My favourite holding interval is perpetually. Think about proudly owning a chunk of a timeless enterprise, one which grows its income yr in and yr out, slowly producing life-changing wealth for you and your family members. After all, these corporations aren’t simple to search out. Most shares do not earn a lifetime membership in an investor’s portfolio.

Nevertheless, Amazon (NASDAQ: AMZN) and Hershey (NYSE: HSY) might qualify. I will clarify what makes them so particular and why they’re price shopping for as we speak and holding perpetually.

A 3-headed wealth machine

There is a good likelihood Amazon impacts your life someway. It is the dominant e-commerce firm in America, with a whopping 38% of the market. Amazon Internet Providers, its cloud section, underpins a lot of the web.

And if you’re a soccer fan, Amazon is a media big that streams Nationwide Soccer League video games — together with hundreds of films and reveals — making billions of {dollars} in advert income by doing it.

Not solely is Amazon’s presence in these three industries spectacular, however the measurement of those markets has additionally given Amazon the digital actual property to develop right into a multitrillion-dollar enterprise. In the present day, it makes over $570 billion in income, pumping out $85 billion in working income which might be reinvested into the corporate.

Its benefit over the competitors begins with its e-commerce enterprise, which has develop into so massive that it is robust to copy. Its provide chain handles almost 1 / 4 of all packages shipped in america. That measurement, mixed with its aggressive tradition of innovation, makes it onerous to see Amazon going away anytime quickly.

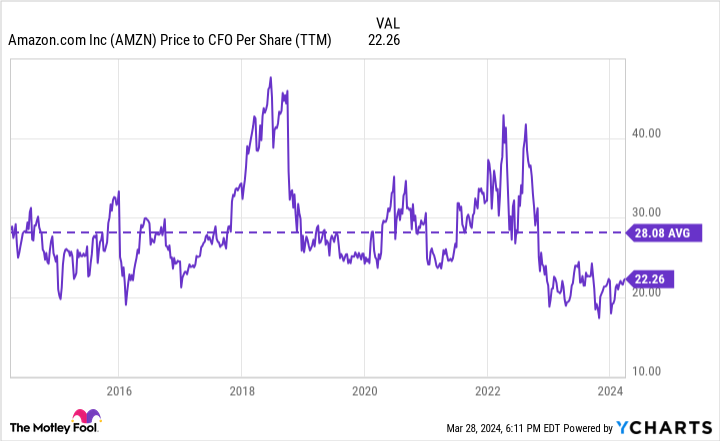

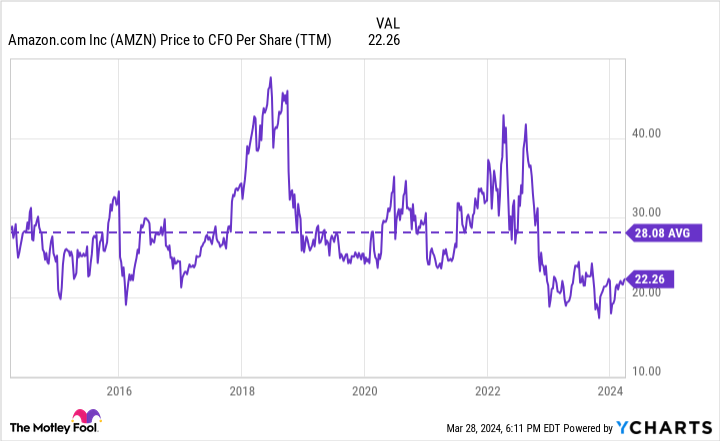

I like valuing the inventory on its working money move as a result of Amazon invests closely in rising the enterprise, even at its present measurement. For those who evaluate the share worth to the working money move per share, the inventory remains to be low-cost relative to its long-term common.

Buyers can confidently add Amazon to their portfolios. And barring an unexpected catastrophe, do not let go.

Candy by no means goes out of favor.

Hershey is on a very totally different finish of the spectrum. It makes chocolate and salty snacks. It is not a posh enterprise mannequin, however that may be good.

It is the model that makes Hershey particular. There are different confectionary corporations available on the market, however Hershey’s identify goes again over a century and its manufacturers are routinely amongst People’ favorites year-round. Who does not love a Hershey bar, Package Kat, Twizzlers, Heath Bar, Jolly Rancher onerous candies, or a Reese’s peanut butter cup?

The corporate’s recognition means it will get prime shelf area at factors of sale, very similar to Coca-Cola and PepsiCo do within the beverage business. Hershey has an estimated 24% of the U.S. confectionary market, a formidable determine contemplating any firm could make chocolate bars. It is the model that makes the magic.

That interprets to financials, too. Hershey is an easy and extremely worthwhile enterprise that earns a formidable 22% return on invested capital. That implies that when Hershey pumps a greenback into its enterprise, it will get $1.22 again. This alerts that Hershey has pricing energy, which helps the corporate take care of a surge in cocoa costs that threatens to stress its revenue margins.

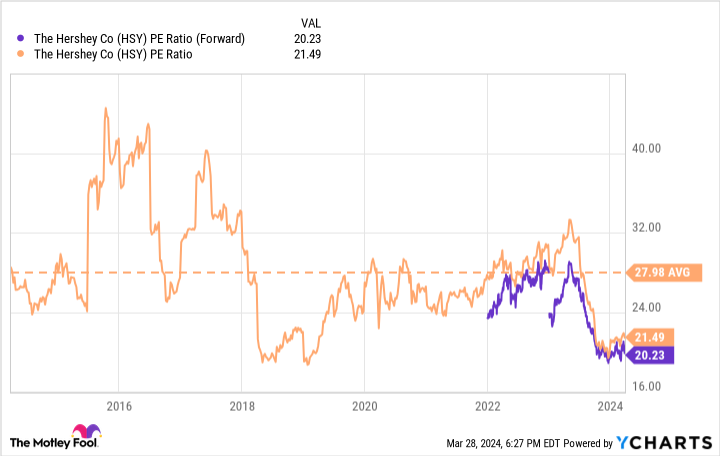

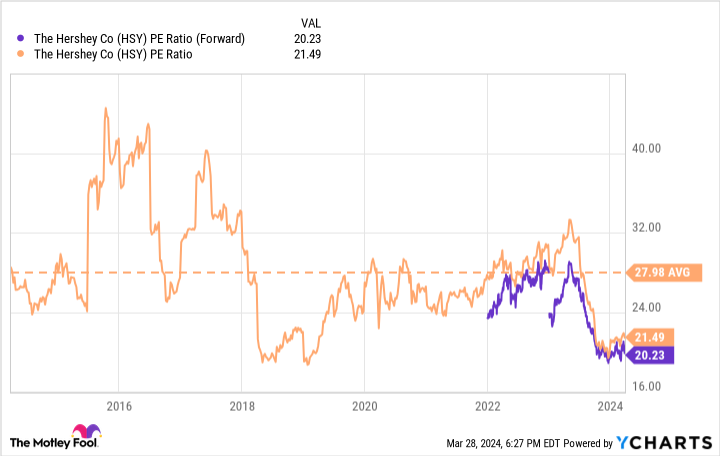

Whereas that is unhealthy information for the corporate, it is creating a chance for long-term traders. Shares have fallen to a price-to-earnings ratio of 20, under the corporate’s long-term common.

Over time, it ought to adapt to the upper cocoa costs, and there is a good likelihood the scarcity will finish and costs will normalize once more. In different phrases, use a short-term downside to purchase this glorious inventory and revel in the next years of dividends and worth appreciation.

Do you have to make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Amazon wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 25, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon. The Motley Idiot recommends Hershey. The Motley Idiot has a disclosure coverage.

2 Magnificent Shares You Can Purchase Proper Now and Maintain Eternally was initially printed by The Motley Idiot