Traders cheered when a report final week confirmed the economic system expanded within the third quarter after back-to-back contractions.

But it surely’s too early to get excited, as a result of the Federal Reserve hasn’t given any signal but that it’s about to cease elevating rates of interest on the quickest tempo in many years.

Under is an inventory of dividend shares which have had low worth volatility over the previous 12 months, culled from three massive change traded funds that display for top yields and high quality in numerous methods.

In a yr when the S&P 500

SPX

is down 18%, the three ETFs have extensively outperformed, with one of the best of the group falling only one%.

Learn: GDP seemed nice for the U.S. economy, however it really wasn’t

That mentioned, final week was an excellent one for U.S. shares, with the S&P 500 returning 4% and the Dow Jones Industrial Common

DJIA

having its finest October ever.

This week, traders’ eyes flip again to the Federal Reserve. Following a two-day coverage assembly, the Federal Open Market Committee is anticipated to make its fourth consecutive enhance of 0.75% to the federal funds charge on Wednesday.

The inverted yield curve, with yields on two-year U.S. Treasury notes

BX:TMUBMUSD02Y

exceeding yields on 10-year notes

BX:TMUBMUSD10Y,

signifies traders within the bond market count on a recession. In the meantime, this has been a tough earnings season for a lot of firms and analysts have reacted by decreasing their earnings estimates.

The weighted rolling consensus 12-month incomes estimate for the S&P 500, primarily based on estimates of analysts polled by FactSet, has declined 2% over the previous month to $230.60. In a wholesome economic system, traders count on this quantity to rise each quarter, not less than barely.

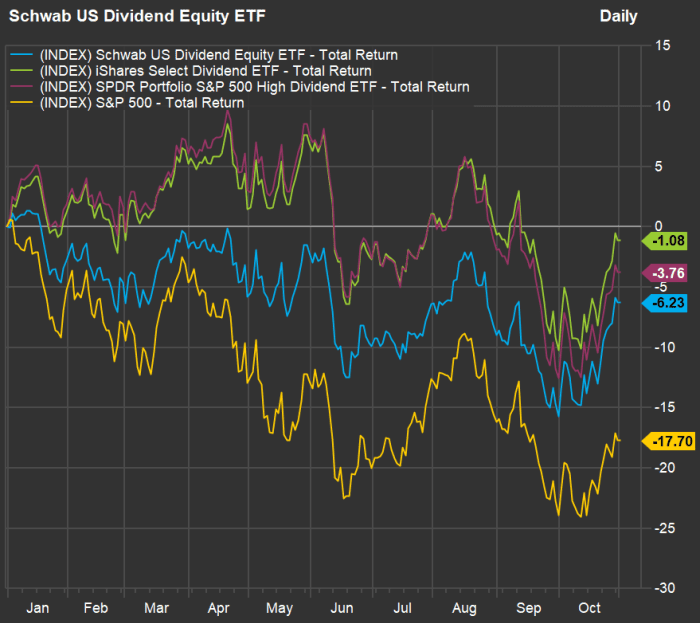

Low-volatility shares are working in 2022

Check out this chart, exhibiting year-to-date complete returns for the three ETFs towards the S&P 500 by way of October:

FactSet

The three dividend-stock ETFs take totally different approaches:

-

The $40.6 billion Schwab U.S. Dividend Fairness ETF

SCHD

tracks the Dow Jones U.S. Dividend 100 Listed quarterly. This strategy incorporates 10-year screens for money move, debt, return on fairness and dividend progress for high quality and security. It excludes actual property funding trusts (REITs). The ETF’s 30-day SEC yield was 3.79% as of Sept. 30. -

The iShares Choose Dividend ETF

DVY

has $21.7 billion in property. It tracks the Dow Jones U.S. Choose Dividend Index, which is weighted by dividend yield and “skews towards smaller corporations paying constant dividends,” based on FactSet. It holds about 100 shares, consists of REITs and appears again 5 years for dividend progress and payout ratios. The ETF’s 30-day yield was 4.07% as of Sept. 30. -

The SPDR Portfolio S&P 500 Excessive Dividend ETF

SPYD

has $7.8 billion in property and holds 80 shares, taking an equal-weighted strategy to investing within the top-yielding shares among the many S&P 500. It’s 30-day yield was 4.07% as of Sept. 30.

All three ETFs have fared properly this yr relative to the S&P 500. The funds’ beta — a measure of worth volatility towards that of the S&P 500 (on this case) — have ranged this yr from 0.75 to 0.76, based on FactSet. A beta of 1 would point out volatility matching that of the index, whereas a beta above 1 would point out increased volatility.

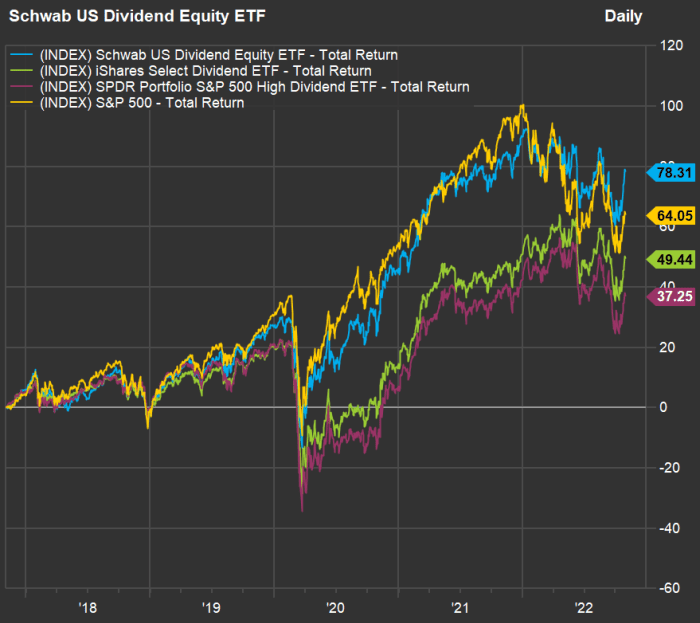

Now have a look at this five-year complete return chart exhibiting the three ETFs towards the S&P 500 over the previous 5 years:

FactSet

The Schwab U.S. Dividend Fairness ETF ranks highest for five-year complete return with dividends reinvested — it’s the solely one of many three to beat the index for this era.

Screening for the least unstable dividend shares

Collectively, the three ETFs maintain 194 shares. Listed here are the 20 with the bottom 12-month beta. The checklist is sorted by beta, ascending, and dividend yields vary from 2.45% to eight.13%:

| Firm | Ticker | 12-month beta | Dividend yield | 2022 complete return |

| Newmont Corp. | NEM | 0.17 | 5.20% | -30% |

| Verizon Communications Inc. | VZ | 0.22 | 6.98% | -24% |

| Common Mills Inc. | GIS | 0.27 | 2.65% | 25% |

| Kellogg Co. | Ok | 0.27 | 3.07% | 22% |

| Merck & Co. Inc. | MRK | 0.29 | 2.73% | 35% |

| Kraft Heinz Co. | KHC | 0.35 | 4.16% | 11% |

| Metropolis Holding Co. | CHCO | 0.38 | 2.58% | 27% |

| CVB Monetary Corp. | CVBF | 0.38 | 2.79% | 37% |

| First Horizon Corp. | FHN | 0.39 | 2.45% | 53% |

| Avista Corp. | AVA | 0.41 | 4.29% | 0% |

| NorthWestern Corp. | NWE | 0.42 | 4.77% | -4% |

| Altria Group Inc | MO | 0.43 | 8.13% | 4% |

| Northwest Bancshares Inc. | NWBI | 0.45 | 5.31% | 11% |

| AT&T Inc. | T | 0.47 | 6.09% | 5% |

| Flowers Meals Inc. | FLO | 0.48 | 3.07% | 7% |

| Mercury Common Corp. | MCY | 0.48 | 4.38% | -43% |

| Conagra Manufacturers Inc. | CAG | 0.48 | 3.60% | 10% |

| Amgen Inc. | AMGN | 0.49 | 2.87% | 23% |

| Security Insurance coverage Group Inc. | SAFT | 0.49 | 4.14% | 5% |

| Tyson Meals Inc. Class A | TSN | 0.50 | 2.69% | -20% |

| Supply: FactSet | ||||

Any checklist of shares could have its canine, however 16 of those 20 have outperformed the S&P 500 up to now in 2022, and 14 have had optimistic complete returns.

You may click on on the tickers for extra about every firm. Click on right here for Tomi Kilgore’s detailed information to the wealth of knowledge obtainable free on the MarketWatch quote web page.

Don’t miss: Municipal bond yields are enticing now — right here’s how to determine if they’re best for you