Synthetic intelligence (AI) has captivated the tech world during the last 12 months, skyrocketing numerous shares. Nonetheless, AI is in no way a brand new idea. So that you may be asking your self, why has it all of a sudden blown up?

Whereas computer systems are wonderful at numerical duties and information processing, they have not at all times been able to pure human capabilities like language, visible processing, and numerous generative duties. Nonetheless, AI bridges that hole, utilizing machine studying to finish duties that sometimes require a human.

Because of this, advances in AI can doubtlessly profit a variety of markets, together with client tech, autonomous autos, healthcare, training, and extra. And with the market and expertise nonetheless of their infancy, it appears the sky is the restrict for AI.

In truth, the AI sector is projected to broaden at a compound annual development price of 37% via 2030, which might see it hit a valuation nearing $2 trillion. The market’s vital potential suggests it is not too late to spend money on and revenue from the tailwinds of AI lengthy into the long run.

So listed here are three AI shares which can be screaming buys this April.

1. Intel

It hasn’t been simple to be an Intel (NASDAQ: INTC) investor lately, with its inventory down 27% since 2022. Nonetheless, the corporate has made vital adjustments to its enterprise mannequin during the last 12 months that might make it a pretty long-term possibility for investing in AI.

Intel is increasing out there by launching its new line of Gaudi 3 AI graphics processing models (GPUs). The chips had been launched earlier this month, and declare to have 50% higher inference and 40% higher energy effectivity than related choices from Nvidia.

Moreover, Intel is utilizing its years of dominance and experience in central processing models (CPUs) to safe a high spot in AI by increasing the AI capabilities of its processors.

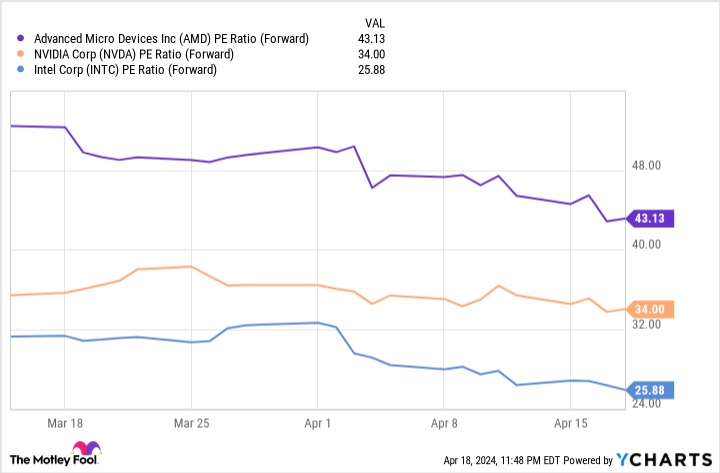

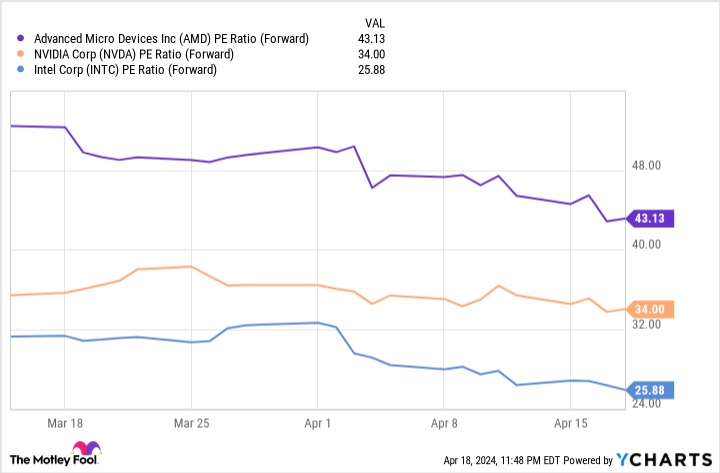

It will take time for Intel to develop its AI enterprise and catch as much as rivals like Nvidia and AMD. Nonetheless, the chart above signifies that Intel is doubtlessly the best-valued AI chip inventory. Intel has the bottom ahead price-to-earnings ratio (P/E) amongst these firms, making it a relative discount.

The corporate is on an thrilling development path, and too good to move up proper now.

2. Apple

Apple (NASDAQ: AAPL) has been quieter on the AI entrance than a lot of its friends. Nonetheless, the corporate is thought for taking its time with new expertise. Apple is not essentially identified for pioneering improvements, however for perfecting established expertise with its personal design language after which rising to dominance within the business by attracting billions of customers.

Markets similar to Bluetooth headphones, smartwatches, and tablets had been every led by totally different firms earlier than Apple appeared on the scene. Nonetheless, the launch of merchandise like AirPods, the Apple Watch, and the iPad have made its opponents nearly a distant reminiscence. Because of this, it is not too regarding that Apple is not at present one of many high canine in AI.

The tech large seems to be quietly honing its AI expertise. In the meantime, its main market shares in a number of areas of client tech may see it steer the business and turn out to be a serious development driver in getting AI into the palms of the common shopper.

Apple shares noticed a slight surge on April 11 when Bloomberg reported that the corporate was overhauling its whole Mac lineup to broaden its AI capabilities and meet hovering demand for such {hardware}. In the meantime, the tech firm has been steadily including new AI options throughout its product lineup, together with enhancements to the iPhone’s Siri and new gestures for the Apple Watch.

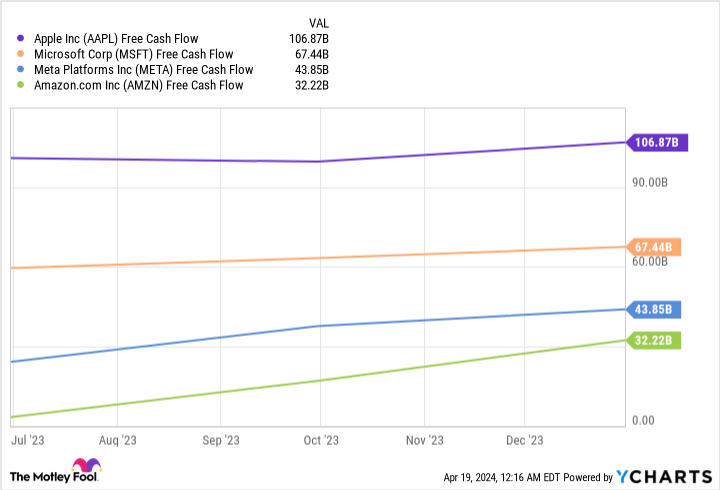

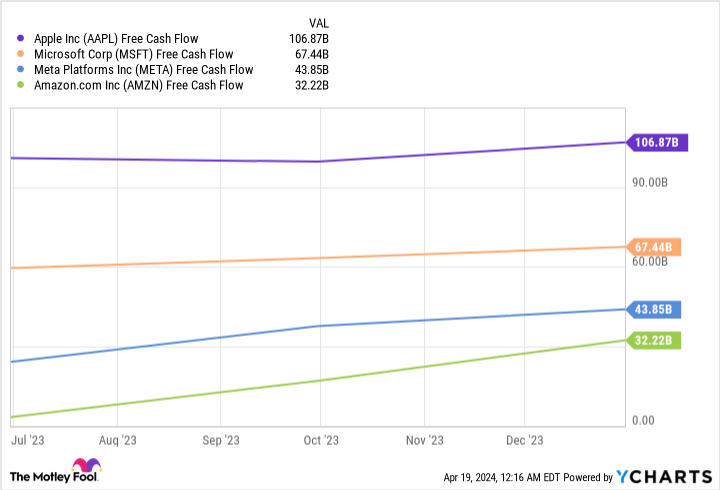

Final 12 months Apple generated practically $107 billion in free money stream, significantly greater than a few of AI’s most outstanding gamers, together with Microsoft, Meta Platforms, and Amazon. This determine means that Apple is well-equipped to broaden within the budding AI market and sustain with its rivals over the long run.

Apple’s inventory is buying and selling at 25 occasions ahead earnings, making it an affordable purchase and an thrilling approach to spend money on AI.

3. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has been barely overshadowed in AI during the last 12 months by cloud rivals Microsoft and Amazon. Nonetheless, the corporate is well some of the thrilling AI shares for long-term good points.

The corporate is residence to a protracted record of potent manufacturers, together with Google, Chrome, Android, and YouTube. These companies repeatedly entice billions of customers, giving Alphabet ample alternative to tout its AI choices.

Because of this, the corporate’s current pivot to the profitable market is promising. Earlier this 12 months, Alphabet launched Gemini, its most superior AI mannequin to this point. Its debut wasn’t good, with the mannequin making some errors at its launch presentation, which pressured the corporate to briefly pause its picture era companies.

Nonetheless, Alphabet is shifting ahead in its AI growth. The corporate not too long ago introduced plans to consolidate its Deep Thoughts and Analysis groups to advertise effectivity in its AI division. Alphabet will transfer its AI-focused Accountable AI groups to Deep Thoughts, the place its fashions are constructed.

Like Intel and Apple, Alphabet’s shares are a discount in comparison with different AI shares. Its ahead P/E at present sits at a pretty 23, considerably decrease than Microsoft’s 34 and Amazon’s 43.

Alphabet’s inventory is a screaming purchase this month, and one you will not need to miss out on.

Must you make investments $1,000 in Intel proper now?

Before you purchase inventory in Intel, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Intel wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $466,882!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 22, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Prepare dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, brief January 2026 $405 calls on Microsoft, and brief Might 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

3 Synthetic Intelligence (AI) Shares That Are Screaming Buys in April was initially revealed by The Motley Idiot