“Over time, it takes just some winners to work wonders.”

— Warren Buffett, from the 2022 Berkshire Hathaway letter to shareholders

One large winner could make a fortune. Nobody is aware of this higher than the Oracle of Omaha.

Take Apple, certainly one of Buffett’s most well-known investments. A $50,000 funding, made in 2007 — the identical 12 months the iPhone debuted — would have grown to a cool $3.5 million right this moment, a mere 17 years later.

Are there any shares on the market right this moment with that kind of potential? In fact. Listed here are three which may have what it takes.

1. Microsoft

Topping the record is Microsoft (NASDAQ: MSFT). The corporate that made former CEOs Invoice Gates and Steve Ballmer a few of the richest males on the earth is as soon as once more the most important firm on the face of the Earth with a market cap topping $3 trillion. And because of its many synthetic intelligence (AI)-related ventures, Microsoft stands a good chance of making many extra fortunes.

Let’s begin with the corporate’s cloud providers enterprise. It is already an enormous moneymaker for Microsoft, producing $25.9 billion in its most up-to-date quarter (the three months ended Dec. 31, 2023). That makes it the second-largest cloud providers vendor globally, trailing solely Amazon Net Companies.

As AI utilization ramps up, Microsoft stands to learn from elevated cloud providers. Certainly, after decelerating some in 2022, cloud spending seems to be reaccelerating as organizations discover how AI can enhance their processes and generate efficiencies.

As well as, Microsoft’s longstanding partnership with OpenAI, the corporate behind ChatGPT, makes Microsoft a significant participant within the race to develop the subsequent AI breakthrough.

Lastly, Microsoft’s typically underrated search, information, and promoting section is gaining market share and rising at near double-digits, thanks partly to its ChatGPT-powered options, which had been added final 12 months.

Microsoft has a number of pathways to riches on the AI entrance. Given its excellent observe file and glorious administration, Microsoft may very well be one AI inventory that makes many fortunes going ahead.

2. CrowdStrike

Subsequent is CrowdStrike (NASDAQ: CRWD). Whereas nowhere close to the scale of Microsoft, CrowdStrike remains to be prone to make various fortunes within the coming years, because of its cutting-edge AI-powered cybersecurity choices.

The corporate runs maybe the premier cybersecurity platform obtainable right this moment, which protects networks, endpoints, and knowledge by add-on modules which are tailor-made to its prospects’ wants. Its modules are scalable and designed to extend in effectiveness as their knowledge inputs develop bigger. In different phrases, CrowdStrike’s product turns into higher the longer a buyer makes use of and feeds extra knowledge to its AI.

What’s extra, this community impact is not restricted to only one buyer. As extra organizations undertake CrowdStrike’s platform, its AI is in a position to attract on extra situations and interactions that assist the system detect and forestall undesirable exercise throughout its whole safety umbrella — just like the way in which native regulation enforcement businesses can depend on the FBI’s Ten Most Wished record to be looking out for particular people they themselves might have by no means encountered.

Financially, CrowdStrike is rocking and rolling. In its most up-to-date quarter (the three months ended Oct. 31, 2023), the corporate reported $786 million in income, up 35% from a 12 months earlier. Furthermore, annual recurring income (ARR) — a carefully watched metric for firms promoting subscription-based merchandise — elevated to $3.15 billion, with $223 million of web new ARR added within the quarter.

In brief, this implies CrowdStrike is rising its subscription base, by bringing in new prospects and by upselling further safety modules to current prospects.

At any charge, the corporate’s strong progress factors to large issues forward, because the variety of cyber threats continues to develop — that means CrowdStrike’s progress curve might prolong for a few years to return.

3. Nvidia

Final, however not at all least, is Nvidia (NASDAQ: NVDA). Let’s face it: No firm or inventory has ridden the AI wave higher or to higher heights than Nvidia. The corporate is now America’s third-largest public firm with a market cap hovering close to $2 trillion — up from $279 billion fewer than 18 months in the past.

Unbelievable as it might appear, it is completely potential that Nvidia might proceed its ascent — even passing Apple and Microsoft to turn out to be the most important firm globally.

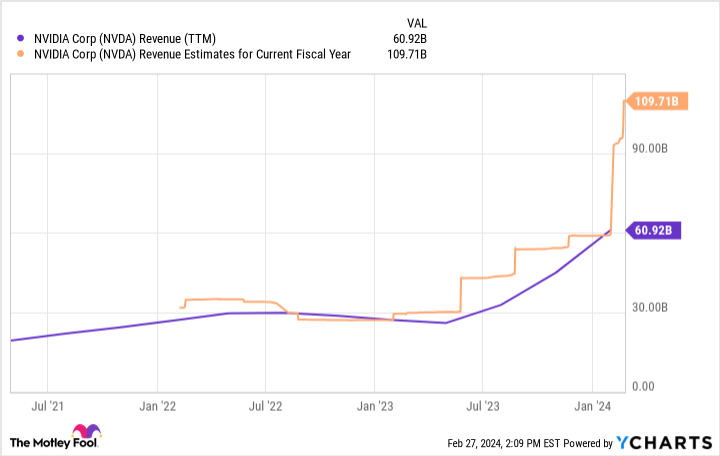

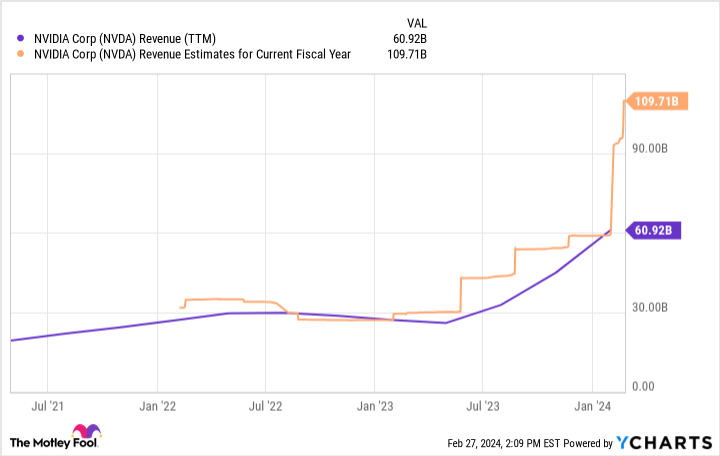

That is as a result of its charge of progress is actually eye-popping. Income grew 265% as of its most up-to-date quarter (the three months ended Jan. 28). Furthermore, estimates of future progress are sky-high.

Finally, nobody actually is aware of how giant the AI chip market might get. Superior Micro Gadgets CEO Lisa Su not too long ago mentioned it might develop to $400 billion. Maybe it may very well be much more.

At any charge, it is clear Nvidia has an enormous head begin over its opponents, and due to aggressive benefits like its CUDA software program, it’d keep these benefits for a while to return. That makes Nvidia, an organization that has already made many fortunes, a main candidate to make numerous extra within the years to return.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 26, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Amazon, CrowdStrike, and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Amazon, Apple, Berkshire Hathaway, CrowdStrike, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

3 Synthetic Intelligence (AI) Shares That May Assist Make You a Fortune was initially revealed by The Motley Idiot