Investing in synthetic intelligence (AI) appears to have turn out to be tougher over the previous few months. Multiple 12 months after generative AI stoked pleasure for tech traders, particular shares similar to Nvidia, Tremendous Micro, and CrowdStrike appear to have drawn many of the curiosity and have risen to nosebleed valuations.

Luckily for traders who really feel they missed out on these shares, AI will doubtless be greater than a flash within the pan. Thus, one can purchase and maintain particular AI shares for the subsequent decade with an affordable expectation of incomes important returns. These three shares ought to ship for traders.

1. Palantir Applied sciences

At first look, traders would possibly assume they’ve missed out on Palantir Applied sciences (NYSE: PLTR). The inventory is up fourfold since its low in late 2022. Additionally, the latest income progress is unlikely to impress progress traders.

Nonetheless, traders could have but to totally notice the game-changing potential of its generative AI product: the Synthetic Intelligence Platform (AIP). AIP builds on the evaluation capabilities of its older Gotham and Foundry platforms. Whereas these platforms additionally relied on AI, the productiveness features reported by AIP customers have yielded eye-popping outcomes.

After attending AIP boot camps, corporations appear to seek out a number of use circumstances. One potential buyer achieved extra in a day by means of AIP than a hyperscaler (like Amazon Net Providers) may need achieved in 4 months, whereas one other claimed to construct 10 occasions sooner with thrice fewer assets. Such outcomes appear to rapidly result in new seven-figure offers for Palantir.

As talked about, outcomes could take time. Within the first quarter of 2024, income of $634 million rose 21%, which seems modest when evaluating progress to its price-to-sales (P/S) ratio of 24.

Nonetheless, its internet earnings of $106 million is up greater than sixfold from year-ago ranges. If income progress begins to replicate the productiveness features and elevated deal volumes pushed by AIP, the inventory value progress ought to speed up considerably over the subsequent few years.

2. Alphabet

Along with up-and-coming AI corporations, traders may additionally need to take a look at one of many pioneers on this subject: Google mum or dad Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG). Alphabet started utilizing the know-how in 2001 and have become an AI-first firm in 2016, using the know-how in all subsequent product releases.

Nevertheless, the rise of ChatGPT left traders with the impression that Alphabet had fallen behind its friends. For the primary time in a long time, Google’s dominant search engine confronted a reputable aggressive menace.

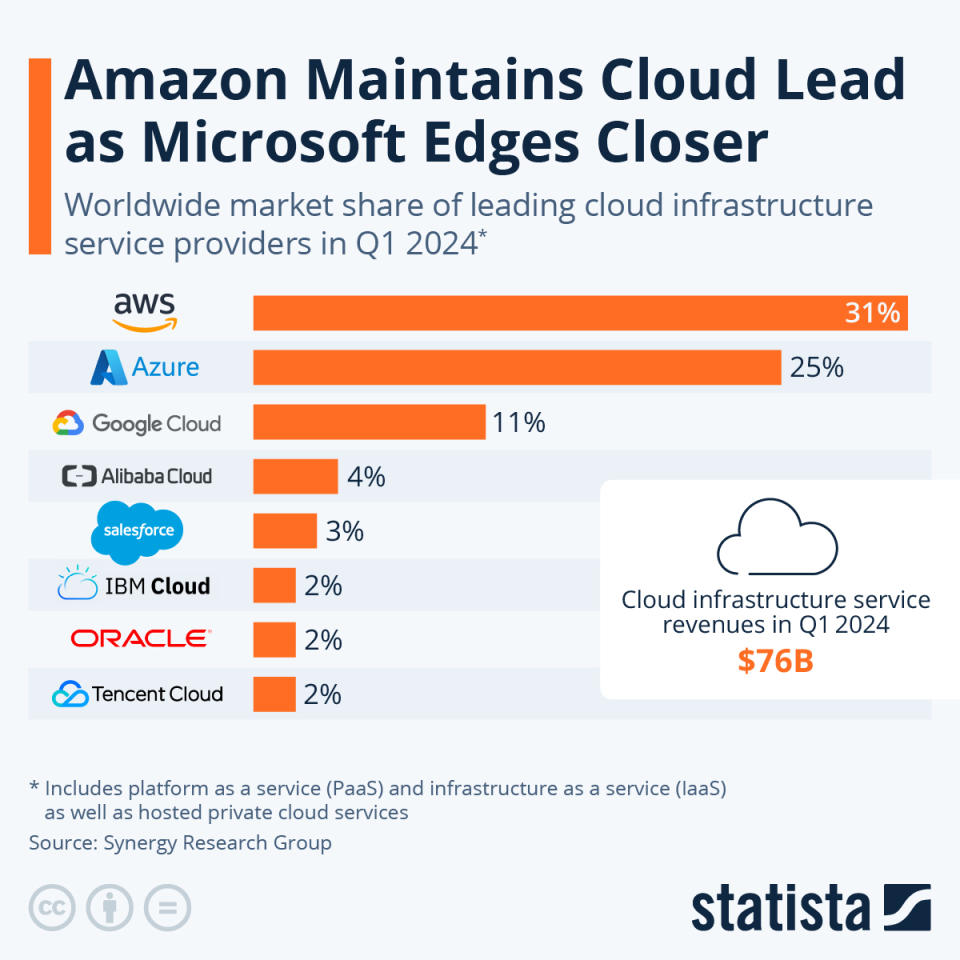

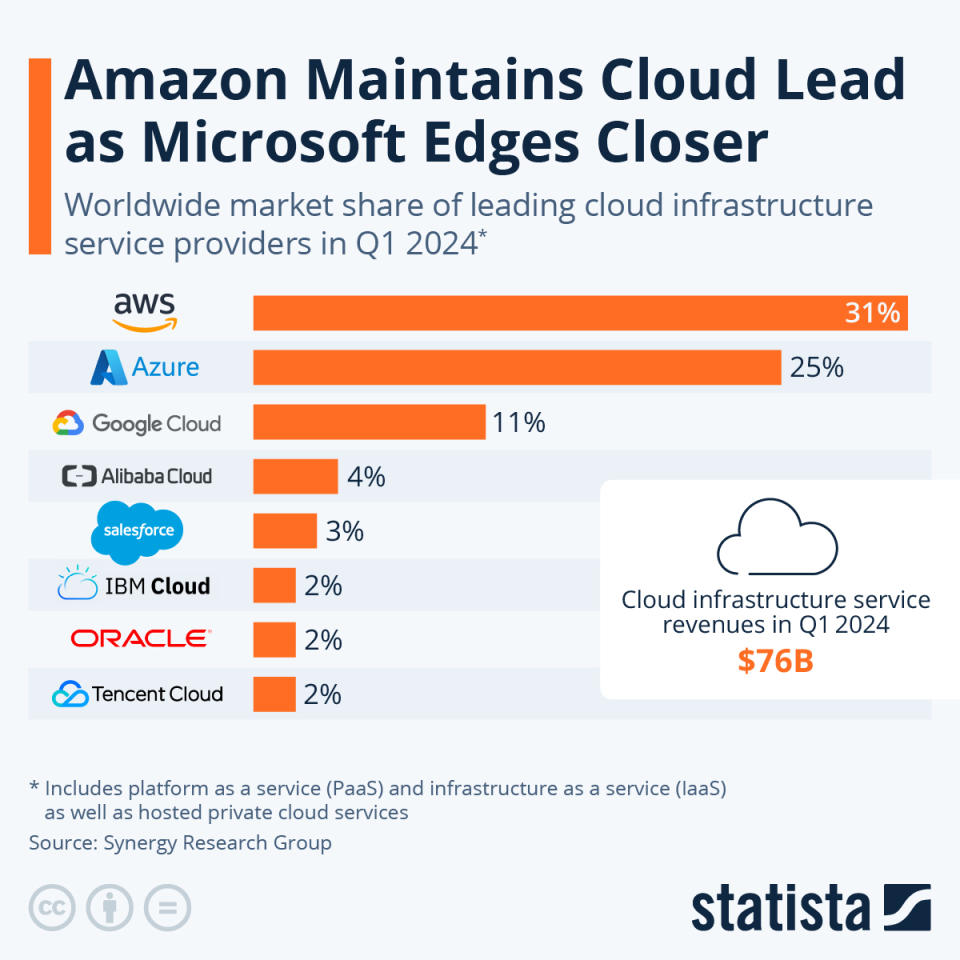

Nonetheless, earlier than writing off Alphabet, traders ought to do not forget that it has launched its personal generative AI instrument within the type of Google Gemini. Furthermore, Google Cloud, which is the third-largest cloud firm, ensures it would play a crucial function in deploying this know-how for shoppers.

Moreover, Alphabet mixed its analysis groups in April 2023 to kind Google DeepMind. With $108 billion in liquidity backing its efforts, Alphabet is unlikely to remain behind on this subject.

Lastly, at a price-to-earnings ratio of 28, it’s cheaper than its mega-tech opponents. Between its breadth of expertise in AI and its great useful resource base, the Google mum or dad will doubtless stay a power within the AI business for a very long time to return.

3. VanEck Semiconductor ETF

Traders preferring to not threat valuable capital on the fortunes of a specific firm could merely need to put money into many of the high chip shares by means of the VanEck Semiconductor ETF (NASDAQ: SMH). Many of the corporations throughout the exchange-traded fund (ETF) both design or manufacture AI-ready chips. With out this know-how, AI wouldn’t have been potential.

This ETF invests round 20% of its belongings in Nvidia, with an extra 13% within the main chip producer Taiwan Semiconductor Manufacturing. The remainder of its holdings make up lower than 10% of the fund every, although Broadcom, Superior Micro Units, and Micron are among the many 26 shares held.

Furthermore, it reported returns of 28% per 12 months during the last 10 years. As compared, the benchmark SPDR S&P 500 reported a mean yearly return of 13% over the identical interval — lower than half the return of the VanEck ETF.

Moreover, VanEck’s ETF expense ratio is 0.35%, barely under the typical expense ratio, which is 0.37%, based on Morningstar. Thus, the fund has delivered these outsized returns at an inexpensive value.

Certainly, the fund doesn’t assure it could actually match the 28% common annual return during the last 10 years. Nevertheless, if one desires outsized returns with decrease threat and with out the work concerned to find such shares, they are going to doubtless discover each within the VanEck Semiconductor ETF.

Must you make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for traders to purchase now… and Alphabet wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $759,759!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 24, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Will Healy has positions in Superior Micro Units, CrowdStrike, and Palantir Applied sciences. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Amazon, CrowdStrike, Microsoft, Nvidia, Oracle, Palantir Applied sciences, Salesforce, Taiwan Semiconductor Manufacturing, and Tencent. The Motley Idiot recommends Alibaba Group, Broadcom, and Worldwide Enterprise Machines and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

3 Synthetic Intelligence Shares You Can Purchase and Maintain for the Subsequent Decade was initially printed by The Motley Idiot