March has entered the body and comes within the wake of two contrasting months. The yr began off with shares in a rush to place 2022’s depressing motion to mattress, pushing greater proper out of the gates. But, February proved a wake-up name for these anticipating a full-on bull market, as many shares pared again a giant chunk of these positive aspects.

So, what’s subsequent? Morgan Stanley’s Chief Funding Officer Mike Wilson says 2023’s early rally was a ‘bull entice.’ Wilson predicts extra ache forward for traders, calling March a “excessive threat month for the bear market to renew.”

That mentioned, Wilson’s analyst colleagues on the banking large have recognized a chance in sure shares they consider might supply safety from the bear’s snarl. We ran two of their current suggestions via the TipRanks database to see what different consultants make of those decisions.

Coursera, Inc. (COUR)

We’ll begin with Coursera, one of many world’s largest on-line studying platforms. The corporate connects individuals with on-line college-level programs, for diploma credit score, for skilled improvement, and even for enjoyable. The corporate boasts over 118 million registered learners taking programs with greater than 300 college and trade companions, together with such names as Duke College, College of Michigan, and Google.

The height of the COVID pandemic in 2020 put an enormous premium on distant actions, for work, faculty, and leisure, and whereas the pandemic has receded, demand for these distant actions stays excessive. Coursera has leveraged that reality into steadily rising revenues.

Within the final reported quarter, 4Q22, the corporate confirmed a high line of $142.18 million, for a year-over-year achieve of 23%. For the total yr 2022, Coursera’s income confirmed 26% y/y development, to achieve $523.8 million.

Whereas the corporate’s high line is rising, and even beat the forecasts for This autumn, traders have been cautious. Coursera usually runs a web quarterly loss, and the current This autumn launch was no exception – though the loss did reasonable. In This autumn, the corporate reported a non-GAAP lack of $6.5 million, about 1/4 of the $24.1 million web loss reported within the year-ago quarter. This most up-to-date web loss interprets into 4.6% of income.

The corporate additionally provided disappointing steering. Coursera is predicting 1Q23 revenues within the vary of $136 million to $140 million, in comparison with a forecast of $142.8 million; for all of 2023, the steering is $595 million to $605 million, towards a forecast of $618.5 million.

Morgan Stanley analyst Josh Baer acknowledges that this firm whiffed on the newest monetary replace, however he factors out a number of necessary elements supporting an upbeat tackle Coursera. He writes, “Whereas we’ve a blended tackle This autumn outcomes total, we proceed to see Coursera as 1) top-of-the-line positioned platforms to allow digital transformation within the massive Training trade, 2) an organization approaching FCF breakeven, with a steadily bettering EBITDA margins on a path towards >20% EBITDA longer-term, and three) low investor sentiment and expectations – all collectively creating a gorgeous threat/reward.”

Taking this collectively, Baer sees match to price COUR shares an Obese (i.e. Purchase), with an $18 worth goal to point room for 55% upside development this coming yr. (To observe Baer’s monitor report, click on right here)

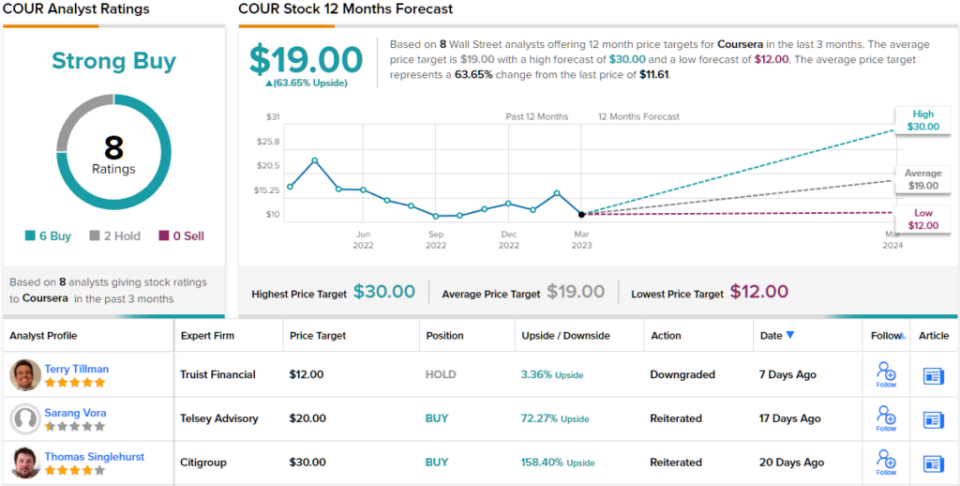

The Morgan Stanley view is much from the one bullish take right here. Coursera has 8 current analyst critiques, breaking down 6 to 2 in favor of Purchase over Maintain for a Sturdy Purchase consensus ranking. The inventory is buying and selling for $11.61 and its $19 common worth goal suggests a robust 64% one-year upside potential. (See COUR inventory forecast)

Neurocrine Biosciences, Inc. (NBIX)

The second Morgan Stanley decide we’ll take a look at is Neurocrine, a commercial- and clinical-stage biopharmaceutical firm targeted on creating new remedies for neurological, neuroendocrine, and neuropsychiatric illness situations. The corporate has 4 accredited drugs available on the market, two as wholly-owned merchandise and two along side AbbVie, in addition to an lively pipeline of Section 2 and Section 3 medical research.

The corporate’s main accredited product – and its major headline maker – is ingrezza (valbenazine), an accredited remedy available on the market for the therapy of adults with tardive dyskinesia, a motion dysfunction inflicting uncontrollable actions of the face and tongue, and typically different physique elements. The drug was accredited in 2017, and has since grow to be the primary driver of Neurocrine’s product revenues. Within the final reported quarter, 4Q22, the corporate confirmed a complete of $404.6 million in product gross sales; of that complete, $399 million got here from gross sales of ingrezza. For 2022 as an entire, ingrezza gross sales introduced in a complete of $1.43 billion.

Having a stable money-maker not solely offers Neurocrine a prepared earnings stream but in addition sees the corporate present a optimistic web earnings. The corporate’s non-GAAP diluted EPS for This autumn was $1.24, up from simply 4 cents within the year-ago quarter, though the determine fell shy of the $1.44 forecast. That mentioned, for all of 2022, non-GAAP diluted EPS got here to $3.47, in comparison with simply $1.90 in 2021.

On the medical aspect, Neurocrine has extra analysis tracks underway for valbenazine, as a therapy for a number of situations, together with chorea resulting from Huntington illness, dyskinetic cerebral palsy, and schizophrenia. The important thing catalyst anticipated from these pertains to the Huntington illness monitor; the corporate submitted the New Drug Software to the FDA this previous December, and has a PDUFA date of August 20, 2023.

Additionally, on the Section 3 stage, are grownup and pediatric research of crinecerfont, a therapy for congenital adrenal hyperplasia in adults and youngsters. The corporate has introduced that enrollment in each research is full, and top-line information is predicted in 2H23.

Analyst Jeffrey Hung, in his feedback on Neurocrine for Morgan Stanley, explains clearly why he believes the corporate is ready up for continued success.

“We predict Neurocrine is well-positioned for continued Ingrezza efficiency in 2023 with favorable upside potential from a number of information readouts,” Hung defined. “We’re inspired by the corporate’s expectations for SG&A leverage of 300bps in 2023 and extra development potential in future quarters from the long-term care setting. Though expectations for continued sturdy Ingrezza gross sales stay excessive, we proceed to see a good setup for NBIX shares with a number of information readouts anticipated later this yr.”

These feedback assist Hung’s Obese (i.e. Purchase) ranking on NBIX shares, whereas his $130 worth goal implies a one-year achieve of ~28% ready within the wings. (To observe Hung’s monitor report, click on right here)

Out of 19 current analyst critiques for this inventory, 12 are to Purchase and seven to Maintain, for a Average Purchase consensus ranking. The shares are at the moment buying and selling for $101.18, and the $125.83 common worth goal signifies room for twenty-four% development within the yr forward. (See NBIX inventory forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your individual evaluation earlier than making any funding.