The inventory market could have witnessed some volatility of late, however it’s price noting that the S&P 500 index has clocked wholesome positive aspects of 41% for the reason that starting of 2023. It is because of a strong rally in expertise shares that outperformed the broader market on account of catalysts similar to synthetic intelligence (AI).

This explains why the tech-laden Nasdaq-100 Expertise Sector index has outperformed the S&P 500 for the reason that starting of 2023 with astounding positive aspects of 74%. The power of expertise firms to capitalize on disruptive traits over time, such because the web, smartphones, video streaming, social media, and now AI, is the explanation why firms on this sector are inclined to ship outsized positive aspects.

That is the explanation why traders would do properly to purchase shares of Nvidia (NASDAQ: NVDA) and SoundHound AI (NASDAQ: SOUN) in 2024, as each firms are profiting from the adoption of AI of their respective industries and will change into top-growth shares in the long term. Shares of each Nvidia and SoundHound are already up 135% thus far this 12 months, and a better have a look at their prospects will inform us that their bull run could possibly be right here to remain.

Nvidia’s AI-fueled rally is prone to acquire momentum

Although Nvidia has been in positive type on the inventory market this 12 months, it has witnessed a slight pullback of late. Nevertheless, all that might change later this month when the semiconductor big releases its second-quarter outcomes for fiscal 2025.

Nvidia is ready to launch its subsequent set of quarterly outcomes on Aug. 28. Analysts are forecasting the corporate to ship $28.5 billion in income, which is barely greater than the chipmaker’s forecast of $28 billion. Its earnings are anticipated to greater than double to $0.64 per share from $0.27 per share in the identical quarter final 12 months.

It will not be stunning to see Nvidia beating Wall Avenue’s forecasts as soon as once more — similar to it has performed previously 4 quarters — due to its dominant place within the AI chip market.

The corporate has witnessed terrific demand for its AI graphics processing items (GPUs), that are powering the expansion of Nvidia’s data-center enterprise. In Q1 of fiscal 2025 (which ended on April 28), Nvidia’s data-center income rose 427% 12 months over 12 months to $22.6 billion. Its general income shot up 262% 12 months over 12 months to $26 billion.

Nvidia’s terrific data-center progress is prone to proceed in fiscal Q2 and past regardless of latest rumors that its next-generation Blackwell chips are prone to face a delay of 4 to 6 weeks earlier than going into manufacturing. That is as a result of Nvidia is witnessing sturdy demand for its present H100 and H200 processors.

CFO Colette Kress remarked on Nvidia’s Might earnings convention name that the corporate stored rising the provision of its earlier flagship processor, the H100, regardless of the supply of a brand new chip such because the H200. On the identical time, Nvidia was discovering it tough to satisfy the demand for the H200 and expects this chip to stay provide constrained subsequent 12 months.

In regards to the firm’s next-generation Blackwell processors, sources counsel that Nvidia might generate a whopping $210 billion in income from their gross sales subsequent 12 months. That may be an enormous enhance over the $47.5 billion data-center income the corporate generated in fiscal 2024. All this explains why analysts predict Nvidia’s income to just about double in fiscal 2025 (which can finish in January subsequent 12 months) to $120.5 billion from $60.9 billion in fiscal 2024.

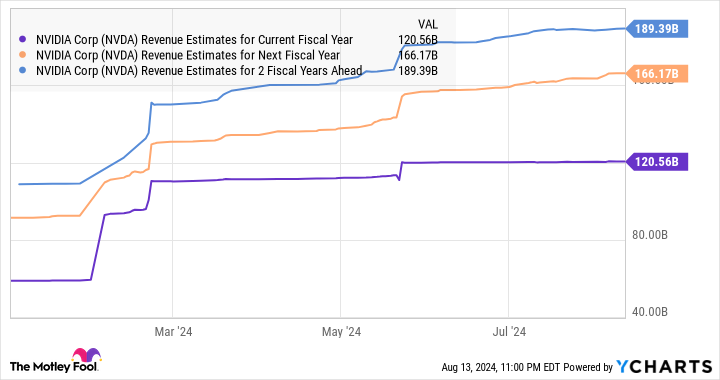

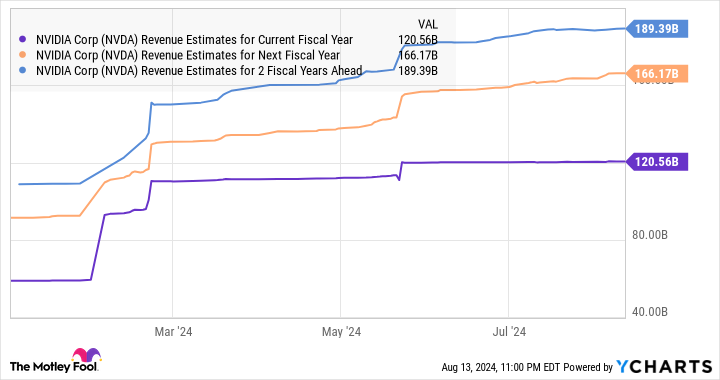

Additionally, as the next chart tells us, analysts have been elevating their progress expectations for Nvidia over the subsequent couple of fiscal years as properly.

NVDA Income Estimates for Present Fiscal 12 months information by YCharts.

All this means that Nvidia might proceed to stay a prime progress inventory in 2024 and past, making it a really perfect guess for growth-oriented traders seeking to benefit from the fast-growing adoption of AI.

SoundHound AI is gaining traction inside a fast-growing AI area of interest

SoundHound AI supplies a platform to prospects to assist them develop voice AI options, similar to chatbots and conversational voice assistants. The corporate believes that its complete addressable market (TAM) could possibly be price a whopping $140 billion, and the nice half is that it’s properly on its method to capitalizing on this chance.

The corporate reported a formidable year-over-year leap of 54% in income in 2024’s Q2 to $13.5 million. SoundHound AI additionally acquired enterprise AI software program firm Amelia for $80 million in order that it may increase its attain within the generative AI-powered customer-service house. SoundHound says that after the acquisition, it will likely be serving 200 marquee prospects throughout the globe, together with prime banks and Fortune 500 firms.

Due to this acquisition and SoundHound’s rising traction within the restaurant and automotive markets, the corporate raised its 2024 income steering to at the least $80 million as in comparison with the sooner steering of $71 million. What’s extra, SoundHound expects income to extend at a terrific tempo once more in 2025 and exceed $150 million.

SoundHound’s 2024 income steering signifies that its prime line is on observe to extend 74% this 12 months, which might be an enchancment over its 2023 income progress of 47%. Even higher, the 2025 steering signifies that the corporate is anticipating to ship an 87% enhance within the prime line subsequent 12 months.

We have now already seen that SoundHound sees a large addressable marketplace for its voice AI options, which is why there’s a good probability that it will likely be capable of maintain its excellent progress in the long term. So, traders seeking to purchase a progress inventory proper now can take into account including SoundHound to their portfolios. Its shares have began taking off after its newest outcomes, and based mostly on the corporate’s prospects, they may preserve heading greater.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $763,374!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 12, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

2 Purple-Sizzling Progress Shares to Purchase in 2024 and Past was initially revealed by The Motley Idiot