Even one of the best development shares see their shares pull again. However simply because their share value is down, that doesn’t essentially imply that the shares are down and out for good. Actually, Amazon famously misplaced 90% of its worth over a two-year interval again within the early 2000s, solely to turn out to be the practically $2 trillion firm it’s at present.

Let us take a look at three client good development shares which are down however actually not out.

1. e.l.f. Magnificence

Off practically 30% from its latest excessive, e.l.f. Magnificence (NYSE: ELF) stays probably the greatest development tales within the client items area. By the usage of influencers and by making shut copies of common status beauty merchandise, the corporate has been in a position to acquire shelf area and take an enormous share within the mass-market beauty class. Actually, it has turn out to be the No. 1 beauty model amongst teenagers, based on client surveys.

Whereas development could sluggish from the breakneck tempo it is had the previous couple of years, e.l.f. nonetheless has an extended pathway of development in entrance of it. It is made robust preliminary inroads with increasing internationally, however it’s nonetheless solely in a couple of markets. The corporate has over-indexed with the Hispanic group within the U.S., so Latin America may very well be a giant future alternative.

In the meantime, the corporate has only recently gotten into skincare. With solely a 2% market share in skincare within the U.S., the potential to take share on this class is a large alternative. Given the corporate’s efficiency within the cosmetics area over the previous few years, there isn’t a motive to imagine it will not have the identical success in skincare.

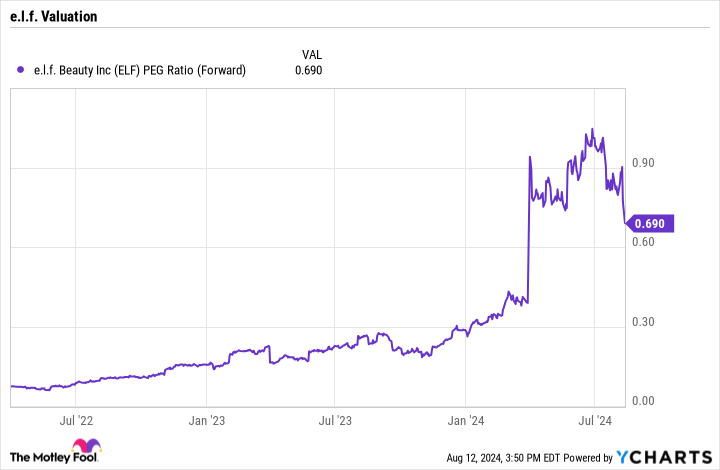

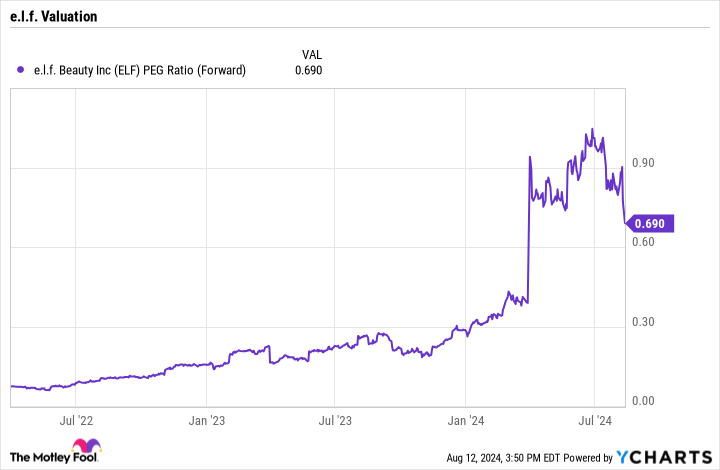

Buying and selling at a value/earnings-to-growth ratio (PEG ratio) of beneath 0.7, this development inventory may be very attractively priced after its latest sell-off. A PEG beneath 1 occasions is usually thought-about engaging, however for a development inventory, it squarely locations e.l.f. within the discount bin.

2. Nike

After reporting solely a 1% improve in income on a relentless foreign money foundation for its fiscal 2024, which led to Could, and guiding for a mid-single-digit gross sales decline in fiscal 2025, it could be finest to name Nike (NYSE: NKE) a former development inventory. In any case, it hasn’t been displaying a lot development recently.

Nevertheless, following the inventory’s most-recent sell-off, buyers should buy the enduring model at one of many most cost-effective valuations it has been at in a very long time at an beneath 20 P/E ratio.

However let’s not rely out Nike simply but. Top-of-the-line methods for a administration staff to get a inventory again on observe is to provide extraordinarily conservative steering after which dash and bounce over the low bar that has been set. Nike appears to be like poised to do exactly that.

One motive why is that the corporate ought to see an Olympic enhance, with it spending extra across the occasion than anytime up to now. Nike additionally launched plenty of new merchandise centered across the occasion.

Analysis outfit Similarweb, in the meantime, confirmed that Nike’s technique was paying off with an enormous spike in visits to its web site and stable conversions to gross sales. In China, which has been a bother spot, the corporate has seen a bounce in gross sales for custom-made T-shirts of ladies’s gold medal tennis participant Zheng Qinwen, who it sponsors.

Given its valuation and low expectations, now may very well be the time to “simply do it” and add Nike to your portfolio because it appears to be like to return to being a development firm.

3. Dutch Bros

Shares of Dutch Bros (NYSE: BROS) obtained crushed after the coffeehouse operator instructed buyers that new retailer openings this yr would are available in on the decrease finish of its steering because it seemed to optimize its actual property technique. Nevertheless, the long-term prospects for the corporate stay in place, because it has an extended runway of enlargement alternatives forward of it.

The corporate’s retailer format is on the small facet, usually starting from 800 sq. ft to 1,000 sq. ft, with a number of drive-thru lanes and a pick-up window. This small format permits for a comparatively cheap buildout program whereas creating stable throughput, as evidenced by its $2.0 million common unit quantity (AUV), which measures the common gross sales of its shops.

With solely 912 areas on the finish of Q2 (612 of them company-owned), the favored espresso chain that started off in Oregon continues to be predominantly within the western U.S. though it does have some areas in locations like Florida, Kentucky, and Tennessee. This makes it a pleasant regional-to-national enlargement story.

The corporate can be simply starting initiatives like cell orders, which ought to be a pleasant enhance to gross sales. This additionally exhibits that the corporate continues to be within the early days of benefiting from technological enhancements that many different chains have already applied. This creates future development alternatives.

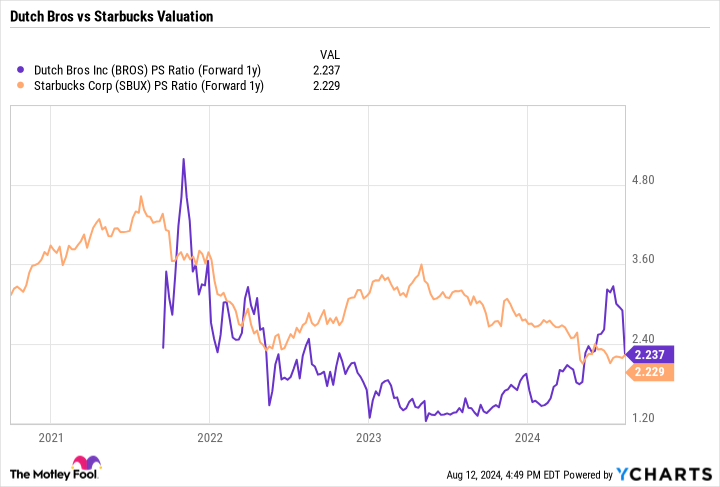

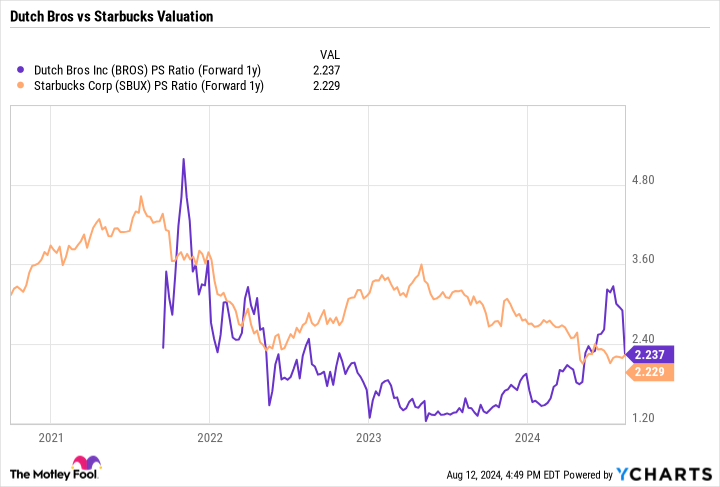

Dutch Bros trades at an identical ahead price-to-sales (P/S) a number of as rival Starbucks however ought to present much more development, on condition that it’s nonetheless within the early days of enlargement. Attributable to this, I’d be a purchaser of the inventory on the latest weak point.

Do you have to make investments $1,000 in Nike proper now?

Before you purchase inventory in Nike, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Nike wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $763,374!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 12, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Nike, Starbucks, and e.l.f. Magnificence. The Motley Idiot recommends the next choices: lengthy January 2025 $47.50 calls on Nike. The Motley Idiot has a disclosure coverage.

3 Development Shares Wall Avenue May Be Sleeping On, however I am Not was initially revealed by The Motley Idiot