Know-how shares have outperformed the broader market handsomely during the last decade — illustrated by the truth that the Nasdaq-100 Know-how Sector Index clocked a achieve of 421% over the interval in comparison with the S&P 500 index’s 178% rise. The outperformance is not stunning. Tech firms have a tendency to learn from disruptive traits, which permits them to ship outsized development.

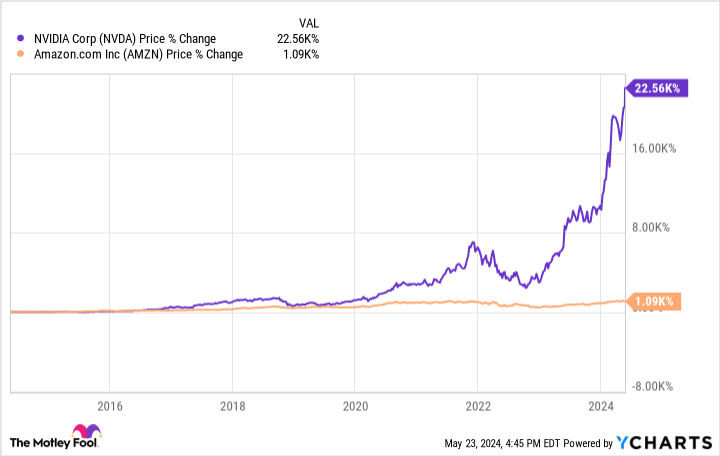

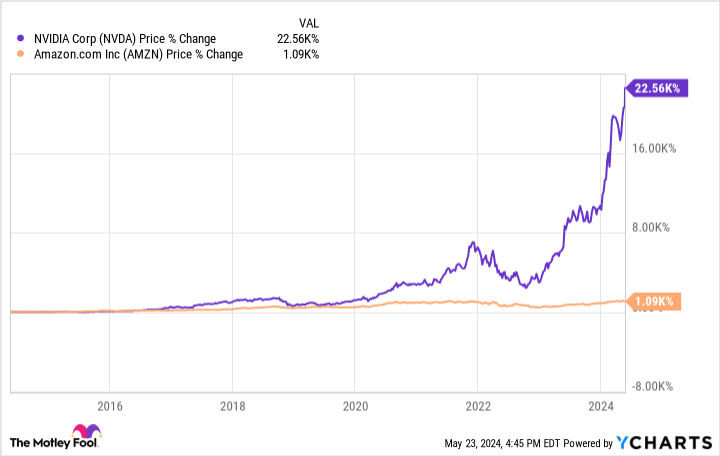

The highest tech shares, resembling Nvidia (NASDAQ: NVDA) and Amazon (NASDAQ: AMZN), have far outpaced even the Nasdaq-100’s efficiency in that timespan, giving long-term buyers’ portfolios an enormous increase.

To be honest, it will be troublesome for Nvidia and Amazon — now two of the world’s largest firms — to copy such terrific 10-year beneficial properties over the subsequent decade. Nevertheless, shopping for these two tech giants and holding on to them as part of a diversified portfolio has an excellent probability of being a wise long-term transfer. Each firms nonetheless sit on super development alternatives in a number of markets, which is why they might change into excellent picks for buyers seeking to develop a million-dollar portfolio.

The case for Nvidia

Nvidia has come a great distance. 20 years in the past, it largely bought graphics processing models (GPUs) to be used in gaming private computer systems (PCs) and workstations, however as we speak, its {hardware} (and software program) is powering computationally intensive functions in information facilities, superior driver-assistance programs, factories, and digital twin creation, amongst different areas. Synthetic intelligence (AI), nonetheless, is at present the largest catalyst for the corporate.

Nvidia’s income and earnings grew at a wide ranging tempo in latest quarters as clients lined as much as get their fingers on its AI chips. The corporate reportedly holds a formidable 92% share of the burgeoning AI chip market, and that dominant presence is predicted to maintain giving its development large pictures within the arm: The AI chip market is predicted to generate $305 billion in international income by 2030 (up from $29 billion in 2022).

Nvidia’s information heart enterprise generated $47.5 billion in income final fiscal yr; assuming it stays the largest participant on this market on the finish of the last decade, that determine could possibly be a lot increased for 2030. This, nonetheless, is just not the one AI-related alternative that Nvidia is ready to capitalize on.

Demand for PCs able to working AI software program regionally is ready to extend at an annualized charge of 44% by 2028, in keeping with market analysis agency Canalys. That spectacular development would ideally result in stronger demand for the Nvidia GPUs which are deployed in laptops and desktops. Consequently, it will not be stunning to see the corporate’s gaming enterprise taking off within the coming years and complementing its information heart development.

On the similar time, Nvidia is gaining traction within the digital twin market. The corporate’s GPUs are being deployed to energy the creation of 3D digital representations of factories earlier than these factories are literally constructed. These digital twins permit organizations to optimize their operations, search for issues, and enhance effectivity earlier than the bodily factories are constructed. Such digital areas are additionally helpful for a bunch of functions after a real-world location is full.

Demand for digital twins is predicted to develop at an annual charge of 41% by 2035, producing annual income of $240 billion on the finish of the forecast interval.

In all, Nvidia administration initiatives that it’s sitting on an addressable market price a whopping $1 trillion. If that is certainly the case, the corporate is originally of a terrific development curve contemplating that it generated slightly below $61 billion in income final yr.

With quite a few profitable development alternatives and catalysts, it ought to continue to grow at a pleasant tempo for fairly a while. That is why buyers on the lookout for tech shares that might assist them develop their portfolios to the million-dollar stage ought to think about shopping for Nvidia.

The case for Amazon

Amazon has benefited from the secular development of the e-commerce market through the years, and it ought to proceed to capitalize on this phase’s development sooner or later. In keeping with a forecast by Exactitude Consultancy, the worldwide e-commerce market will clock a compound annual development charge of 15% by 2030, producing simply over $20 trillion in annual income on the finish of that interval.

Amazon is in a stable place to capitalize on this large development alternative as it’s the main e-commerce participant in key markets together with the U.S., the place it has a market share of almost 40%, a quantity that has slowly crept increased through the years. Nevertheless, e-commerce is just not the one huge development driver that Amazon is ready to take advantage of.

The corporate is the most important participant within the cloud infrastructure providers market, with a share of 31% within the first quarter of 2024. Amazon Net Providers (AWS), its cloud computing division, reported wholesome year-over-year development of 17% in Q1 and generated $25 billion in income. That was increased than the 13% development in Amazon’s total income final quarter to $143.3 billion.

Rising demand for cloud-based AI providers ought to give AWS an enormous increase in the long term. Mordor Intelligence estimates that the cloud AI market might generate $274 billion in annual income in 2029 as in comparison with this yr’s estimate of $67 billion. Amazon’s strong share within the cloud computing market and the rising adoption of AI-focused providers on AWS means that the corporate is nicely positioned to take advantage of this chance.

The expansion drivers mentioned above inform us why analysts predict Amazon’s annualized earnings development to speed up to 30% for the subsequent 5 years from 14% prior to now 5. The corporate’s improved earnings energy could lead on the market to reward the tech inventory over the long term, making it a super decide for buyers wanting so as to add potential millionaire-maker shares to their portfolios.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $652,342!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Might 13, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Nvidia. The Motley Idiot has a disclosure coverage.

2 Prime Tech Shares That Might Make You a Millionaire was initially printed by The Motley Idiot