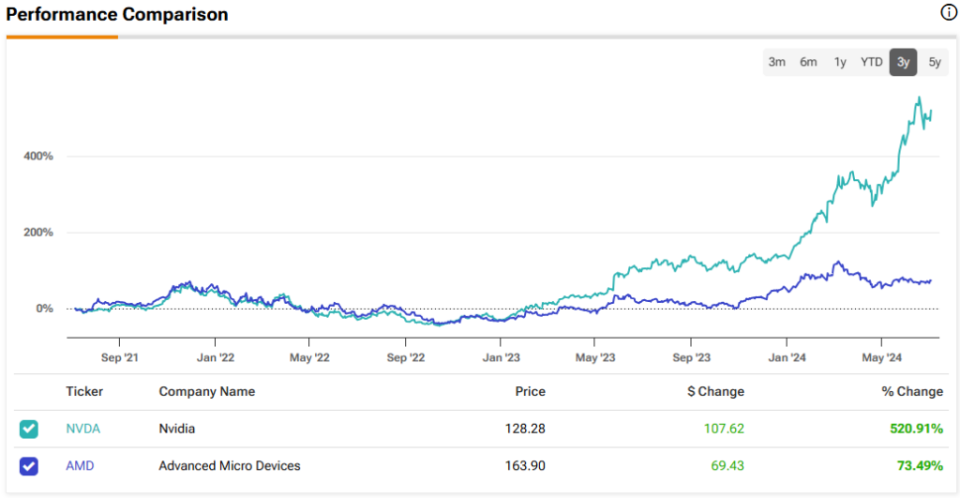

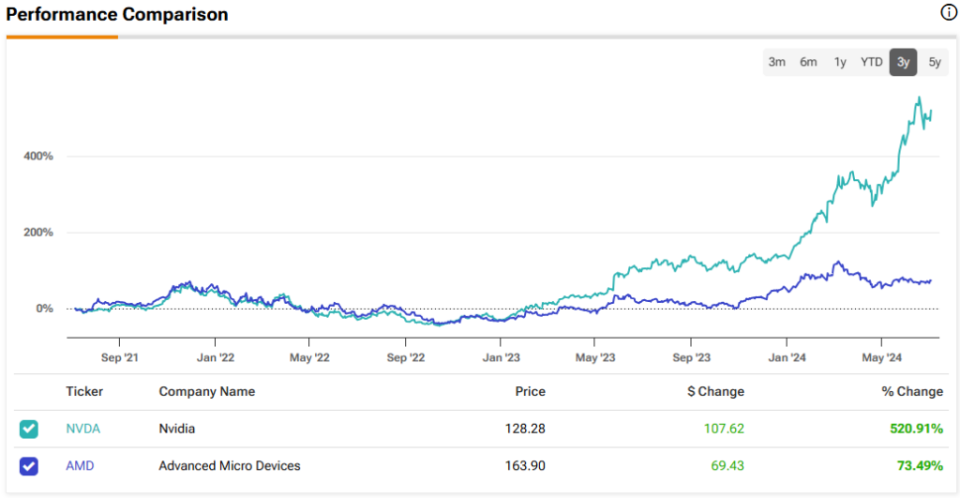

Whereas AI chief Nvidia (NASDAQ:NVDA) reported stellar Q1 earnings, laptop processor and graphics card maker Superior Micro Gadgets (NASDAQ:AMD) comparatively underperformed, solely assembly expectations. This led to a decline within the inventory worth, post-earnings. Nevertheless, traders should word that NVDA is just a few quarters forward of AMD. AMD is showcasing spectacular progress in its AI-driven Information Middle revenues, which is able to finally movement into margins and earnings. Due to this fact, I’m bullish on AMD inventory.

AMD’s Muted Q1 Earnings Did not Impress Buyers

On April 30, AMD reported Q1 EPS of $0.62, consistent with analysts’ estimates. The determine got here in a mere 3.33% increased than the Q1FY23 determine of $0.60 per share. Q1 revenues grew 2.2% year-over-year to $5.47 billion, additionally roughly consistent with consensus estimates. Sturdy Information Middle section revenues considerably offset the weak spot within the Embedded and Gaming segments, however the general Q1 outcomes had been lackluster.

Crucially, Information Middle income progress continued to impress, rising a formidable 80% year-over-year in the course of the quarter, pushed by the launch of its newest MI300 AI accelerators, Ryzen, and EPYC processors. Disappointingly, nevertheless, Gaming income fell 48% year-over-year as a consequence of a decline in gaming chip gross sales. Additional, adjusted gross and working margins had been uninspiring, standing at 52% (78.4% for Nvidia) and 21%, respectively.

Subsequent, AMD’s income steerage met avenue expectations. For Q2, complete income is anticipated to be round $5.7 billion (+/- $300 million). Positively, nevertheless, administration raised the outlook for knowledge heart GPU gross sales, which are actually anticipated to return in at $4 billion versus $3.5 billion guided earlier. The agency’s adjusted gross margin is forecast to be roughly 53%.

AMD’s AI Product Roadmap Presents Sturdy Progress Potential

A comparatively underwhelming Q1 print and fears of AI demand waning have led to a 28% decline in AMD’s inventory from its all-time excessive of $227 in March 2024 to round $164 presently.

Nevertheless, traders ought to word that AMD is the closest competitor to NVDA. It’s well-known that AMD’s GPUs are a less expensive different to NVDA’s GPUs. Given the clear hole between demand and provide as a consequence of restricted manufacturing capability, the surge within the recognition of AI creates a chance for AMD chips to fill within the hole.

As an example, Microsoft (NASDAQ:MSFT) not too long ago introduced that its cloud computing clients utilizing Azure can go for AMD’s MI300 chips together with NVDA’s H100 GPUs. It will give clients an alternate in case of general provide constraints or purchasers’ particular person budgetary constraints. Notably, AMD’s MI300 accelerator, which competes with NVDA’s H100 chips, prices 33% much less.

Whereas Nvidia is presently main within the AI and GPU markets with over 80% market share, AMD’s aggressive pricing and efficiency enhancements might assist it acquire market share over time. It’s price noting that MI300 is reckoned because the fastest-ramping product within the historical past of AMD. Launched simply two quarters in the past, it has already crossed the $1 billion gross sales milestone.

It’s no marvel, then, that AMD’s administration has been constantly rising the outlook for MI300 gross sales for the previous three quarters. There’s a sturdy probability that the gross sales enhance pattern will proceed for the upcoming quarters as effectively.

It’s necessary to notice that AMD has a greater variety of choices in comparison with NVDA. Whereas NVDA is well-known for its highly effective GPUs for knowledge facilities, AMD caters to a wider vary that features CPUs for PCs and GPUs for the gaming trade. Throughout COVID-19, the PC market noticed roaring demand. Now, it’s time once more for customers to maneuver to new PCs with upgraded expertise. AMD is a key provider to the high-end PC market and is certain to profit from the uptick in demand for PCs.

Additional, each NVDA and AMD proceed to unveil their latest merchandise, together with accelerators and processors. Whereas AMD launched its MI300 accelerators in December 2023, NVDA launched its Blackwell GPUs in March 2024.

In response to NVDA’s tempo of innovation, AMD’s CEO Lisa Su additionally introduced an annual cadence of recent product launches on the Computex present held on June 2. The product roadmap appeared spectacular with newer launches year-on-year anticipated to incrementally add to revenues and earnings.

Notably, AMD has constantly undertaken acquisitions to reinforce its knowledge heart choices. As an example, it acquired Xilinx in February 2022 and Pensando Programs in Could 2022. Furthermore, the acquisitions haven’t but been built-in to their full potential and are anticipated to yield a $10 billion cross-selling alternative, as cited by administration. With its acquisitions, its complete addressable market continues to develop, having elevated to $300 billion presently from just below $80 billion in FY2020.

AMD’s Valuation Is Not Low-cost however Nonetheless Seems Cheap

Surprisingly, AMD is buying and selling at a excessive ahead P/E a number of (47x), barely increased than the AI prodigy Nvidia, which is buying and selling at a ahead P/E of 45x. What could possibly be the rationale for AMD’s excessive valuation regardless of lagging behind NVDA’s inspiring outcomes? The reply is obvious: AMD will seemingly observe in NVDA’s footsteps within the subsequent few years, as its AI progress story is simply starting.

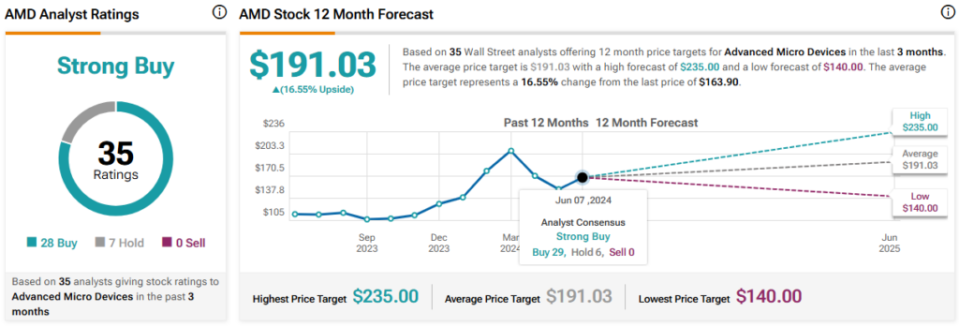

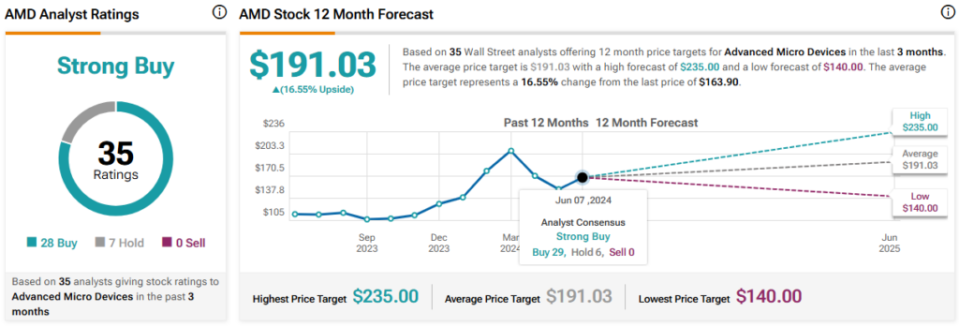

Now, let’s contemplate whether or not it’s price shopping for AMD at present ranges. Wall Avenue analysts anticipate AMD’s EPS to be roughly $5.59 in FY2025 (with expectations of round $6.50 in FY2026). If AMD retains the identical ahead P/E a number of of 47x by then, its share worth will probably be about $275, or 68% increased than the present worth.

Placing it in a different way, AMD shares are buying and selling at a P/E of 28x its FY2025 EPS estimate, implying a 35% low cost to its five-year historic common of 43x.

Due to this fact, it is sensible to contemplate shopping for AMD inventory at present ranges, given the sturdy progress fundamentals within the AI area.

Is Superior Micro Gadgets Inventory a Purchase, In line with Analysts?

The sentiment amongst Wall Avenue analysts is decidedly constructive relating to Superior Micro Gadgets inventory. The inventory boasts a Sturdy Purchase consensus ranking, with 28 Purchase suggestions and 7 Holds. AMD inventory’s common worth goal of $191.03 implies 16.6% upside potential from present ranges.

Conclusion: Contemplate AMD for the Lengthy-Time period AI Potential

There’s a clear-cut demand for AI throughout a broad vary of industries as firms look to construct their very own knowledge heart infrastructure. This suggests that sturdy progress in gross sales for AI chips, GPUs, and CPUs will proceed for not less than some years. AMD’s developments in AI and knowledge heart options place the corporate effectively for future progress, and its aggressive pricing will assist it acquire market share over time.

Moreover, AMD has a powerful foothold within the AI marketplace for PCs and can seemingly proceed to win market share. The approaching PC improve cycle with AI-enabled PCs will add to gross sales and margin progress for AMD within the coming quarters. Given my bullish stance, I view the present share worth weak spot as a shopping for alternative.

Disclosure