After surging its method right into a bull market over the previous 12 months, the S&P 500 (SNPINDEX: ^GSPC) has stumbled in current weeks. The index is at present down by round 4% from its peak in late March, and a few buyers are starting to really feel pessimistic concerning the future.

It is unclear precisely the place the market is headed, so even the consultants cannot say for sure whether or not this downturn will proceed or if inventory costs would possibly shortly rebound. It doesn’t matter what occurs, although, there are two strikes to keep away from proper now.

1. Pulling your cash out of the market

For those who’re apprehensive that shares are going to fall additional, it may be tempting to withdraw your cash from the market whereas costs are nonetheless comparatively excessive. Nevertheless, this technique can do extra hurt than good.

Once more, it is unsure what is going to occur with the market within the close to time period. Whereas inventory costs might proceed falling, the market might additionally surge tomorrow. For those who guess the place shares are headed and your guess is fallacious, it might be expensive.

For instance, say you resolve to tug your cash out of the market proper now. If shares surge, you will have missed out on these potential earnings. Then if you happen to resolve to reinvest later, you will find yourself shopping for the identical shares you simply bought — this time at larger costs.

2. Ready for the proper second to speculate

When the market is risky, many buyers will need to anticipate the perfect time to purchase. Nevertheless, as a result of the market is unpredictable within the quick time period, there’ll by no means be an ideal second to speculate. And the longer you wait, the extra time you lose to permit your cash to develop.

Time is your Most worthy asset when constructing wealth within the inventory market. Oftentimes, shopping for at a “unhealthy” second can nonetheless aid you earn greater than if you happen to waited and invested when the market appeared safer.

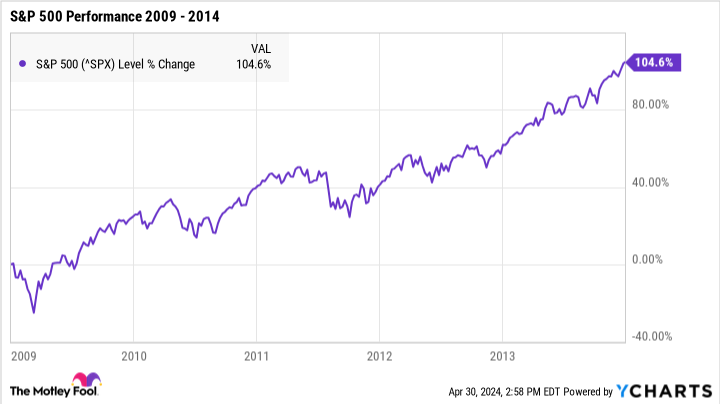

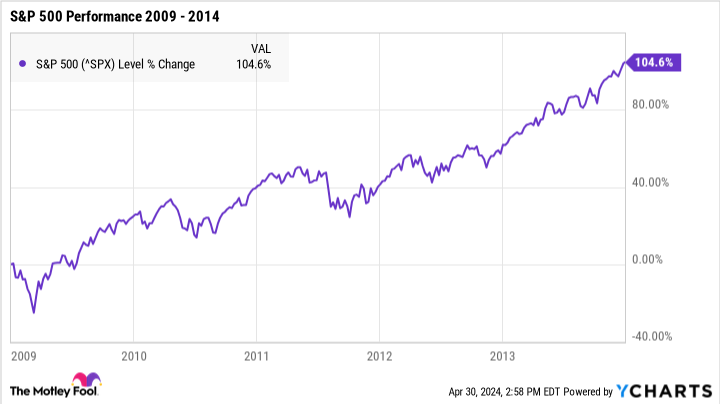

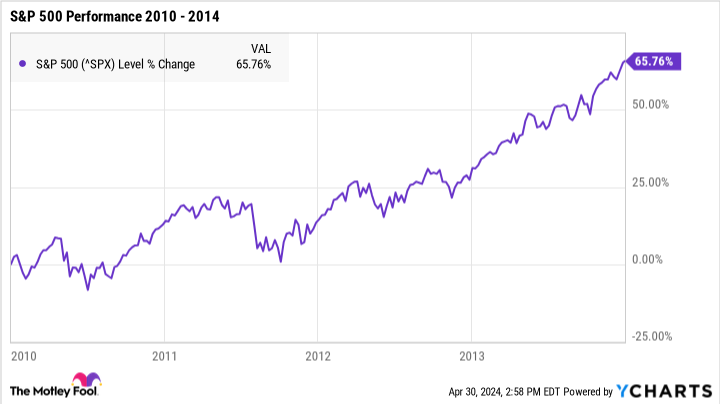

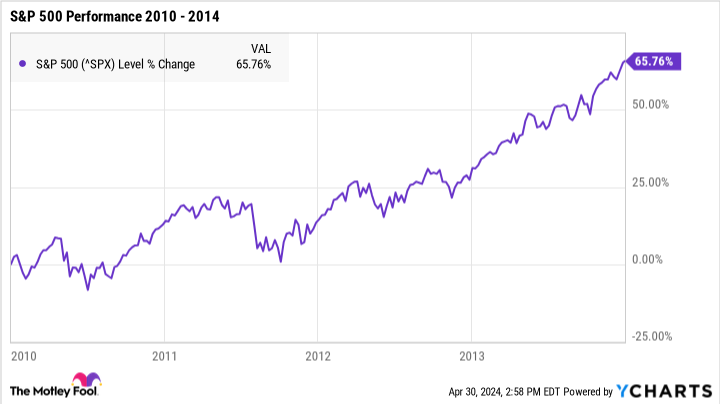

For instance, say you had invested in an S&P 500 index fund in January 2009. The market had yet another huge drop earlier than bottoming out amid the Nice Recession, and on the time, which will have appeared like an terrible time to speculate. But over the following 5 years, you’d have earned complete returns of round 105% — greater than doubling your cash.

Now for example that you just determined to attend only one 12 months and invested in January 2010. The S&P 500 was properly into its bull market at that time, and it might have appeared like a safer time to speculate. Nevertheless, you’d solely have earned returns of round 66% by 2014.

Time in the market is much extra necessary than timing the market. Even when inventory costs drop within the coming weeks or months, giving your cash as a lot time as doable can nonetheless aid you earn greater than investing on the “greatest” second.

One good investing transfer to make proper now

Whereas it might appear counterintuitive, the most effective issues you are able to do proper now could be ignore the market’s short-term fluctuations. It may be nerve-wracking to speculate when the market is shaky, and by ignoring the day-to-day actions, it is typically simpler to maintain a clearer head.

The market’s long-term efficiency is much extra necessary than its short-term ups and downs, and traditionally, it has a flawless observe file of recovering from downturns. By merely holding your investments and staying available in the market for so long as doable, you are much more more likely to see optimistic returns over time.

It is equally necessary, although, to make sure you’re investing in high quality shares from corporations with stable underlying enterprise fundamentals. Robust shares are much more more likely to get well from durations of volatility and expertise long-term progress, and the extra of those shares you’ve gotten in your portfolio, the safer your cash can be.

The current inventory market sell-off is nerve-wracking, so if this volatility has you feeling shaken, you are not alone. However by conserving your cash available in the market, investing persistently in high quality shares, and sustaining a long-term outlook, you possibly can maximize your long-term earnings whereas minimizing threat.

The place to speculate $1,000 proper now

When our analyst group has a inventory tip, it might pay to pay attention. In spite of everything, the publication they have run for over a decade, Motley Idiot Inventory Advisor, has almost tripled the market.*

They simply revealed what they imagine are the 10 greatest shares for buyers to purchase proper now…

See the ten shares

*Inventory Advisor returns as of April 30, 2024

Katie Brockman has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

S&P 500 Promote-Off: 2 of the Worst Investing Strikes You Might Make Proper Now was initially revealed by The Motley Idiot