This yr has been robust for traders. The inflation numbers could have been down in October, nevertheless it was nonetheless 7.7% compounded on final October’s 6.2%, and that’s too excessive. Rates of interest are rising quick in response, making capital costlier, and the obtainable money is chasing items constrained by tight provide chains and continued COVID lockdowns in China. Meals and vitality costs are excessive, and more likely to rise, as Russia’s warfare in Ukraine places a significant clamp on international provides of pure gasoline, wheat, and cooking oils. It’s no surprise that inventory markets have been extremely unstable, making it ever tougher for traders to foretell what’s coming subsequent.

However even with all of these headwinds, there are shares we are able to be pleased about this Thanksgiving vacation season. These are the market’s confirmed performers, the shares which have introduced sound returns to traders regardless of all of the challenges that 2022 has by means of on the markets.

The constructive attributes of those successful shares are mirrored of their Sensible Scores. The TipRanks Sensible Rating takes the collected knowledge on each inventory and collates it by 8 separate classes, every of which is understood to correlate with constructive inventory efficiency going ahead. The Sensible Rating offers every inventory a single-digit rating, on a scale of 1 to 10, making it straightforward to inform at a look the shares’ principal probability within the coming months.

Typically, shares that get a ‘Good 10’ on the Sensible Rating will present stable ends in every of the 8 elements, however that’s not a tough and quick rule. Pulling up the Sensible Rating knowledge on two shares which have hit that goalpost, we discover that they provide traders a stable basis and mixture of strengths. Let’s take a better look.

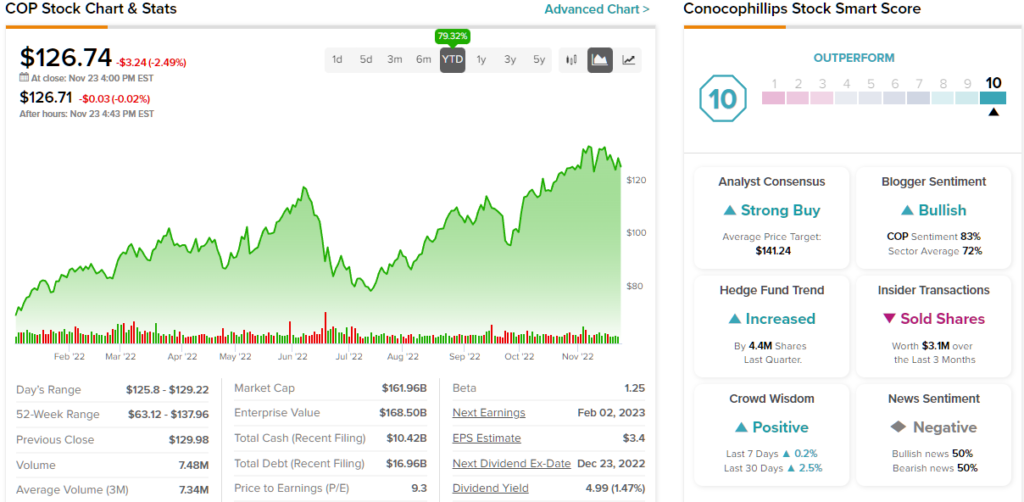

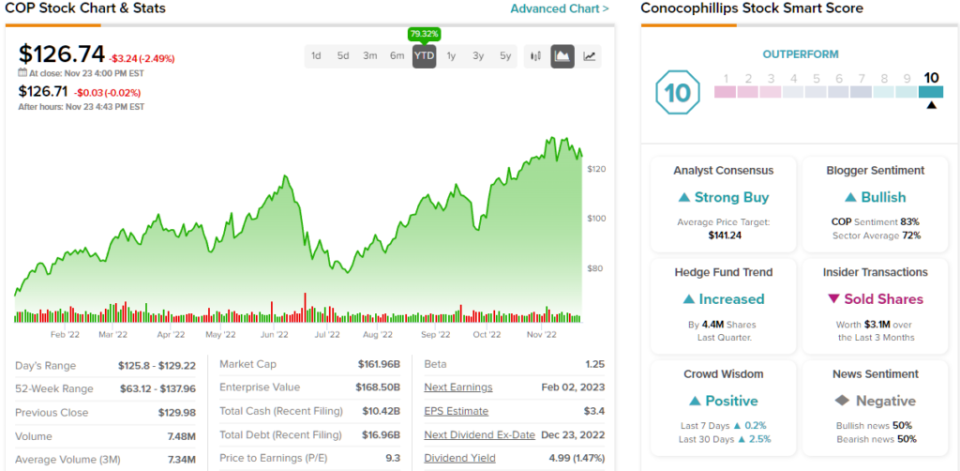

ConocoPhillips (COP)

We’ll begin within the vitality business, the place ConocoPhillips is without doubt one of the sector’s largest legacy names. ConocoPhillips boasts a market cap of $158 billion, together with operations in 13 international locations and manufacturing on the order of 1.5 million barrels of oil equal each day. Annual revenues hit $46 billion final yr, and has already overwhelmed that complete this yr; the highest line for the primary 9 months of the yr hit $60.5 billion.

Within the final reported quarter, 3Q22, income got here in at $21.14 billion, up 79% year-over-year. Web earnings was $4.53 billion, for a 90% y/y; on a per-share foundation, the adjusted EPS of $3.60 represented a 103% acquire from the year-ago quarter.

Along with stable monetary outcomes, ConocoPhillips completed the quarter with $10.7 billion in money and liquid property available – after distributing $4.3 billion to shareholders by means of a mix of $1.5 billion in dividends and $2.8 billion in share repurchases. In the course of the quarter, the corporate elevated its repurchase authorization going ahead by $20 billion and introduced an 11% improve within the quarterly dividend fee.

With that within the background, it’s no surprise that shares in COP are up 83% to date this yr, far outpacing the 16% year-to-date loss on the S&P 500.

Truist’s 5-star analyst Neal Dingmann couldn’t assist however sing the praises of ConocoPhillips, noting that the corporate has is resting on a very stable basis.

“Conoco finds itself within the enviable monetary and operational positions with practically no debt, document manufacturing, and sizeable, high quality stock. Whereas we have now acquired some investor pushback that has targeted on the corporate’s inventory hitting a current all-time excessive, we level out that the valuation nonetheless seems to be very cheap with the shares buying and selling at a ~15% FCF yield and ~4.4x earnings foundation; each 20%+ reductions to its closest friends,” Dingmann opined.

“Additional,” the analyst added, “we imagine the corporate’s three tier returns on its capital program is without doubt one of the higher within the business because it returns extra capital to traders than the majors, but retains extra monetary optionality than various the massive impartial operators. We imagine this mix offers traders what they presently need…”

Towards this backdrop, it is no surprise that Dingmann charges COP as a Purchase, and his value goal of $167 implies it has a one-year upside potential of ~32%. (To look at Dingmann’s monitor document, click on right here)

Dingmann represents the bullish view on COP, which is held by 15 of the 18 analysts who’ve just lately filed evaluations on the shares. Total, the inventory will get a Sturdy Purchase from the analyst consensus. (See COP inventory evaluation on TipRanks)

CECO Environmental (CECO)

Subsequent up, CECO Environmental, is ‘inexperienced’ agency, engaged on the event and set up of recent applied sciences in environmental air air pollution management applied sciences, vitality applied sciences, and fluid dealing with and filtration. The corporate has discovered prospects in sectors and industries as assorted as aerospace, automotive, brick making, cement, chemical compounds, gas refining, and even glass manufacturing.

CECO’s revenues have been rising pretty steadily – with 5 sequential will increase for the reason that starting of 2001. In 3Q22, the final quarter reported, the corporate confirmed a prime line of $108.4 million, up 36% year-over-year. Revenues have been supported by a ten% improve in enterprise orders, to $101.7 million, and the corporate’s backlog, an necessary metric indicating future enterprise and earnings, rose by 27% to $277.7 million. In an necessary turnaround, the online earnings got here in at $1.9 million, a acquire of $3.1 million from the $1.2 million internet loss within the year-ago quarter.

Reflecting these sound metrics, CECO printed full-year 2022 income steerage of $410 million or higher, forecasting a y/y top-line acquire of 25%.

Total, traders have been happy with CECO over the course of this yr, and that is one other inventory that has far outperformed the broader markets, posting stable share beneficial properties even through the bearish turns we’ve seen all year long. CECO shares are up 83% year-to-date.

Taking a look at CECO from Craig-Hallum, analyst Aaron Spychalla is impressed by what he sees, noting: “CECO is seeing the advantages of a strategic transformation from a enterprise primarily targeted on longer-cycle, cyclical, and project-based Power markets to at least one extra diversified by product and vertical, with a shorter cycle profile, and end-markets which might be benefiting from ESG tailwinds for clear air and clear water. With stable fundamentals and rising visibility, a mix of company-specific and secular progress drivers, and modest valuation, we reiterate our Purchase ranking.”

That Purchase ranking comes with a $17 value goal, which suggests room for 48% progress by the top of subsequent yr. (To look at Spychalla’s monitor document, click on right here)

Total, there are 5 current analyst evaluations on this inventory – and they’re unanimous, it’s one to purchase. This offers CECO shares their Sturdy Purchase ranking. (See CECO inventory evaluation on TipRanks)

Keep abreast of the greatest that TipRanks’ Sensible Rating has to supply.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely necessary to do your personal evaluation earlier than making any funding.