Investing in shares will be tough, because the market’s previous efficiency would not at all times point out what’s to return. Nevertheless, data is energy, and noticing previous patterns may also help make sure you’re able to strike if historical past decides to repeat itself. Because of this, it might probably solely assist buyers to know that historical past suggests the Nasdaq Composite might surge in 2024.

For the reason that index launched in 1971, it has risen by a median of 19% in every year that adopted a market restoration of the magnitude seen in 2023. Consequently, it isn’t a foul concept to think about investing within the firms fueling the majority of the Nasdaq Composite’s development.

The phrase “Magnificent Seven” was coined final 12 months to explain the seven most distinguished tech firms, which embody Alphabet, Amazon (NASDAQ: AMZN), Apple, Meta Platforms, Microsoft, Nvidia (NASDAQ: NVDA), and Tesla. These firms rule tech, and plenty of had been key gamers available in the market’s stellar restoration final 12 months.

The Magnificent Seven might be a wonderful place to speculate and revenue from a possible surge within the Nasdaq composite in 2024. So, listed below are two Magnificent Seven shares to purchase proper now.

1. Nvidia

Whether or not you are an informal investor or commerce professionally, you are seemingly conscious of Nvidia’s meteoric rise final 12 months. Its inventory soared by 239% in 2023 as its graphics processing models (GPUs) grew to become the gold commonplace for synthetic intelligence (AI) builders in all places. These high-powered parallel-processing chips are essential for coaching and powering AI fashions, with elevated demand inflicting Nvidia’s earnings to skyrocket.

The corporate achieved an estimated 90% market share in AI chips whereas rivals like Superior Micro Gadgets and Intel scrambled to atone for the expertise entrance.

In Nvidia’s most up-to-date quarter (the fiscal fourth quarter of 2024, which led to January), the corporate’s income elevated by 265% 12 months over 12 months to $22 billion. In the meantime, working revenue jumped 983% to almost $14 billion. This monster development was primarily due to a 409% improve in knowledge heart income, reflecting a spike in AI GPU gross sales.

Competitors within the AI chip house is anticipated to warmth up this 12 months, with AMD and Intel bringing highly effective new {hardware} to market. Nevertheless, along with hovering earnings, Nvidia’s free money circulation is up 430% within the final 12 months to $27 billion, considerably greater than AMD’s $1 billion and Intel’s detrimental $14 billion.

So, regardless of new GPU releases from each rivals, Nvidia’s head begin in AI doubtlessly pushed it additional forward with larger money reserves to proceed investing in its expertise and retain market supremacy.

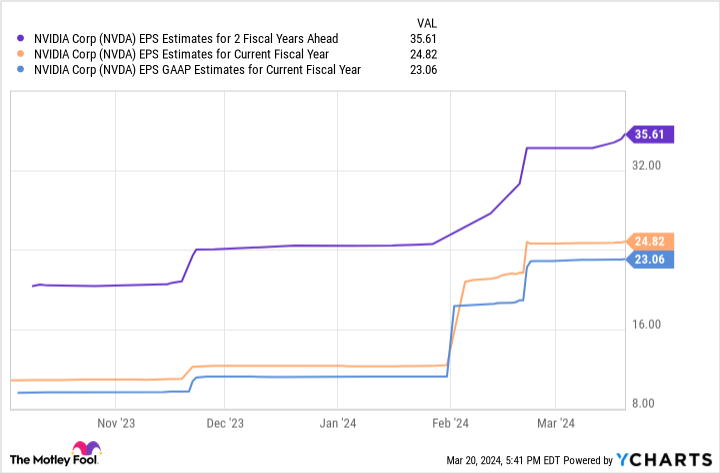

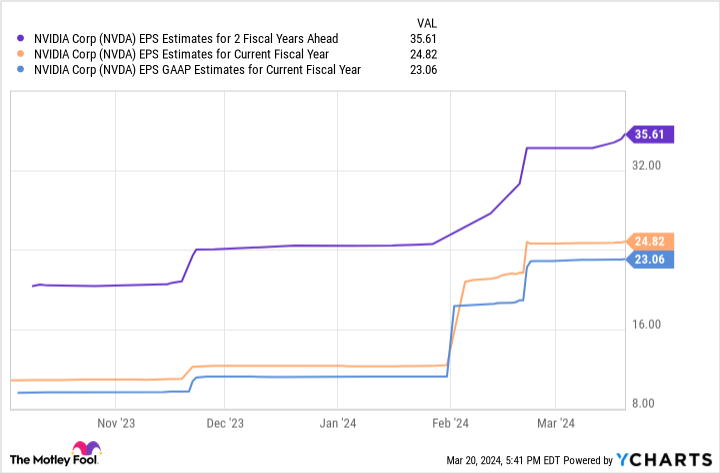

The desk above exhibits Nvidia’s earnings might hit near $36 per share by fiscal 2026. Multiplying that determine by its ahead price-to-earnings (P/E) ratio of 37 yields a inventory worth of about $1,300.

Contemplating the corporate’s present place, that projection would see Nvidia’s inventory rise 44% over the following two fiscal years. Given its distinguished place in AI, Nvidia is a Magnificent Seven inventory that is too good to cross up.

2. Amazon

Amazon has come a great distance since beginning as a web based e book retailer out in Seattle virtually 30 years in the past. The tech large has expanded to a number of industries, from turning into a titan of e-commerce to main the cloud market, creating house satellites, and venturing into grocery, gaming, client tech, and extra.

However all eyes have been on Amazon’s AI efforts during the last 12 months. Because the operator of the world’s largest cloud service, Amazon Net Providers (AWS), the corporate has the potential to leverage its huge cloud knowledge facilities and steer the generative AI market.

In 2023, AWS responded to elevated demand for AI providers by introducing quite a lot of new instruments. Amazon is even utilizing AI to spice up its retail web site. It introduced an AI buying assistant dubbed Rufus forward of its newest earnings launch.

In fiscal 2023, Amazon’s income rose 12% 12 months over 12 months, with working revenue greater than tripling to $37 billion. A strong restoration in its e-commerce earnings during the last 12 months has seen Amazon’s free money circulation soar 904% to over $32 billion, indicating the corporate has the funds to proceed investing in its enterprise and overcome potential headwinds.

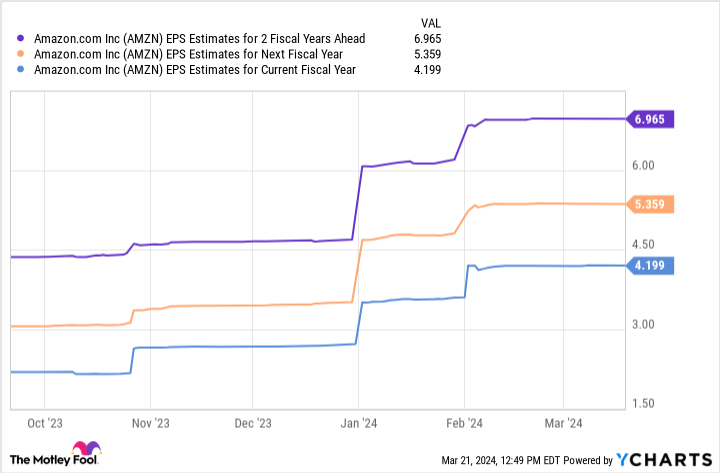

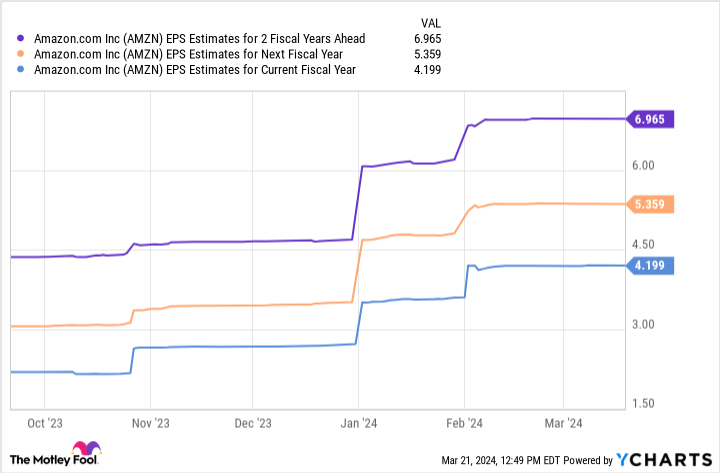

The chart above signifies that Amazon’s earnings might obtain almost $7 per share by fiscal 2026. When multiplying that by its ahead P/E of 43, you get a inventory worth of $300.

This projection would see Amazon’s inventory rise 68% from its present worth over the following two fiscal years. Because of this, the corporate is price contemplating earlier than its share worth surges.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 21, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Dani Prepare dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, quick January 2026 $405 calls on Microsoft, and quick Might 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

Historical past Suggests the Nasdaq Will Surge in 2024: 2 “Magnificent Seven” Shares to Purchase Proper Now was initially printed by The Motley Idiot