Berkshire Hathaway is likely one of the world’s premier funding conglomerates. Via strategic investments, subsidiary companies working in insurance coverage and logistics, and a disciplined enterprise method, it has grown to an almost $800 billion firm.

Led by Warren Buffett and his group, Berkshire Hathaway and its investments have influenced numerous traders globally. Nonetheless, copying Berkshire’s portfolio, inventory for inventory, is probably not the most suitable choice as a result of your objectives and danger tolerance might not solely align with it.

Nevertheless, for traders in search of Berkshire Hathaway shares to load up on now, listed here are three which can be effectively value contemplating.

1. Coca-Cola

Coca-Cola (NYSE: KO) has been a staple in Berkshire Hathaway’s portfolio since its first funding in 1988. Since then, Berkshire Hathaway has amassed 400 million Coca-Cola shares, representing round 9% of the corporate’s shares.

Within the U.S., Coca-Cola had a 46% market share within the carbonated mushy drink market on the finish of 2022, far outpacing its largest competitor, PepsiCo. No matter Coca-Cola’s market dominance over the many years, I admire the way it has but to get complacent and continues prioritizing innovation and adapting to customers’ ever-changing preferences. A testomony to this has been Coca-Cola’s Transformational Innovation Workforce, whose sole objective is driving product improvement and exploring new market developments.

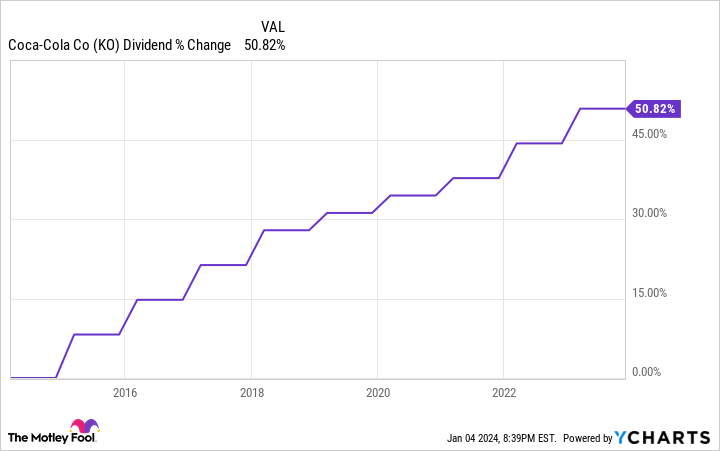

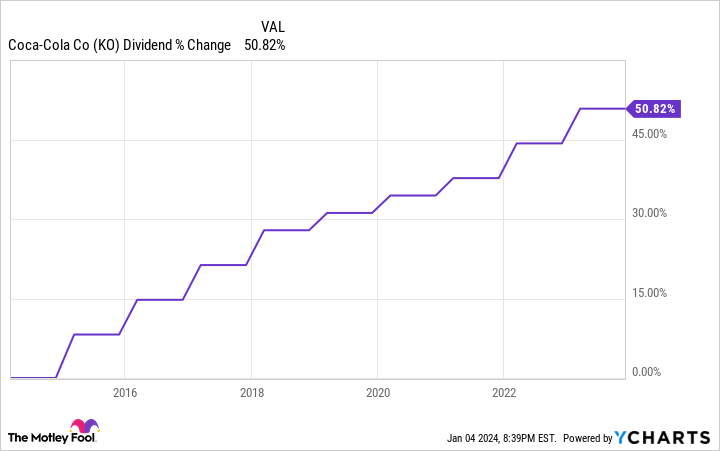

Coca-Cola’s inventory worth has underperformed in opposition to the S&P 500 over the previous decade, however its dividend is what usually attracts traders. Coca-Cola’s quarterly dividend is $0.46, with a trailing 12-month yield of round 3%. Arguably extra spectacular is that it has elevated its yearly dividend for 61 consecutive years, giving it the esteemed title of Dividend King. Prior to now 10 years alone, Coca-Cola’s quarterly dividend has elevated by over 50%.

Coca-Cola is not a development inventory that’ll constantly return double-digit percentages 12 months in and 12 months out, however it could possibly present traders with as dependable a dividend as you may discover on the inventory market.

2. Visa

Visa (NYSE: V) is the worldwide chief in digital funds, with an enormous, always increasing attain. It operates in over 200 nations, has over $4.3 billion playing cards in circulation, and is accepted by over 130 million service provider places.

Visa’s attain is its key aggressive benefit, principally due to the community impact. Think about you are a retailer and have to decide on which playing cards you may settle for. Likelihood is excessive that you will go together with Visa since you perceive your clients will seemingly have a Visa card over different choices. Not accepting Visa playing cards may imply lacking out on gross sales. The identical applies to customers trying to get a card. Many favor a Visa card as a result of companies that settle for playing cards are very more likely to settle for Visa.

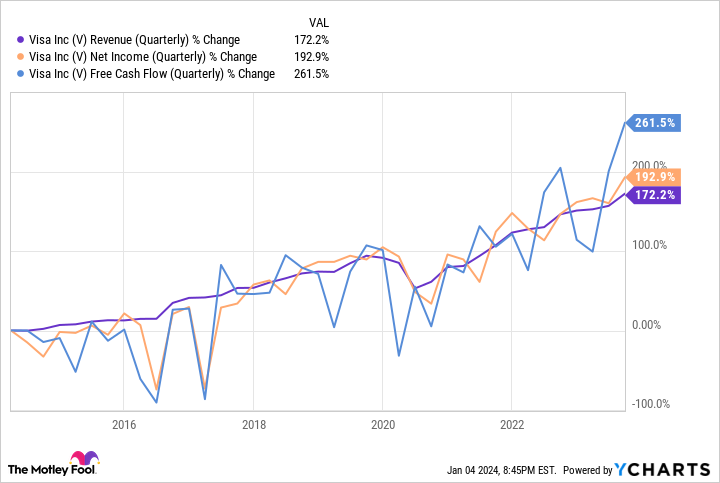

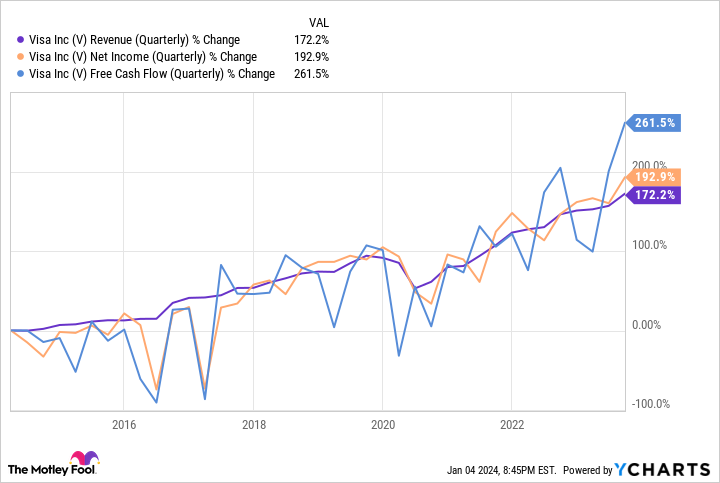

Visa’s latest development has translated effectively to its financials as effectively. Over the previous decade, its income is up 172%, however its internet earnings and free money circulation have grown sooner, signaling the corporate is working extra effectively.

The U.S. could also be a frontrunner in digital funds, however a lot of the world nonetheless operates in a money financial system. That offers Visa loads of market alternative as nations transition towards digital and digital funds. It is a inventory I really feel comfy holding onto for the lengthy haul.

3. Amazon

Amazon (NASDAQ: AMZN) is not an organization that wants a lot of an introduction. Its e-commerce enterprise has made it a family identify across the globe. Nevertheless, it seemingly will not be Amazon’s e-commerce enterprise that drives a whole lot of its development within the foreseeable future — it could be the logistics community that powers it.

Amazon lately introduced “Provide Chain by Amazon,” a completely automated set of provide chain providers. The service permits sellers to make the most of Amazon’s advanced logistics, warehousing, distribution, success capabilities, and transportation (together with worldwide).

Amazon has spent billions constructing out its logistics community, and Provide Chain by Amazon permits the corporate to capitalize from it outdoors of its core e-commerce enterprise.

E-commerce will proceed to be Amazon’s foremost income driver, and Amazon Internet Providers can be its foremost revenue generator, but it surely’s encouraging to see different segments starting to drag their very own weight a bit of extra. Within the third quarter of 2023, Amazon’s third-party vendor providers income grew 20% 12 months over 12 months (YOY). Promoting led the way in which, rising 26%.

Amazon has its arms in lots of high-growth industries, so there needs to be loads of worth to be returned to shareholders as the corporate continues to broaden throughout industries.

Must you make investments $1,000 in Berkshire Hathaway proper now?

Before you purchase inventory in Berkshire Hathaway, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Berkshire Hathaway wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Stefon Walters has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Berkshire Hathaway, and Visa. The Motley Idiot recommends the next choices: lengthy January 2024 $47.50 calls on Coca-Cola. The Motley Idiot has a disclosure coverage.

3 Berkshire Hathaway Shares to Purchase Hand Over Fist in January was initially revealed by The Motley Idiot