Enthusiasm for the potential of synthetic intelligence (AI) has helped push many corporations, together with Nvidia and Microsoft, to new valuation highs, and there is a excellent likelihood that this probably unimaginable new tech development will energy much more beneficial properties for these tech titans. However not all AI-related shares hit new highs in 2023 and there are nonetheless some main AI gamers that commerce at large reductions in comparison with their earlier peaks.

Should you’re trying so as to add AI shares with explosive potential to your portfolio, learn on to see why two Motley Idiot contributors suppose it is best to spend money on these high corporations whereas they’re inventory costs are nonetheless down greater than 50% from their respective highs.

Palantir is the main supplier of AI companies to companies and establishments

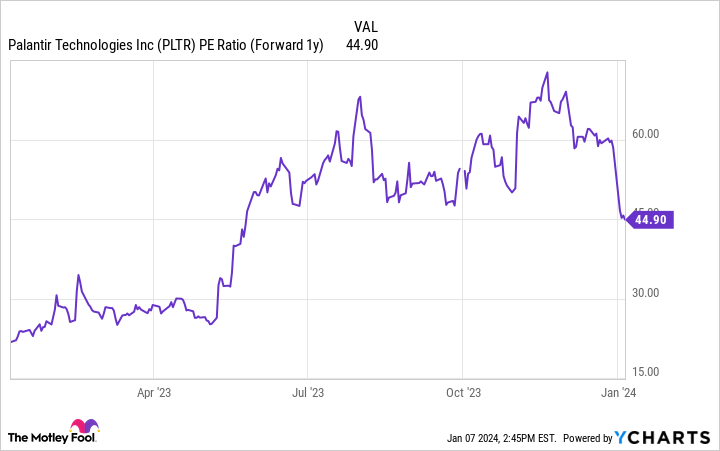

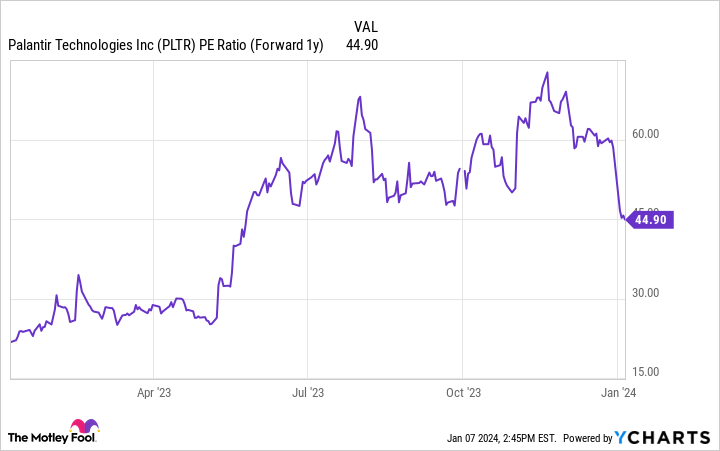

Parkev Tatevosian: Palantir Applied sciences (NYSE: PLTR), one of many main companies offering enterprise options utilizing AI, has seen its share value fall 57% off the highs reached in 2021. The drop is likely to be a possibility for long-term buyers so as to add shares of this wonderful development inventory at engaging valuations.

Palantir’s income has greater than tripled from 2018 ranges of $595 million to $1.9 billion in 2022. The corporate is anticipated to point out continued income growth when it studies its full-year numbers for 2023. Furthermore, given the elevated demand for AI options, Palantir’s development ought to proceed for a number of extra years.

Even higher, Palantir managed to manage prices whereas gross sales elevated. Working profitability, which measures the distinction between income and working bills, elevated from a lack of $141 million within the quarter that resulted in June 2021 to a revenue of $40 million within the quarter that resulted in September 2023.

Palantir’s inventory value sell-off and the expansion in its earnings have it buying and selling at a beautiful ahead price-to-earnings ratio of 45. Traders may wish to purchase this wonderful AI inventory at an affordable valuation whereas the choice stays open. It could not shock me if this inventory have been to get costly in a rush to begin 2024.

Snowflake will play a foundational function within the rise of AI

Keith Noonan: Because the administration crew at Snowflake (NYSE: SNOW) is fond of claiming, “There isn’t any AI technique with out a knowledge technique.” Knowledge is the gasoline that powers and improves synthetic intelligence algorithms. The power to entry and analyze the widest attainable breadth of invaluable data is central to being aggressive in tech — and AI specifically.

Snowflake’s Knowledge Cloud platform makes it attainable to mix and analyze data generated from in any other case walled-off cloud companies. Inside its Knowledge Cloud, Snowflake additionally provides the power to construct, run, and scale functions natively on the platform. For sure data-intensive apps, being constructed immediately on a platform that already accommodates mixed knowledge from totally different cloud platforms can supply important benefits.

As a substitute of utilizing the subscription-based mannequin that has turn out to be the norm for many cloud software program corporations, Snowflake generates the overwhelming majority of its income from a consumption-based setup. This units up a dynamic the place the corporate grows alongside its clients, and the information specialist is poised to learn as its purchasers proceed to create and use AI apps.

Notably, Snowflake remains to be simply beginning to profit from long-term AI tailwinds — and it is already posting explosive development. Product income grew 34% yr over yr to succeed in $698 million within the third quarter of the corporate’s 2024 fiscal yr, a interval that ended Oct. 31. In the meantime, non-GAAP (adjusted) free money circulate jumped 70% yr over yr to hit $111 million.

Wanting forward, the corporate expects that product income will rise from roughly $2.65 billion within the 2024 fiscal yr that ends this month to $10 billion in fiscal 2029. Administration additionally anticipates important growth for margins throughout the stretch.

With large development alternatives forward and the inventory nonetheless down 51% from its excessive, Snowflake stands out as a sensible purchase for buyers who’re on the lookout for methods to revenue from the rise of AI.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Palantir Applied sciences wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 8, 2024

Keith Noonan has no place in any of the shares talked about. Parkev Tatevosian, CFA has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Microsoft, Nvidia, Palantir Applied sciences, and Snowflake. The Motley Idiot has a disclosure coverage.

2 Magnificent Synthetic Intelligence (AI) Progress Shares Down Greater than 50% to Purchase in 2024 was initially printed by The Motley Idiot