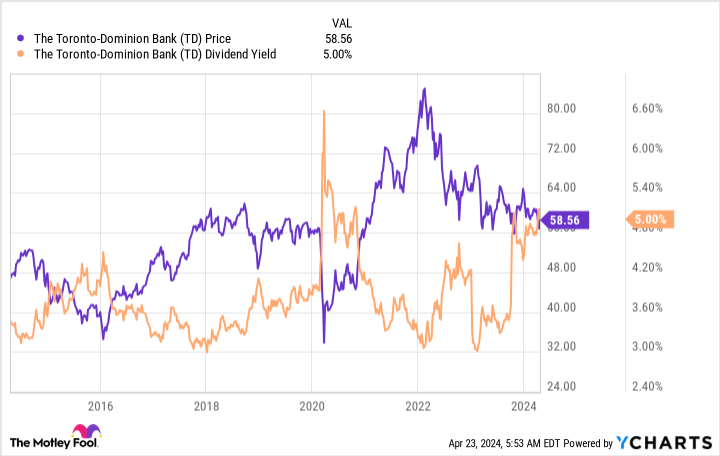

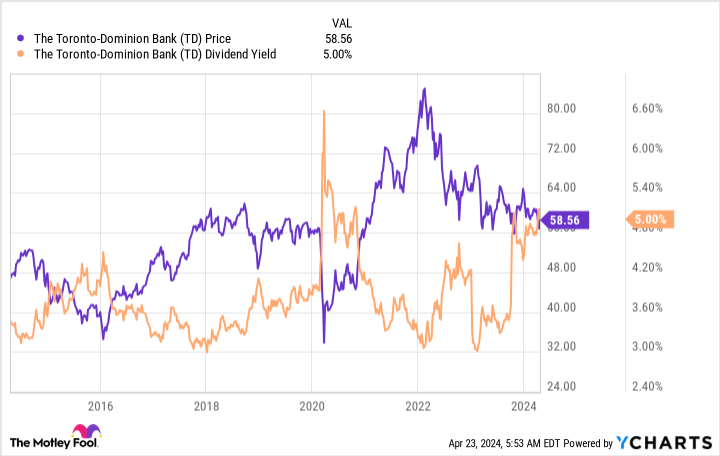

TD Financial institution is the sixth-largest financial institution in North America by belongings, and is the second-largest financial institution in Canada on that measure. It’s an trade big that competes with U.S. firms like Financial institution of America (NYSE: BAC) and Citigroup (NYSE: C). However there’s one factor that dividend buyers ought to notice: In the course of the Nice Recession, Financial institution of America and Citi each lower their dividends. TD Financial institution didn’t. If dividend consistency issues to you, you will wish to take a look at TD Financial institution and its traditionally excessive 5.1% yield.

There are, after all, issues to think about. For instance, the Canadian housing market has been cooling down after an enormous run up. Add within the swift rise in rates of interest has buyers involved that the mortgage enterprise is slowing down, and the financial institution may also probably begin to see a rise in mortgage issues. To this point that hasn’t actually proven up, however on the finish of the fiscal first quarter TD Financial institution had the second-highest Tier 1 Capital ratio in Canada (and third-highest in North America), which suggests it’s higher ready for adversity than most of its friends. Even when there are issues on the housing entrance in Canada, the financial institution ought to muddle by means of moderately properly.

Then there’s the U.S. market, the place TD Financial institution was pressured to name off an acquisition as a result of regulators had been involved in regards to the financial institution’s cash laundering controls. There’s more likely to be a fantastic, and it’ll most likely take a while to each resolve the considerations and earn again regulator belief. Meaning acquisition-led progress within the U.S. is more likely to be off the desk for a bit bit. Whereas that is not good, since it would imply slower near-term progress, TD Financial institution can nonetheless open new branches by itself. And ultimately it ought to be capable to get again on the acquisition monitor. This can be a non permanent roadblock.

All in all, when you can abdomen a bit near-term uncertainty, this well-respected financial institution appears to be like engaging in the present day.

Shopping for when others are scared

There isn’t any manner round it: If you wish to purchase low-cost shares, you are going to need to get used to investing in shares with some warts. Rexford and TD Financial institution are each a bit out of favor proper now, for reputable if maybe non permanent causes, which has pushed their yields close to decade highs. If you’re on the lookout for engaging dividend shares, each must be in your radar proper now.

Must you make investments $1,000 in Rexford Industrial Realty proper now?

Before you purchase inventory in Rexford Industrial Realty, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Rexford Industrial Realty wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $537,557!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 22, 2024

Citigroup is an promoting associate of The Ascent, a Motley Idiot firm. Financial institution of America is an promoting associate of The Ascent, a Motley Idiot firm. Reuben Gregg Brewer has positions in Toronto-Dominion Financial institution. The Motley Idiot has positions in and recommends Financial institution of America and Rexford Industrial Realty. The Motley Idiot has a disclosure coverage.

2 Extremely Low cost Dividend Shares to Purchase Now was initially revealed by The Motley Idiot