What was the highest monetary story of 2023? It needs to be Synthetic Intelligence (AI), proper?

No different topic dominated the headlines fairly like AI. Whether or not it was ChatGPT, viral AI-generated pictures, or the failed ouster of Sam Altman at OpenAI, it appears AI retains pumping out huge tales, one after the opposite.

So, with 2024 proper across the nook, listed below are three AI shares value proudly owning in 2024 — and past.

AI evaluation may help firms optimize their operations

Jake Lerch (Palantir Applied sciences): With the top off 178% 12 months so far, 2023 has been an unbelievable 12 months for Palantir Applied sciences (NYSE: PLTR) and its shareholders. There are, nonetheless, indicators that 2024 (and past) could possibly be even higher.

Palantir operates AI-based analytics programs for governmental and industrial makes use of and is on the forefront of translating AI innovation into shareholder returns. Contemplate Palantir’s current announcement that it’s extending its long-standing partnership with UniCredit S.p.A., a significant European financial institution.

In its press launch , Palantir famous that its signature Foundry working system delivered materials outcomes for UniCredit. For instance, in 2023, “superior analytics and propensity fashions in Foundry helped [UniCredit] generate a four-fold enhance in buyer redemption of safety merchandise via higher focusing on.”

Certainly, UniCredit is only one of many purchasers that’s determined to ramp up its use of AI to streamline its operations. In a Dec. 7, 2023 interview with Fox Enterprise, Palantir co-founder and CEO Alex Karp mentioned, “We simply cannot sustain with our product demand…We’re simply breaking on the seams within the U.S.”

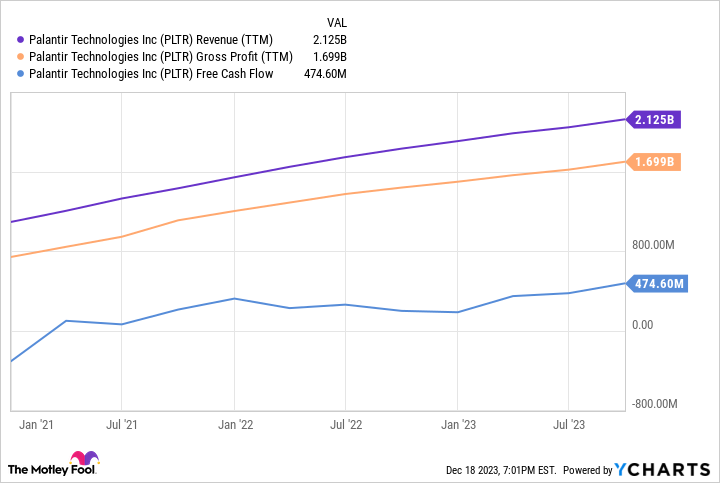

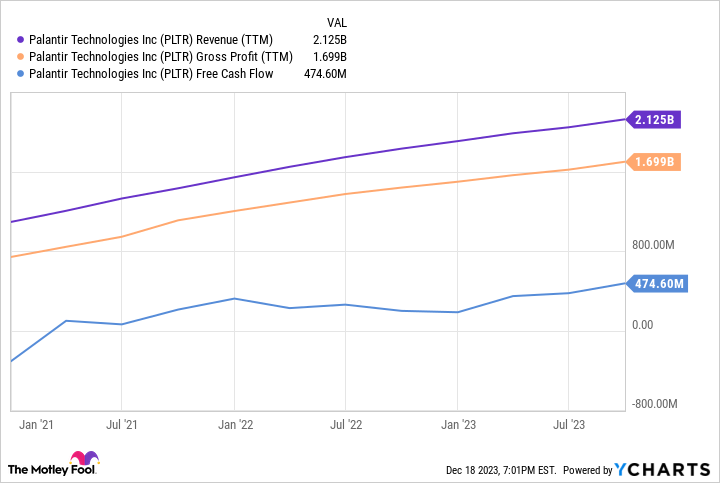

The numbers actually again that assertion up. In its most up-to-date quarter (the three months ending on Sept. 30, 2023), Palantir grew income by 17% 12 months over 12 months. Trailing-12-month income hit $2.1 billion, gross revenue swelled to $1.7 billion, and free money circulate elevated to $474 million.

However, Palantir inventory is not for everybody. For the reason that firm remains to be early in its lifecycle, its inventory will probably be risky. Certainly, shares plummeted greater than 84% from their all-time excessive between January 2021 and January 2023.

Nonetheless, for long-term, growth-oriented traders, Palantir is a reputation value contemplating, given the hovering demand for its merchandise and its bettering fundamentals.

AI is not nearly what you see; it is about what you say and listen to

Justin Pope (SoundHound AI): A lot of the hype round AI has centered on giant language fashions like ChatGPT, however there are different methods to make use of AI that traders is probably not totally conscious of. SoundHound AI (NASDAQ: SOUN) develops conversational AI, taking an audio enter, akin to somebody voicing a query and responding with dialogue or motion.

Conversational AI has lots of current and potential use instances. SoundHound AI is utilized in restaurant and hospitality industries to take orders or make reservations. It is in autos, sensible gadgets, and home equipment for voice help. Sooner or later, the know-how may discover its method into healthcare, customer support, and extra. SoundHound AI estimates a long-term potential addressable market of $160 billion.

As an organization, SoundHound AI is simply getting began. It is solely finished $38 million in income over the previous 12 months, however analysts imagine it should develop considerably. Estimates name for 50% income progress over the subsequent two years. The corporate additionally just lately introduced an acquisition of SYNQ3 Restaurant Options, giving SoundHound entry to a possible restaurant pipeline of 100,000 areas.

SoundHound AI is a dangerous inventory as a result of the enterprise is so nascent. It is burning money each quarter, and there may be solely a 12 months or so of money on the steadiness sheet at this charge. Traders should not be shocked if the corporate points new inventory to lift funds. Conversely, the inventory’s market cap is simply $480 million. Traders may ultimately be handsomely rewarded if SoundHound AI can change into a frontrunner on this large (however underrated) area of interest inside AI.

It is method too early to depend out this “AI-first” firm

Will Healy (Alphabet): The narrative within the AI house appears to have turned away from Google mum or dad Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG).

Certainly, the rise of OpenAI’s ChatGPT appeared to catch Alphabet off guard, significantly as rival Microsoft (NASDAQ: MSFT) cast an alliance with the analysis and improvement firm. This gave customers a cause to begin utilizing Microsoft’s search engine, Bing, and a few started questioning the dominance of the Google search engine for the primary time in a number of years.

Nonetheless, Alphabet has responded with its personal generative AI device known as Bard. Whereas the instruments supply comparable outcomes, Bard was first in producing extra up-to-date outcomes because it leverages Google’s search engine.

Furthermore, the corporate has an extended historical past with AI. Alphabet first used AI to right spelling as early as 2001. The instruments superior from that time, a lot in order that Alphabet declared itself an “AI first” firm in 2016.

Moreover, traders ought to keep in mind that Alphabet owns quite a few firms, a few of which may drive AI innovation. Earlier this 12 months, it mixed two of its AI firms into Google DeepMind. This subsidiary is a gaggle of scientists, engineers, and others researching AI.

Additionally, with the funding backing Google DeepMind, the corporate has a excessive likelihood of driving innovation. Alphabet claims nearly $120 billion in liquidity, and it generated practically $32 billion in free money circulate within the first 9 months of 2023. This provides the corporate large assets to develop AI-related merchandise and the flexibility to buy the innovation it can not create.

Such optionality provides traders fewer causes to doubt Alphabet, and one has to wonder if the sentiment in opposition to the Google mum or dad was overblown. Regardless of the issues of some, the inventory has risen by greater than 40% over the past 12 months.

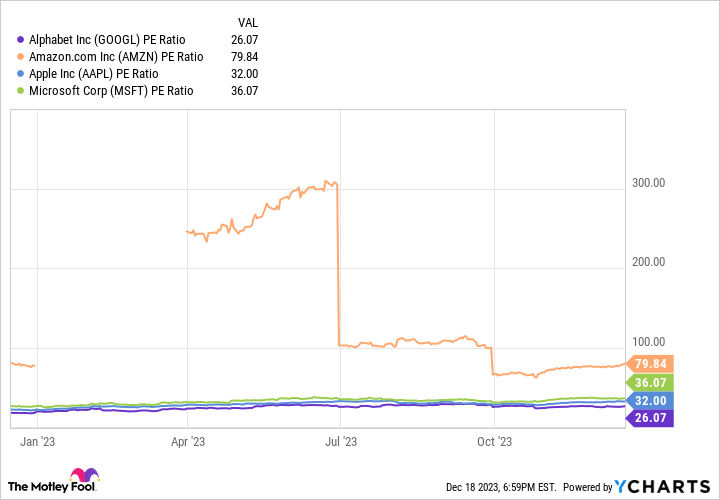

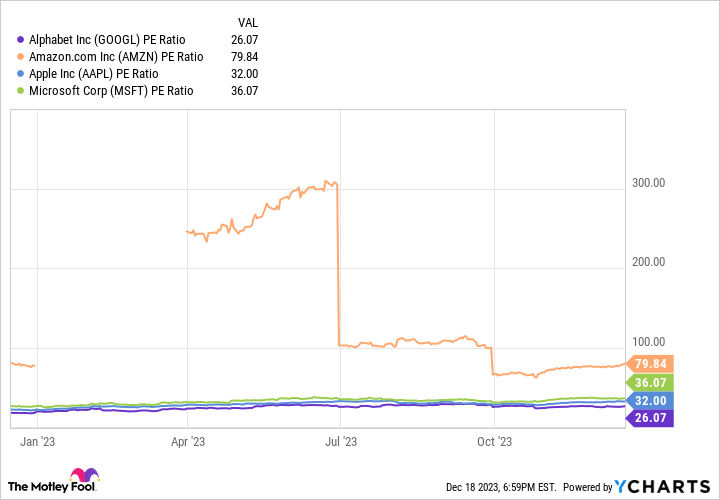

Moreover, the rise has taken its P/E ratio to 26. Whereas not cheap, its P/E is decrease than these of Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), and Microsoft. That decrease valuation could possibly be a possibility to purchase this inventory because it makes use of its AI data base and huge assets to stay a power within the synthetic intelligence trade.

Must you make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Alphabet wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 11, 2023

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Alphabet and Amazon. Justin Pope has no place in any of the shares talked about. Will Healy has positions in Palantir Applied sciences. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Palantir Applied sciences. The Motley Idiot has a disclosure coverage.

3 Synthetic Intelligence (AI) Shares for 2024 (and Past) was initially printed by The Motley Idiot