The political winds are pushing the vitality {industry} ever additional towards the inexperienced, selling renewable energy sources and electrification over fossil fuels. The irony in that is that sure uncommon metals, important to a inexperienced vitality financial system, have taken on a brand new significance. In a way, lithium is the brand new coal.

This level was pushed house simply this month, when the Chinese language battery maker CATL, a frontrunner within the international marketplace for electrical automobile battery packs, introduced a altering to its pricing technique. The brief model is, the corporate will likely be subsidizing lithium to cut back the price of its batteries, accepting successful to margins and income in an effort to maximise market share. The results of this choice have been overwhelming, and lithium miners have been among the many first to really feel it.

As a bunch, main lithium mining corporations noticed their shares fall on fears that CATL’s value manipulations could distort demand and pricing all through the lithium manufacturing and provide chains. However a minimum of some Wall Road analysts are saying that now could be the time to get into lithium, trusting the underlying energy of the {industry} going ahead and utilizing present pricing to ‘purchase the dip.’

We’ve used the TipRanks database to search for the main points on two lithium miners which have not too long ago gotten the nod from the Road.

Sociedad Quimica Y Minera de Chile (SQM)

First up is the Chilean agency of Sociedad Quimica Y Minera, SQM. This firm has its fingers in a variety of chemical and mineral manufacturing sectors, from iodine and potassium to industrial chemical substances and plant fertilizers – and it’s the world’s largest single producer of lithium. Elevated demand for lithium, powered by the EV market’s endless urge for food for lithium-ion battery packs, has been supportive of SQM, which has seen rising revenues, earnings, and share costs during the last yr.

On the monetary facet, SQM received’t report 4Q and full yr 2022 outcomes till subsequent week, however in accordance with the 3Q22 outcomes, the corporate had a backside line of $2.75 billion for the 9 months ending on September 30, 2022. This was nearly 10x greater than the $263.9 million reported in the identical interval of 2021, and displays each the worldwide financial reopening post-COVID in addition to growing demand for lithium on the worldwide markets. EPS for the nine-month interval was $9.65, in comparison with simply $0.92 within the prior yr timeframe. On the high line, 9-month revenues got here to $7.57 billion.

Of that 9-month income whole, $5.62 billion got here from lithium and lithium derivatives, exhibiting simply how dominant lithium is in SQM’s enterprise. SQM’s lithium-related income grew by 1,161% year-over-year in 3Q22 alone, to succeed in $2.33 billion.

With the lithium sector powering that form of income and earnings development, SQM ought to have the ability to climate any storm. J.P. Morgan analyst Lucas Ferreira would agree. Wanting on the disruptions within the lithium markets this week, he writes, “Whereas noisy, we predict this could not grow to be an industry-wide apply, and lithium costs ought to in the end be a operate of Li SxD dynamics, which we nonetheless see in a deficit for the subsequent three years….”

“We expect CATL’s lithium subsidies ought to generate a battery value conflict, which isn’t wholesome for the worth chain. Nonetheless, the corporate can’t remedy the lithium deficit by itself as this can be a operate of the unbalanced SxD JPM forecasts to stay in place for the subsequent 3 years. That mentioned, we imagine CATL’s actions ought to have restricted affect on pricing of different suppliers [like SQM] within the close to time period,” the analyst added.

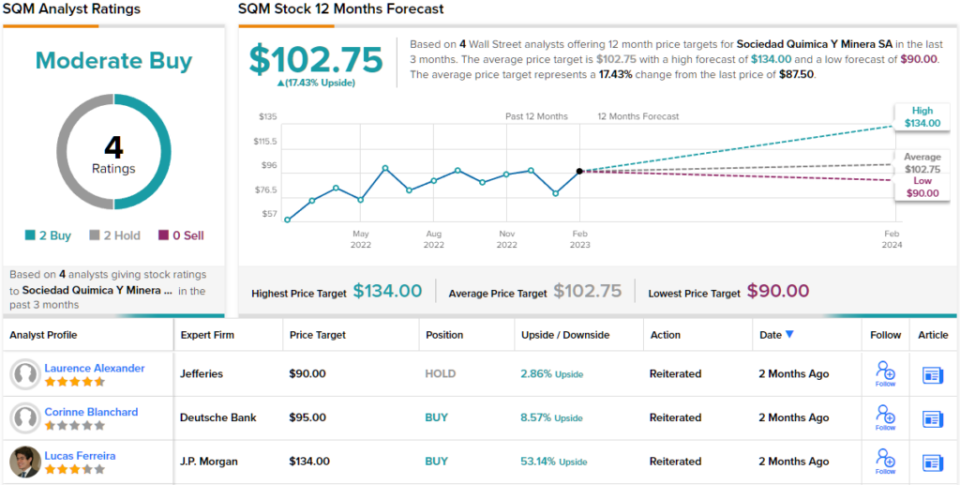

Ferreira backs his bullish view with an Obese (i.e. Purchase) score on SQM, and value goal of $134 that signifies his personal confidence in a 53% upside by the top of this yr. (To observe Ferreira’s monitor file, click on right here)

So, that’s J.P. Morgan’s view, let’s flip our consideration now to remainder of the Road: SQM 2 Buys and a couple of Holds coalesce right into a Reasonable Purchase score. There’s a double-digit upside – 17.43% to be precise – ought to the $102.75 common value goal be met within the subsequent 12 months. (See SQM inventory forecast)

Albemarle Company (ALB)

The second lithium inventory we’ll take a look at is North Carolina-based Albemarle, a specialty chemical firm with a concentrate on lithium and bromine refining. The corporate is a serious title available in the market for battery-grade lithium merchandise, and holds a number one market share within the EV battery phase. The corporate boasts a worldwide attain, and sources its lithium from three main manufacturing websites, in Nevada, Chile, and Australia.

As with SQM above, Albemarle has benefited from rising lithium costs over the previous yr. For the complete yr 2022, Albemarle’s revenues got here to greater than $7.3 billion. The corporate noticed its high line rise sequentially in every quarter of 2022, culminating in This fall’s year-over-year improve of 163% to $2.6 billion. On the backside line, Albemarle noticed a quarterly web earnings of $1.1 billion, or an adjusted diluted EPS of $8.62 – a determine that was up a whopping 753% y/y.

Lithium was the motive force of the corporate’s robust outcomes, with the This fall web gross sales coming in at $2.06 billion. This was a 410% improve from the prior-year quarter.

Wanting forward, Albemarle is guiding towards full-year 2023 revenues of $11.3 billion to $12.9 billion, and predicts an adjusted earnings for this yr within the vary of $4.2 billion to $5.1 billion. Attaining the midpoint of the income steering will translate to a 65% year-over-year high line achieve.

5-star analyst Colin Rusch, from Oppenheimer, offers an encouraging outlook on Albemarle’s prospects, writing, “We view the incremental info on spot pricing, seasonality, and total manufacturing ranges for China EVs as comforting for bulls. ALB is assuming 40% Y/Y development in EV manufacturing in China, which we imagine might show conservative given historic patterns and scale advantages to OEM price construction possible will assist drive increased volumes… We proceed to imagine ALB’s know-how place in lithium extraction and processing is underappreciated by buyers…”

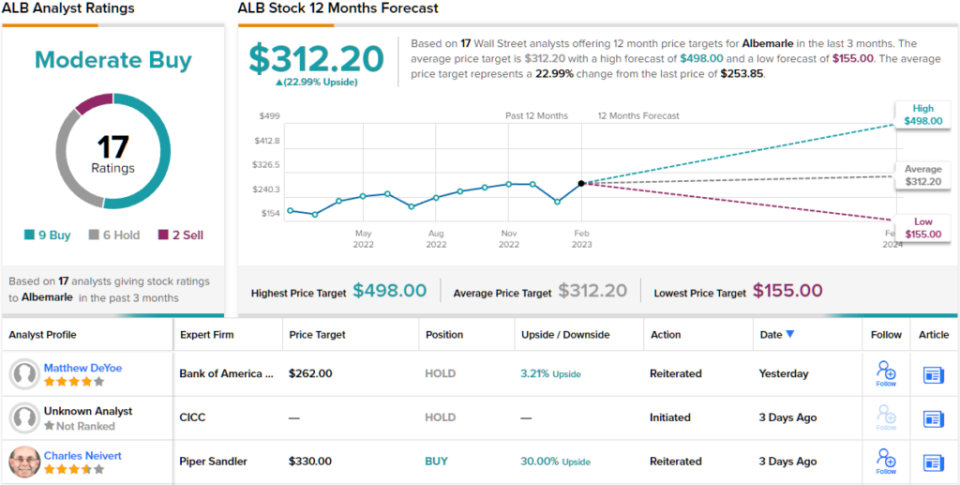

Taking this line ahead, Rusch offers ALB an Outperform (i.e. Purchase) score, with a $498 value goal to counsel a formidable one-year upside potential of 96%. (To observe Rusch’s monitor file, click on right here)

General, ALB has 17 latest analyst evaluations on file, and so they embrace 9 buys, 6 Holds, and a couple of Sells – for a Reasonable Purchase consensus score. The shares are promoting for $253.85 and their common value goal of $312.20 factors towards a achieve of 23% within the months forward. (See ALB inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally vital to do your personal evaluation earlier than making any funding.