All eyes have been on synthetic intelligence (AI) shares in 2023, with the market virtually singlehandedly triggering a restoration for the Nasdaq Composite after it plunged greater than 30% final yr.

Macroeconomic headwinds curbed client and business spending in 2022, resulting in a sell-off. Nonetheless, the launch of OpenAI’s ChatGPT in November 2022 made Wall Road bullish about tech shares once more, with numerous corporations restructuring their companies to give attention to the know-how. In consequence, the index has soared 43% since Jan. 1.

In response to Grand View Analysis, the AI market is valued at $137 billion, however is projected to exceed $1 trillion by the top of the last decade, increasing at a compound annual progress fee of 37%. The numerous progress potential suggests it isn’t too late to speculate on this budding business and revenue from its long-term growth.

Listed here are two no-brainer AI shares to purchase earlier than 2024.

1. Superior Micro Gadgets

Shares of Superior Micro Gadgets (NASDAQ: AMD) have soared 115% yr so far. Chipmakers loved essentially the most inventory progress amid the AI pleasure, as their {hardware} is essential for coaching and operating AI fashions. Actually, AMD’s greatest competitor, Nvidia, has seen its shares rise greater than 200% this yr alongside a spike in chip gross sales.

AMD’s financials have but to replicate its potential within the sector, with its knowledge middle income really dipping slightly below 1% yr over yr within the third quarter of 2023. Nonetheless, that would all change in 2024, when the corporate will start delivery what it calls its strongest graphics processing unit (GPU) ever, designed particularly to compete with Nvidia’s choices.

AMD’s new AI GPU, the MI300X, comes at a time when the market has grown determined for options to Nvidia, with corporations trying ahead to elevated competitors decreasing the price of chips. In consequence, if the chipmaker can ship higher price-to-performance, it may have an actual shot at taking a major chunk out of Nvidia’s estimated 90% market share in AI chips.

The MI300X is already off to a promising begin, with Microsoft‘s Azure saying in November that it could turn out to be the primary cloud platform to make use of the GPU to develop its AI capabilities. In the meantime, AMD has partnered with Meta, Cisco, and Broadcom to construct superior AI techniques.

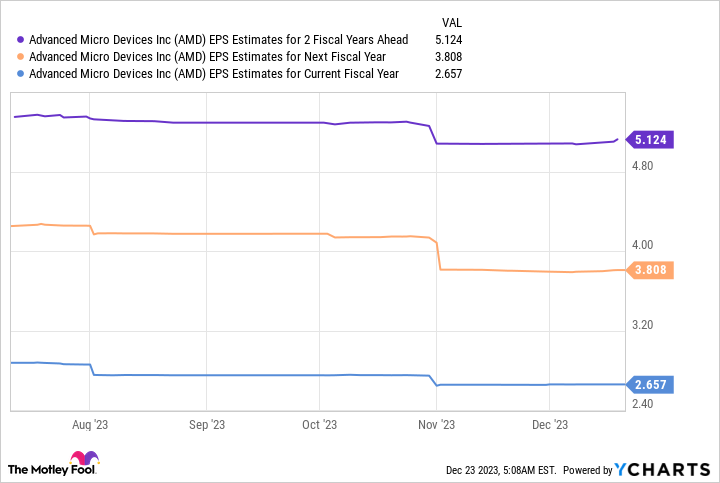

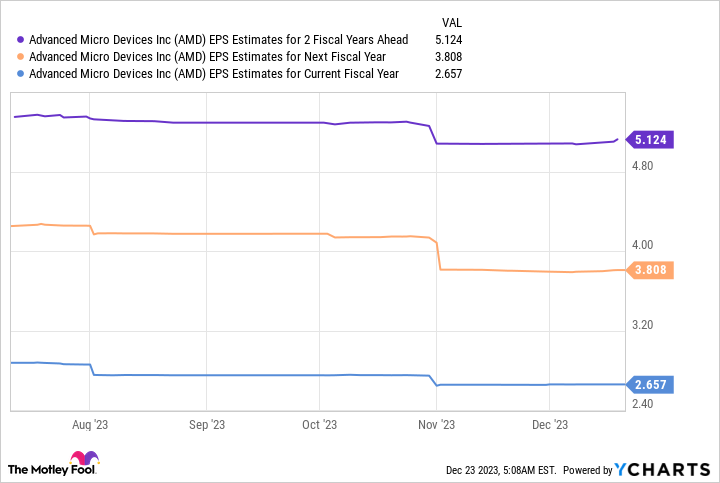

AMD’s hovering inventory worth, alongside earnings which have but to see a return on its funding in AI, has made its shares costly, illustrated by the corporate’s ahead price-to-earnings ratio (P/E) of about 52. Nonetheless, EPS estimates recommend the corporate nonetheless has a lot to supply new traders.

This chart reveals AMD’s earnings may hit $5 per share over the following two fiscal years. Multiplying that determine by the chipmaker’s ahead P/E yields a inventory worth of $265, projecting progress of 90% over the following two fiscal years.

Consequently, AMD’s inventory is engaging forward of 2024, and a no brainer for anybody seeking to put money into AI.

2. Alphabet

Whereas AMD appears prone to shake up the AI chip market subsequent yr, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) might be poised to see huge good points from the software program facet of the business.

In early December the corporate unveiled its extremely anticipated giant language mannequin, Gemini. In response to CEO Sundar Pichai, the brand new mannequin “represents one of many greatest science and engineering efforts we have undertaken as an organization.” The brand new mannequin is predicted to be aggressive with OpenAI’s ChatGPT-4, and able to crunching numerous types of knowledge equivalent to textual content, video, and audio.

Gemini will possible open the door to numerous progress alternatives in AI. The superior mannequin and in-house manufacturers like Google, Android, and YouTube may show a robust mixture. Alphabet can have the tech to supply extra environment friendly promoting by means of Google Search and YouTube, create a Search expertise nearer to ChatGPT, introduce AI options on its numerous productiveness platforms, develop its vary of AI instruments on Google Cloud, and extra.

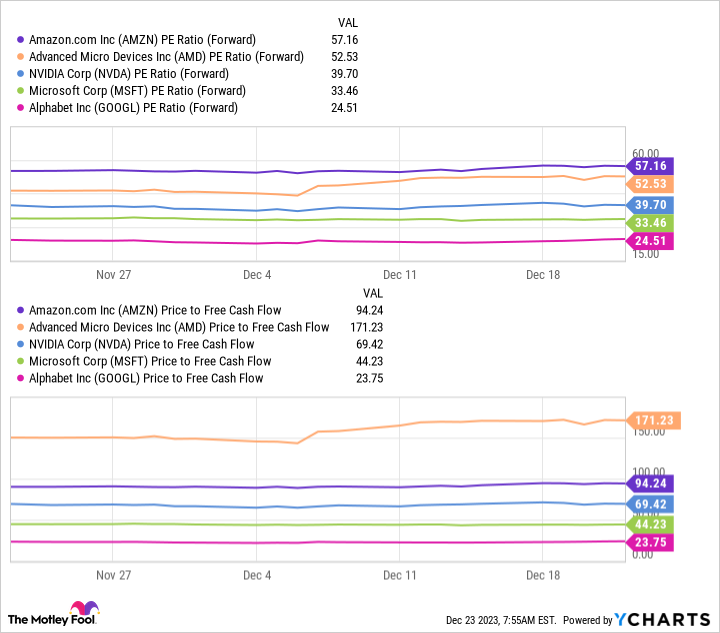

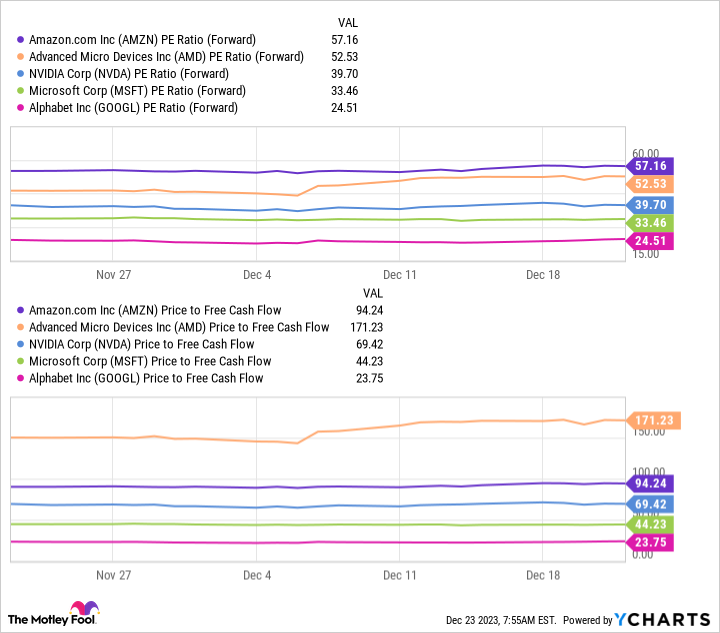

These charts show the ahead price-to-earnings ratios (P/E) and price-to-free money circulation for a number of the most distinguished names in AI proper now. Alphabet has the bottom figures for each metrics, indicating its inventory is at the moment providing essentially the most worth.

Alongside free money circulation that topped $78 billion this yr and a newly launched AI mannequin, Alphabet is an thrilling approach to put money into the burgeoning sector. It has the funds to gasoline R&D, and is probably the most important cut price in AI. The corporate’s inventory is a screaming purchase forward of the brand new yr.

Do you have to make investments $1,000 in Superior Micro Gadgets proper now?

Before you purchase inventory in Superior Micro Gadgets, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Superior Micro Gadgets wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Dani Prepare dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Amazon, Cisco Methods, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.

2 No-Brainer Synthetic Intelligence (AI) Shares to Purchase Earlier than 2024 was initially printed by The Motley Idiot