Traders have good causes to love Walmart (NYSE: WMT). Initially, it is the largest retailer on this planet with almost $650 billion in trailing-12-month income. Its greater than 10,600 shops carry all the things from groceries to residence items to auto elements and extra.

In brief, buyers can all the time anticipate shoppers will patronize Walmart — it sells nearly all the things and its huge shops are conveniently situated to serve communities all through the nation. In different phrases, it is not a enterprise that buyers want to fret about.

This is one other optimistic: Walmart’s e-commerce operations at the moment are a $100 billion annual enterprise. And having a digital platform of this scale permits the corporate to develop its promoting enterprise, which will likely be an vital driver for income within the coming years.

That mentioned, it is potential to criticize Walmart inventory from an funding perspective proper now. When wanting on the inventory’s valuation from a number of views, this is likely one of the least well timed moments to purchase it previously decade.

Walmart’s price-to-sales (P/S) ratio is at a 10-year excessive. Its price-to-earnings (P/E) ratio is greater than the typical for the S&P 500. And the corporate’s dividend yield is at a 10-year low.

Subsequently, I wish to spotlight three different low cost retail chains I like greater than Walmart as funding alternatives proper now: Ollie’s Cut price Outlet Holdings (NASDAQ: OLLI), 5 Beneath (NASDAQ: FIVE), and Greenback Normal (NYSE: DG).

1. Ollie’s Cut price Outlet

Earnings progress tends to drive rising inventory costs, and that is excellent news for shareholders of Ollie’s. The pandemic hit the corporate’s profitability, creating provide chain points and added labor bills. However Ollie’s bounced again in 2023 with an enormous 74% enhance in working revenue, and future progress appears seemingly.

In 2024, Ollie’s plans to open 48 new places, which is sweet progress from the 512 places it had on the finish of 2023. And buyers can anticipate new openings at a speedy clip for a while, contemplating administration simply elevated its long-term aim to 1,300 shops.

Revenue margins for Ollie’s have traditionally held regular because it has grown. It is a good purpose to imagine that administration has a deal with on the enterprise and might maintain profitability sturdy because it expands. Subsequently, with lots of of recent shops within the pipeline, I anticipate earnings to extend for Ollie’s, resulting in upside for the inventory worth.

2. 5 Beneath

The funding thesis for 5 Beneath is much like that of Ollie’s: The corporate has worthwhile shops and plans to open many extra, resulting in earnings progress and upside for buyers. The distinction between these two, nevertheless, is that 5 Beneath has a extra outlined (and aggressive) timeline.

There have been greater than 1,500 5 Beneath places on the finish of 2023. However administration intends to have greater than 2,600 places by the top of 2026 and greater than 3,500 places by the top of 2030.

Remember that 5 Beneath is totally debt-free as a result of its price to open a brand new retailer is comparatively low and the payback interval is only one 12 months. Consider it like a cash-flow snowball rolling downhill. The corporate is worthwhile, and makes use of money to open new places. These places rapidly pay for themselves, and the cash-flow snowball grows.

The excellent news for buyers proper now could be that 5 Beneath inventory is down about 16% 12 months thus far, giving buyers a greater entry level for a long-term funding.

3. Greenback Normal

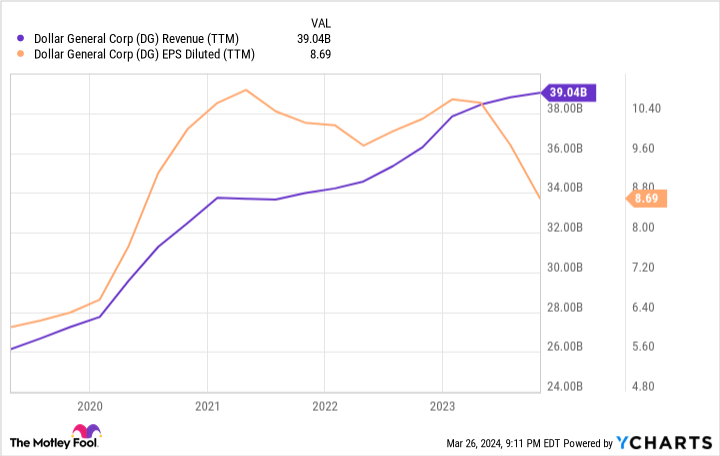

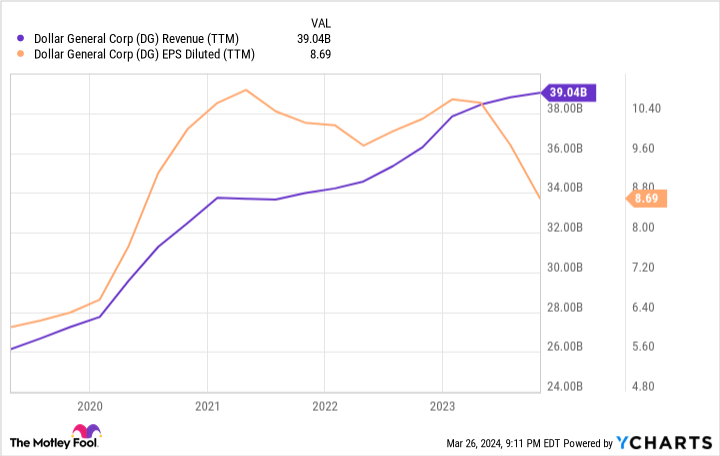

Whereas enterprise is buzzing for Walmart, Ollie’s, and 5 Beneath, Greenback Normal has some issues. On one hand, its income is at an all-time excessive, powered each by new places and same-store gross sales progress at current shops. Nonetheless, its diluted earnings per share (EPS) fell in 2023, they usually’re anticipated to fall once more in 2024.

The silver lining is that Greenback Normal remains to be seeing loads of shopper demand, and it’s nonetheless worthwhile. Subsequently, this enterprise is salvageable. Administration simply must determine the issues which can be conserving its income down and repair them.

In actuality, Greenback Normal already is aware of that the important thing downside is sub-optimal stock administration, and it is working to right it. Based mostly on administration’s steering, the turnaround will not be full this 12 months. However I imagine it should occur ahead of later, boosting the corporate’s earnings by a stunning quantity within the coming years.

Within the meantime, those that purchase Greenback Normal inventory immediately will be rewarded whereas they wait. In contrast to Ollie’s or 5 Beneath, Greenback Normal inventory pays a dividend. The yield is greater than Walmart’s — one more reason to desire Greenback Normal. And on prime of that, Greenback Normal inventory will seemingly enhance its payout once more in 2024, simply because it has completed for eight straight years.

In abstract, I perceive why buyers love Walmart inventory, however it’s not essentially a great worth proper now. Subsequently, for buyers who love the low cost retail area, Ollie’s, 5 Beneath, and Greenback Normal supply higher alternatives for earnings progress. I would purchase shares of all three immediately earlier than shopping for shares of Walmart.

Do you have to make investments $1,000 in 5 Beneath proper now?

Before you purchase inventory in 5 Beneath, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and 5 Beneath wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 25, 2024

Jon Quast has positions in Greenback Normal and 5 Beneath. The Motley Idiot has positions in and recommends Walmart. The Motley Idiot recommends 5 Beneath and Ollie’s Cut price Outlet. The Motley Idiot has a disclosure coverage.

3 Low cost Retail Shares That I would Purchase Right this moment Earlier than Shopping for Walmart Inventory was initially printed by The Motley Idiot