Effectively-chosen dividend shares may also help you construct bountiful streams of passive earnings you can depend on to develop steadily 12 months after 12 months. To assist your seek for these wealth-builders, listed here are two high-yield shares with confirmed histories of rewarding their buyers with ample and reliable dividends.

No. 1 high-yield inventory to purchase: Verizon Communications

Verizon Communications (NYSE: VZ) excels at turning connectivity companies into money for its shareholders. The telecom chief is at present providing a good way to spice up your passive earnings with its hefty dividend yield of 6.2%.

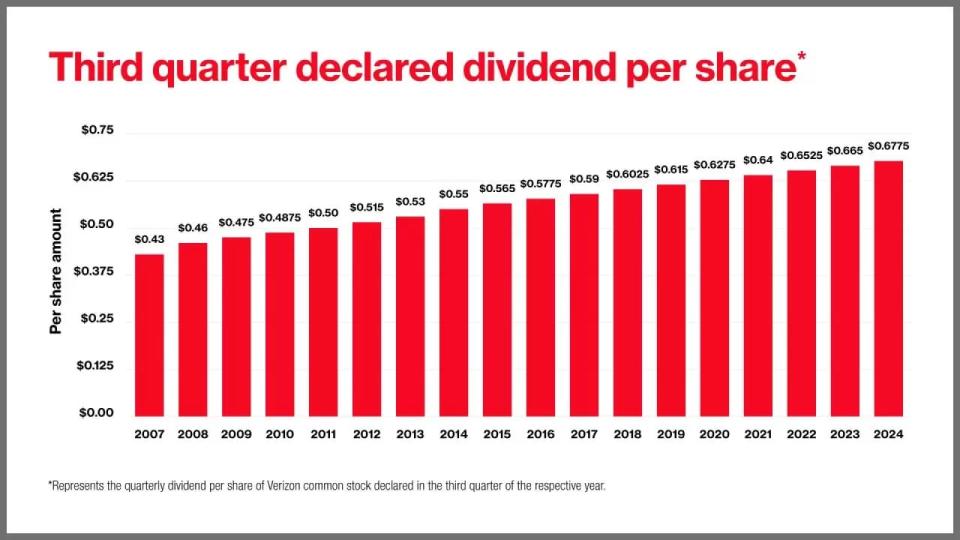

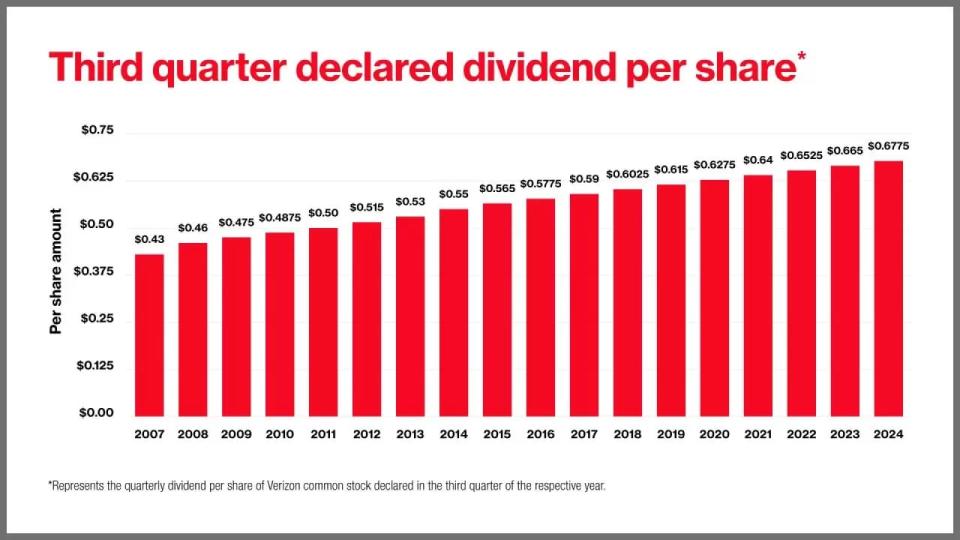

Verizon delivers quick 5G wi-fi companies to over 114 million retail prospects and 30 million enterprise shoppers. With retention charges which can be sometimes over 98%, these accounts produce dependable income, which Verizon passes on to its shareholders by way of rising money funds. The telecom big generated almost $14 billion of free money stream over the trailing 12 months. That allowed Verizon to lift its dividend for the 18th straight 12 months earlier this month.

The dividend stalwart additionally just lately struck a $20 billion deal to accumulate fiber web supplier Frontier Communications, which ought to assist it lengthen this spectacular dividend-growth streak. Administration expects the deal to bolster Verizon’s potential to bundle residence web, TV, and cellphone companies, which may cut back buyer churn by as a lot as 50% in comparison with those that subscribe to its wi-fi service alone.

Frontier would add over 2 million fiber subscribers to Verizon’s roughly 7.4 million Fios web connections. The mixed firm may have a possible fiber buyer base of greater than 25 million, primarily based on the variety of households linked to Verizon’s and Frontier’s fiber networks.

Verizon’s acquisition of Frontier is anticipated to shut in about 18 months, topic to shareholder and regulatory approval. Verizon expects the deal to spice up its adjusted earnings quickly after closing.

No. 2 high-yield inventory to purchase: Realty Earnings

Actual property will be one other glorious supply of passive earnings. Realty Earnings (NYSE: O) presents buyers a simple and low-risk solution to money in on this profitable asset class.

Realty Earnings is structured as an actual property funding belief (REIT). Meaning it is constructed to purchase properties and cross the earnings it earns on to shareholders. With 650 consecutive months of money funds, together with 107 straight quarterly will increase, Realty Earnings’s dividend is as dependable as they arrive.

The actual property big owns over 15,000 business properties throughout the U.S. and Europe. It leases these properties to over 1,500 totally different tenants in 90 industries. This broad diversification is a key a part of Realty Earnings’s prudent risk-management technique.

A concentrate on companies that have a tendency to carry up properly throughout difficult financial occasions additionally helps to cut back the dangers for buyers. Comfort shops, automotive restore outlets, and grocery chains are properly represented in Realty Earnings’s portfolio. It is a good technique that is helped the REIT maintain spectacular occupancy charges of 96% or increased since 1992.

As we speak, Realty Earnings’s dividend yield stands at a strong 5%. With the Federal Reserve set to start to cut back rates of interest as early as this month, the REIT’s financing prices ought to decline within the coming 12 months. That must make its actual property investments extra worthwhile — and result in increased dividend funds for buyers who purchase Realty Earnings’s shares at this time.

Must you make investments $1,000 in Realty Earnings proper now?

Before you purchase inventory in Realty Earnings, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Realty Earnings wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $716,375!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 9, 2024

Joe Tenebruso has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Realty Earnings. The Motley Idiot recommends Verizon Communications. The Motley Idiot has a disclosure coverage.

2 Extremely-Excessive-Yield Dividend Shares to Purchase Now was initially revealed by The Motley Idiot