For 1000’s of years, people have tried to interpret indicators in an try to know what the long run holds. Gazing on the stars and studying palms, tarot playing cards, and tea leaves are just some of the strategies used.

Such efforts are thought-about superstitious by many immediately. Nonetheless, some traders assume sure alerts can precisely predict how shares will carry out. And two key indicators are flashing proper now that might level to a serious inventory market transfer.

The “concern index” is rising

Franklin D. Roosevelt famously mentioned, “The one factor we now have to concern is concern itself.” In that case, traders may have one thing to concern. Why? The inventory market’s “concern index” is rising.

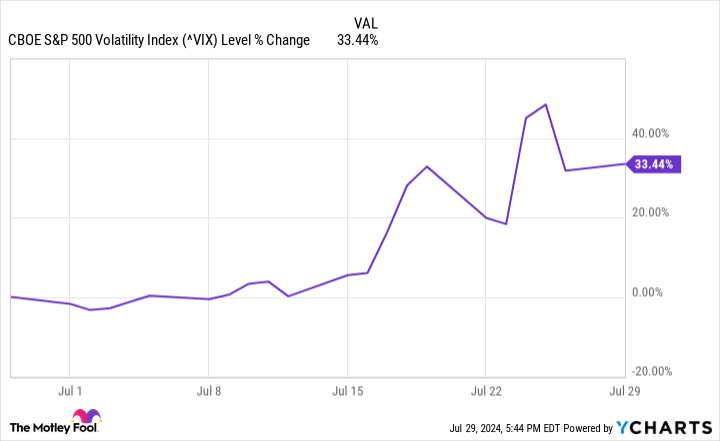

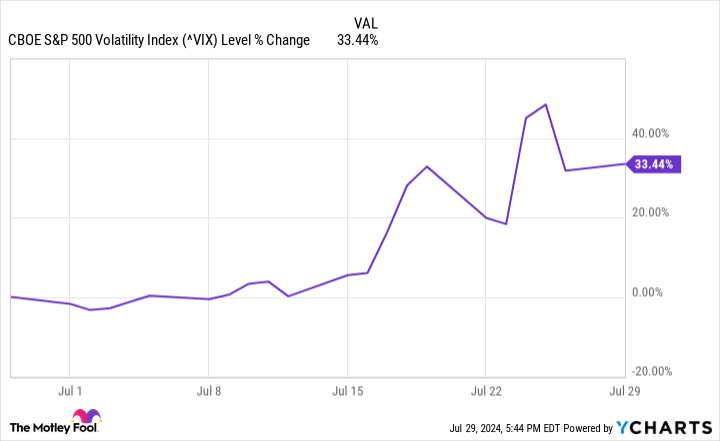

I am referring to the CBOE Volatility Index (VOLATILITYINDICES: ^VIX), which can be broadly identified by its ticker image VIX. During the last month, the VIX has jumped greater than 30%.

This index measures the expectation of volatility within the S&P 500 over the subsequent 30 days. It is calculated through the use of the costs of S&P 500 index choices. The upper the costs of those choices, the extra volatility is anticipated.

To a big extent, the inventory market is pushed by the mindsets of traders. When traders are assured, they’re extra seemingly to purchase shares. This creates shopping for stress that pushes share costs increased. Nonetheless, when traders are fearful, they’re extra prone to keep on the sidelines. This may set the stage for inventory costs to fall.

The Buffett indicator is close to an all-time excessive

Greater than twenty years in the past, Warren Buffett described in Fortune journal what he considered as “in all probability the very best single measure of the place valuations stand at any given second.” He was speaking in regards to the ratio of the whole U.S. inventory market worth to the nation’s gross home product (GDP). This ratio grew to become generally known as the Buffett indicator.

When Buffett made that assertion in December 2001, the inventory market was amid a serious sell-off because the dot-com bubble burst. The legendary investor argued that when the ratio of complete inventory market worth to GDP rose to an unprecedented degree two years earlier, it “ought to have been a really sturdy warning sign.”

Buffett additionally mentioned within the Fortune article, “If the ratio approaches 200% — because it did in 1999 and part of 2000 — you’re enjoying with fireplace.” He talked about that the ratio had not too long ago hit 133%.

Quick ahead to the current. The Buffett indicator is at practically 194%. The one time it has been increased was in November 2021. The S&P 500 quickly started a pointy decline and ultimately fell greater than 19%.

Is a serious inventory market decline on the best way?

With two indicators flashing ominously, is a serious inventory market decline on the best way? Perhaps, however not essentially. No inventory market indicator is ideal.

For instance, the CBOE Volatility Index was a lot increased in early 2023 than it’s now. The S&P 500 completed the 12 months up 24%.

As for the Buffett indicator, even with the ratio setting all-time highs starting in early 2018, the S&P 500 continued to rise. It is also essential to notice that the ratio makes use of solely U.S. GDP, however many U.S. corporations generate a lot of their income in different international locations. Globalization has made the Buffett indicator much less helpful than it as soon as was.

What ought to traders do? I believe they need to solely purchase shares which have enticing valuations relative to their development prospects. I additionally imagine that having some money on the sidelines to deploy if the inventory market falls is a good suggestion. Nonetheless, I might advocate these two issues even when the “concern index” was declining and the Buffett indicator was a lot decrease.

Don’t miss this second probability at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? Then you definitely’ll wish to hear this.

On uncommon events, our skilled crew of analysts points a “Double Down” inventory advice for corporations that they assume are about to pop. If you happen to’re fearful you’ve already missed your probability to take a position, now’s the very best time to purchase earlier than it’s too late. And the numbers communicate for themselves:

-

Amazon: in case you invested $1,000 after we doubled down in 2010, you’d have $20,633!*

-

Apple: in case you invested $1,000 after we doubled down in 2008, you’d have $41,238!*

-

Netflix: in case you invested $1,000 after we doubled down in 2004, you’d have $338,114!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable corporations, and there will not be one other probability like this anytime quickly.

See 3 “Double Down” shares »

*Inventory Advisor returns as of July 29, 2024

Keith Speights has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

2 Key Indicators Are Flashing That Might Level to a Main Inventory Market Transfer was initially printed by The Motley Idiot