Investing in synthetic intelligence (AI) has turn out to be profitable and dangerous. Shares similar to Nvidia and Palantir may revolutionize AI, however additionally they promote at valuations that make them more and more dangerous selections.

Nevertheless, not all AI shares have turn out to be costly previously yr. These three corporations play essential roles in AI, however commerce at valuations that may enable risk-averse buyers to purchase in now with out overpaying.

IBM

Now that Worldwide Enterprise Machines (NYSE: IBM) has turn out to be a frontrunner within the cloud, it’s in all probability time to contemplate including it to your portfolio. The corporate’s transfer into the hybrid cloud and the spinoff of its underperforming managed infrastructure enterprise as a brand new firm, Kyndryl, have modified the outlook for this tech inventory.

IBM has additionally developed AI options. Amongst its merchandise is Watsonx, which helps customers construct basis fashions, scale AI workloads from its knowledge retailer, and monitor AI lifecycles of their entirety. Furthermore, IBM Analysis and the corporate’s crew of consultants may assist purchasers deploy AI throughout their organizations.

Revenue buyers will like IBM’s payout. With a dividend of $6.64 per share yearly, at present share costs, it presents a yield of three.6%, and the corporate has a 27-year streak of annual payout hikes. This makes it the dividend inventory within the cloud area, since its friends both present extra modest payouts or do not pay dividends in any respect.

Additionally, after years of decline and stagnation, the inventory has begun to return again. During the last yr, it’s up greater than 35% and will quickly return to the all-time excessive it touched in 2013. But even after these features, it trades at a P/E ratio of 23, a discount valuation in comparison with many AI shares in the present day. Given these components, buyers might wish to purchase shares of IBM earlier than they turn out to be considerably dearer.

Taiwan Semiconductor Manufacturing

Admittedly, Taiwan Semiconductor Manufacturing (NYSE: TSM) — aka, TSMC — might not seem to be a low-risk choose. Just lately, all shares tied to China, on some stage, have struggled with progress. Traders like Warren Buffett have exited their positions in TSMC out of worry of the chance that China may invade Taiwan, which is dwelling to many of the firm’s chip fabrication services.

Nevertheless, virtually each chip design firm is dependent upon TSMC for its manufacturing. Thus, corporations similar to Nvidia and AMD face this identical threat, although it’s doubtless not priced into their shares. Secondly, China additionally is dependent upon TSMC’s chips, making it much less doubtless it will put its financial system in danger with an invasion.

Traders might have began to note as TSMC inventory has risen greater than 40% over the previous yr. That has taken its P/E ratio to 26. Whereas its earnings a number of has considerably elevated over the previous couple of months, TSMC routinely traded at greater than 30 instances earnings throughout the 2021 bull market.

Additionally, analysts forecast a ten% surge in earnings for this yr and a 23% improve in 2025. These components ought to put upward stress on the semiconductor inventory as TSMC produces extra of the chips that may energy the AI revolution.

T-Cell

T-Cell US (NASDAQ: TMUS) is one in every of solely three nationwide 5G wi-fi suppliers within the U.S. This positions it as one of many few wi-fi telecoms that may present a essential hyperlink for quite a few AI functions.

Furthermore, it was based in 1994, and in contrast to Verizon Communications and AT&T, it began as a wi-fi supplier. As such, T-Cell doesn’t have legacy prices similar to pensions, nor does it face in depth environmental cleanup prices from outdated lead-lined cables — simply two of the issues which can be at present plaguing these rivals.

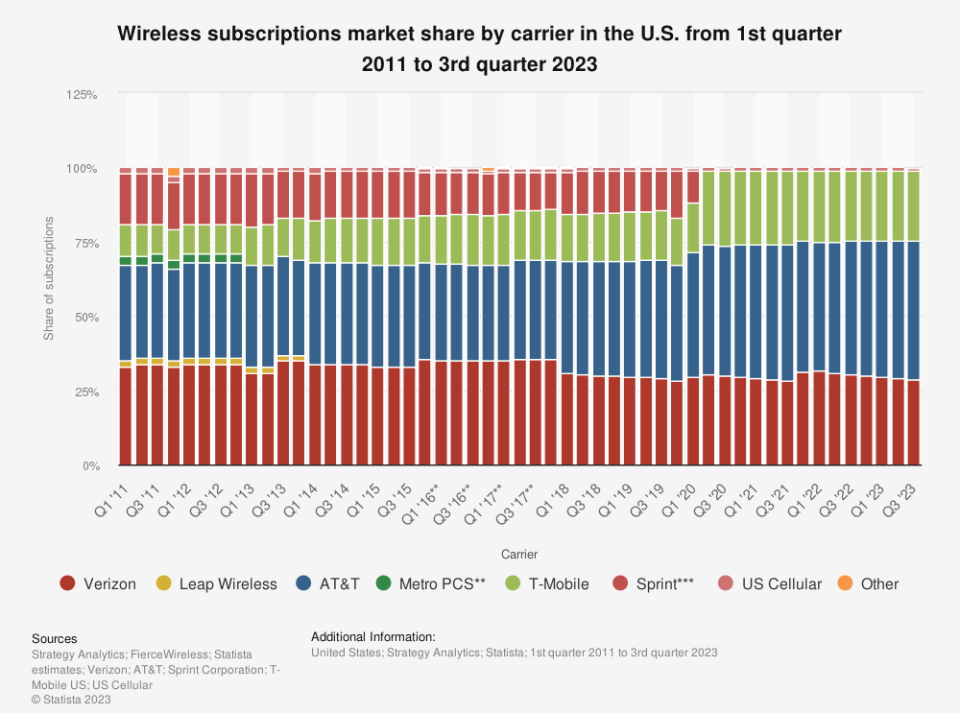

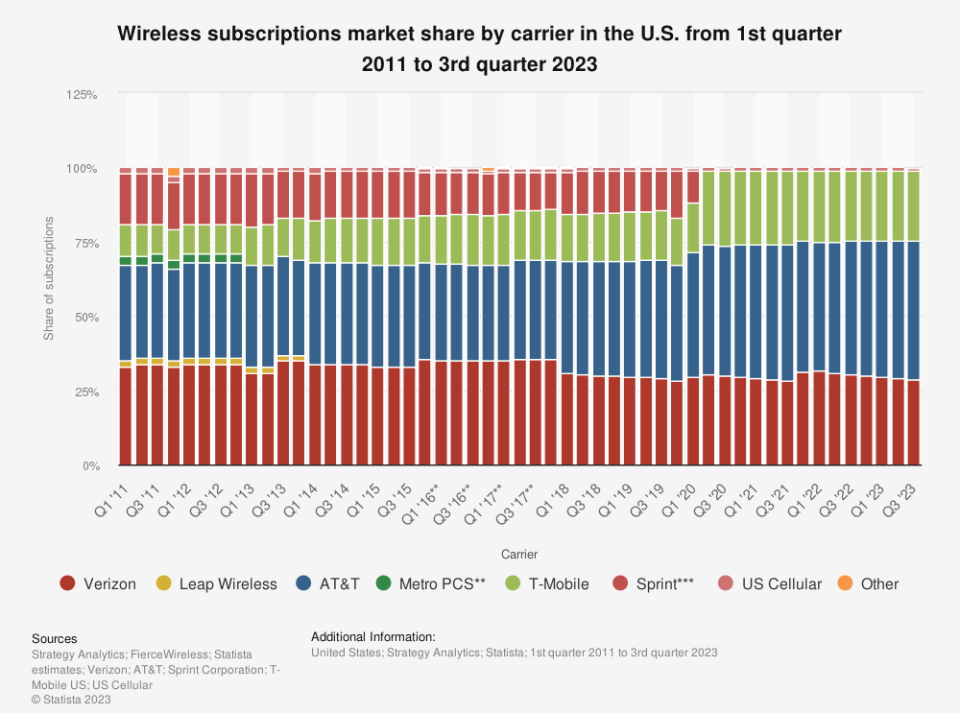

For these causes, it has lengthy been free to spend its capital on its wi-fi networks and acquisitions, and to supply worth cuts which have squeezed the revenue margins of its friends. All of this has allowed T-Cell to develop its market share to round 24%.

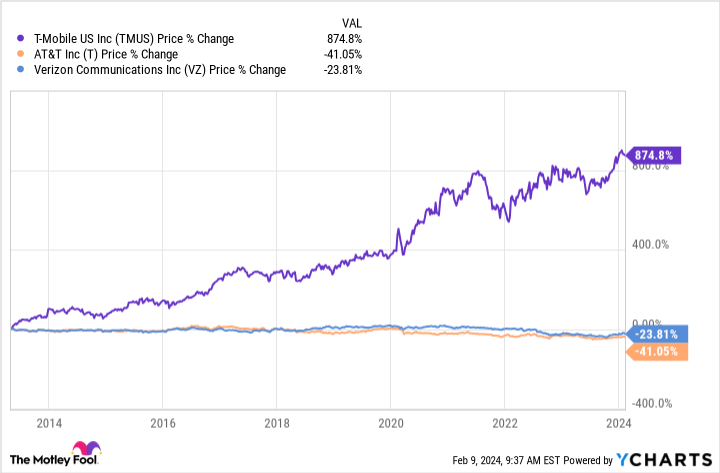

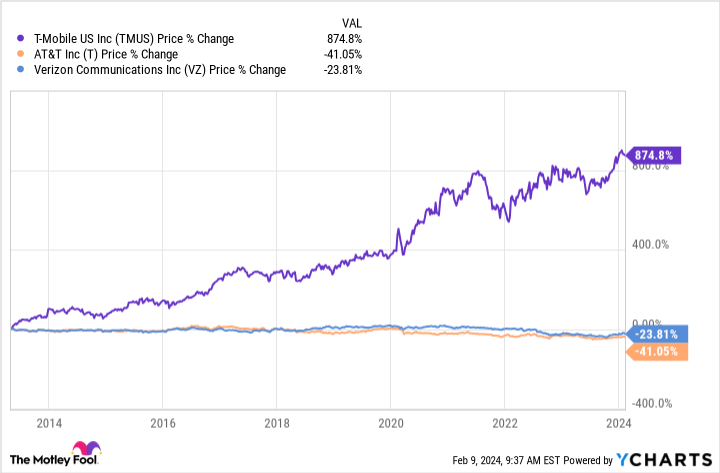

Though T-Cell’s share worth rose solely 12% final yr, the telecom inventory outperformed its friends. It has additionally risen by almost 875% since its inception, making it extra of a progress inventory.

Nevertheless, its P/E ratio of 23 is low by historic requirements. Additionally, because it initiated a dividend in December, extra conservative buyers may take an curiosity. At $2.60 per share yearly, its 1.6% money return is dwarfed by the better than 6% dividend yields of AT&T and Verizon.

Nonetheless, its payout may act as a stabilizing power for T-Cell over time, and with inventory worth progress supplementing returns, it ought to proceed to outpace its friends.

Do you have to make investments $1,000 in Worldwide Enterprise Machines proper now?

Before you purchase inventory in Worldwide Enterprise Machines, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Worldwide Enterprise Machines wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 12, 2024

Will Healy has positions in Superior Micro Gadgets and Palantir Applied sciences. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Nvidia, Palantir Applied sciences, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Worldwide Enterprise Machines, T-Cell US, and Verizon Communications. The Motley Idiot has a disclosure coverage.

3 Compelling Synthetic Intelligence (AI) Shares That Threat-Averse Traders Can Really feel Protected Shopping for was initially printed by The Motley Idiot