Cybersecurity will probably be an important a part of the digital economic system shifting ahead. Firms are financially incentivized to make use of one of the best safety instruments to guard their knowledge and programs. Do you know the common breach can value an organization practically $4.5 million? That is in line with an annual examine by IBM.

Nevertheless, legacy merchandise like antivirus software program typically do not do the job anymore. That is the place next-generation options come into the image. Buyers have a wide range of cybersecurity shares to select from, however after some due diligence, three emerged as potential long-term winners.

Listed here are the three cybersecurity shares you should buy and maintain for the subsequent decade.

1. Palo Alto Networks

The firewall has been vital to safety for years, and that is the place Palo Alto Networks (NASDAQ: PANW) specializes. A firewall is just like the safety element at a celebration checking the visitor checklist to make sure solely the invited individuals get in. Firewalls monitor incoming and outgoing community site visitors, searching for something that does not belong. Palo Alto Networks’ firewall safety is top-notch; third-party companies like Gartner‘s prestigious Magic Quadrant rankings have named it a pacesetter in its class.

Right this moment, Palo Alto Networks has over 70,000 energetic clients and is rising by increasing its product choices to incorporate extra safety classes on two different platforms. That provides the corporate three platforms: Community Safety, Cloud Safety, and Safety Operations. Presently, simply half of the corporate’s clients use two of three platforms, and simply 13% use all three, so there are alternatives to cross-sell.

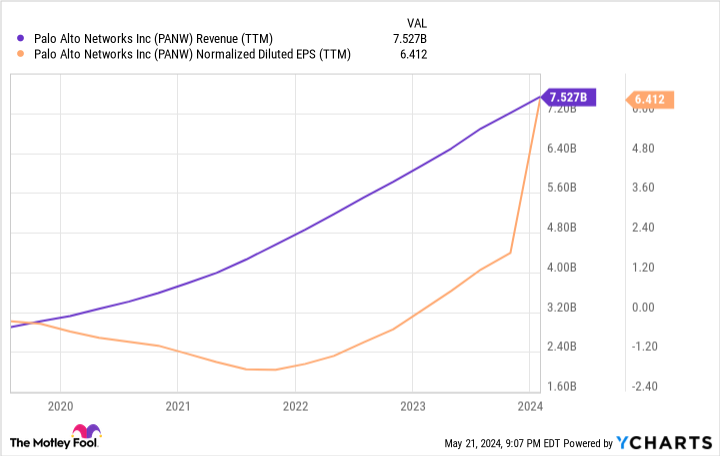

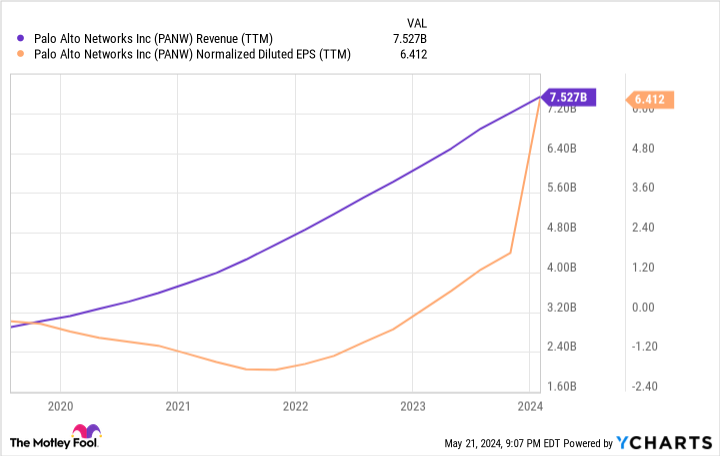

Palo Alto is likely one of the largest safety firms, with over $7.5 billion in annual income. Earnings have exploded lately, and analysts consider income will proceed to develop, averaging 22% annualized for the subsequent three to 5 years. The corporate’s giant buyer base and dimension give it a powerful hand because it competes for purchasers’ safety funds {dollars} over the subsequent decade.

2. CrowdStrike Holdings

Endpoint safety is likely one of the focal factors of next-generation options, and CrowdStrike Holdings (NASDAQ: CRWD) is shortly proving to be a winner on this enviornment. Endpoint safety protects gadgets on a community (endpoints), akin to computer systems or cell gadgets. CrowdStrike makes use of synthetic intelligence (AI) and a cloud-based platform to offer instantaneous and efficient safety in opposition to potential threats. The platform learns from risk encounters, which means the product improves because it grows and encounters extra threats.

CrowdStrike makes it remarkably simple to cross-sell its product as a result of it sells totally different services and products as modules. Prospects can choose and select what they need for his or her wants. CrowdStrike has launched modules over time because it expands into new classes. Right this moment, 27% of CrowdStrike’s clients use at the very least seven modules, and the variety of these utilizing at the very least eight has greater than doubled because the finish of 2023.

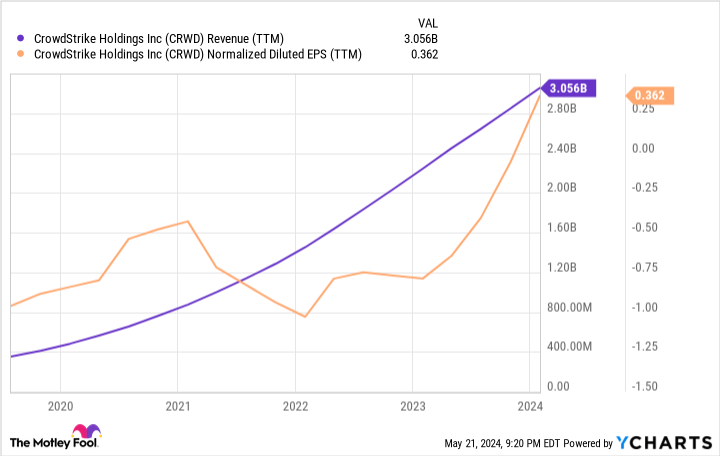

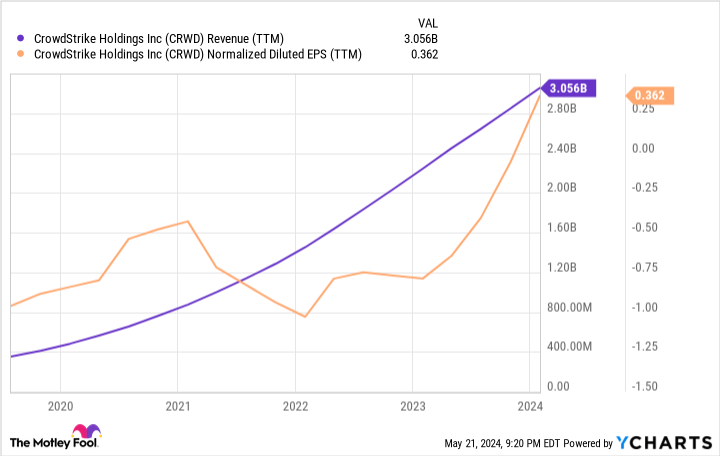

A mix of buyer development and cross-selling has fueled large development; income has multiplied from $400 million to $3 billion in simply 4 years. The enterprise has additionally reached the scale the place earnings begin rocketing greater, which supplies the inventory a shiny outlook for long-term traders. Analysts consider CrowdStrike’s earnings will develop by an annual common of twenty-two% over the subsequent three to 5 years.

3. Microsoft

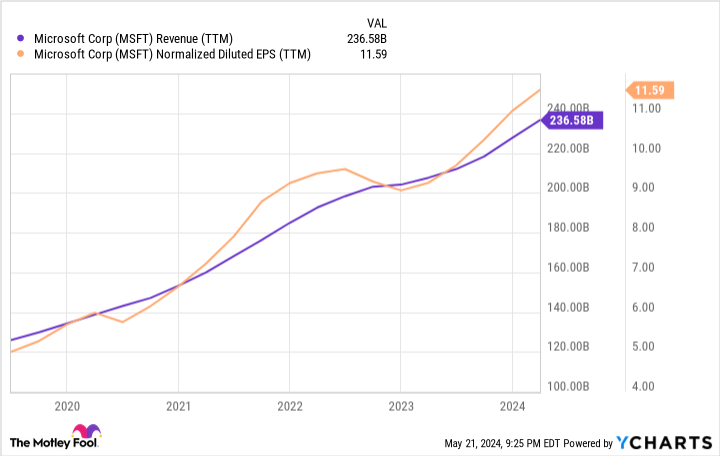

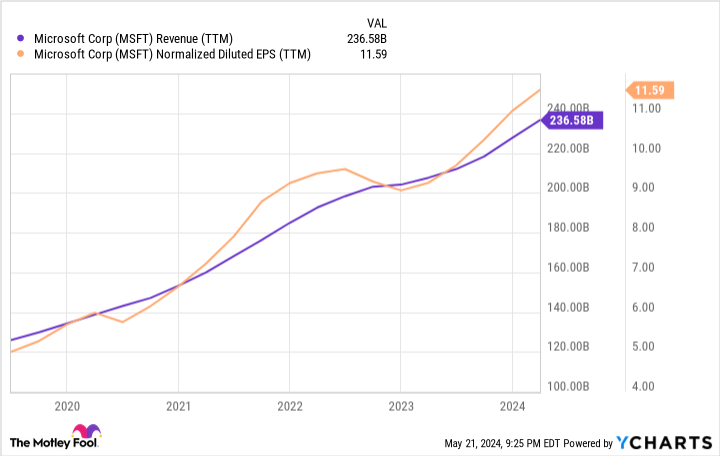

Tech large Microsoft (NASDAQ: MSFT) is not the primary identify you consider when discussing cybersecurity development shares. It is also not rising as shortly because the others on this checklist. However what Microsoft does supply is a a lot greater ground as a result of it is a extremely diversified firm with main companies in a number of industries. Microsoft Defender’s safety product is embedded inside Home windows and Workplace software program.

Trying to sleep properly at evening together with your investments? Look no additional. Palo Alto Networks and CrowdStrike are drops within the bucket in comparison with what Microsoft generates annually. The corporate has an ironclad steadiness sheet with a AAA score, considered one of solely two publicly traded firms with such standing. It is also the one firm on this checklist that pays dividends, which Microsoft has raised for over 20 consecutive years.

Microsoft Defender won’t ever be the focus for shareholders, however that is OK. The inventory may give traders cybersecurity publicity with the bonus of enterprise software program, cloud, gaming, and extra. Regardless of its monumental dimension, Microsoft continues to be rising. Analysts consider the corporate will develop earnings by 16% yearly for the subsequent three to 5 years, making Microsoft a jack-of-all-trades traders can confidently maintain for the long run.

Do you have to make investments $1,000 in Palo Alto Networks proper now?

Before you purchase inventory in Palo Alto Networks, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and Palo Alto Networks wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $652,342!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Might 13, 2024

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends CrowdStrike, Microsoft, and Palo Alto Networks. The Motley Idiot recommends Gartner and Worldwide Enterprise Machines and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

3 Cybersecurity Shares You Can Purchase and Maintain for the Subsequent Decade was initially printed by The Motley Idiot