It has been some time for the reason that time period “FAANG shares” captured buyers’ consideration, principally as a result of these shares aren’t the red-hot names they was once. The so-called “Magnificent Seven” tickers have taken their place because the market’s hot-button grouping.

The factor is, all 5 FAANG shares are nonetheless unimaginable investments, and three of them are standout prospects you may need to take into account including to your portfolio sooner slightly than later.

1. Amazon

Most buyers know Amazon (NASDAQ: AMZN) has (actually) been the market’s most rewarding inventory over the previous three many years; shares are up greater than 260,000% since their 1997 preliminary public providing. Most buyers additionally perceive, nonetheless, that the e-commerce big’s highest-growth days are up to now. It is just too massive now to proceed rising at its historic tempo.

That does not imply its future is not shiny, nonetheless. It is simply completely different in a handful of compelling methods.

Considered one of these methods is a comparatively new, intense concentrate on profitability. Though the corporate has traditionally been extra serious about increasing its footprint than turning a revenue, for the previous couple of years it has been closing and canceling warehouses that could not function as cost-effectively as wanted. It is streamlining all of its operations to cull prices.

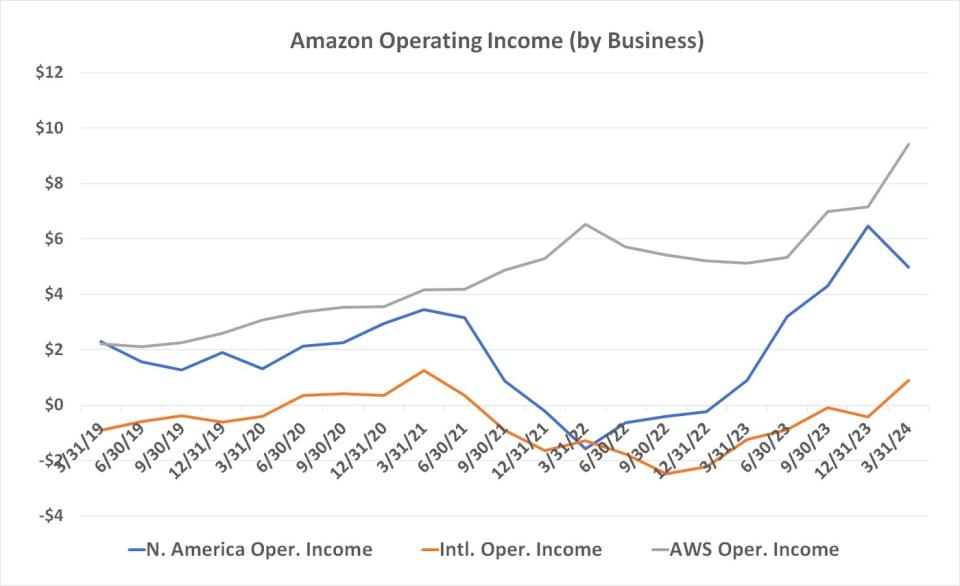

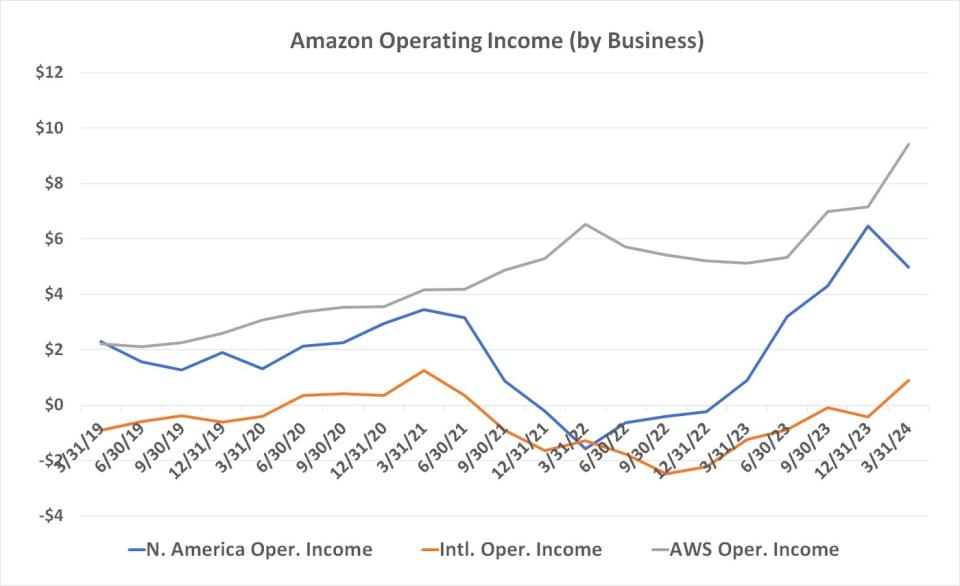

And it is working! Whereas its first-quarter high line improved 13% yr over yr, working earnings greater than tripled. Notably, its worldwide e-commerce operation swung from an everyday loss to an working revenue of $900 million. That is the very best this arm’s finished since early 2021 when the COVID-19 pandemic was in full swing.

Amazon’s cloud computing arm, Amazon Net Companies, can also be firing on all cylinders, bouncing again from hovering working bills seen in late 2022 and 2023. Its first-quarter working earnings of $9.4 billion is record-breaking and continues to enhance. Search for extra of the identical, too. Mordor Intelligence believes the cloud market is poised to develop at a mean annual tempo of greater than 16% via 2029.

Amazon’s latest enterprise is on a roll as properly. That is promoting. Amazon.com’s third-party sellers forked over $11.8 billion to extra prominently characteristic their merchandise on the web site, up 24% yr over yr.

Amazon shares are already up greater than 130% since early final yr, reaching new information simply final week. Given the revenue development within the near-term and long-term playing cards although, there’s extra upside forward for this FAANG inventory.

2. Netflix

It might be straightforward to imagine the worst for streaming powerhouse Netflix (NASDAQ: NFLX). Suspiciously, after a transparent slowdown in its buyer development, starting subsequent yr the corporate will not disclose its subscriber numbers. The streaming market itself can also be working right into a saturation headwind, forcing its main firms to companion up with friends and rivals to create extra marketable bundles. Cable big Comcast just lately unveiled a cable TV package deal that included Netflix and Apple TV, for instance, whereas Walt Disney and Warner Bros. Discovery are pairing up Disney+, Max, and Hulu in a bundle that will probably be priced at a reduction and launched someday this summer time.

Simply because the crowded business’s maturing, nonetheless, doesn’t suggest Netflix is doomed. It is acquired a few key issues working in its favor that might — and may — hold the inventory’s present rally going. Considered one of them is the corporate’s place inside the streaming market.

See, it is not simply the unique identify within the enterprise that gave rise to all of the others. It is also nonetheless the most well-liked and “stickiest” streaming platform. Almost 270 million households pay for entry to its content material … way over any of its rivals. In the meantime, streaming market analysis home Antenna reviews Netflix’s buyer churn price stands at solely 2%, versus greater than 4% for Disney+ and over 6% for Max, for perspective. For many U.S. households that pay for a number of streaming providers, a “Netflix-first after which the others” type of mindset nonetheless prevails. Habits are highly effective.

The opposite matter working in Netflix’s favor is the rise of ad-supported streaming providers. Whereas solely about 40 million of its 270 million subscribers (roughly 15%) are paying a decrease month-to-month worth in trade for watching the occasional tv industrial, it is an choice that may hold its service way more marketable for a lot longer than it’d in any other case have been. Market analysis outfit International Market Perception believes the ad-supported streaming market is ready to develop at an annualized price of greater than 8% via 2032.

3. Apple

Final however not least, add Apple (NASDAQ: AAPL) to your checklist of FAANG shares to contemplate shopping for earlier than the top of July.

It isn’t essentially a simple identify to get enthusiastic about proudly owning proper now. Though the inventory was a must have for years following 2007’s debut of the iPhone, slowing iPhone gross sales — which account for about half of Apple’s income — have prompted worries relating to its future development.

There’s an enormous new development catalyst already at work although. That is synthetic intelligence.

Whereas there is not any denying the corporate was late to the social gathering, it is catching up shortly. Final month Apple unveiled a number of completely different AI options for its smartphones, tablets, and computer systems that may make its wares much more highly effective know-how (notably because it pertains to generative synthetic intelligence). As Oppenheimer analyst Martin Yang writes, “Apple’s introduction of Apple Intelligence will place the corporate because the chief within the shopper AI expertise.”

It isn’t simply Apple’s consumer-facing synthetic intelligence apps that maintain a lot promise, nonetheless. The corporate’s additionally engaged on tech that almost all customers won’t ever really see in motion firsthand. As an illustration, it is engaged on the event of its personal chips to be used in AI knowledge facilities. Though Nvidia‘s dominance of this market is not in any speedy hazard, The Wall Avenue Journal reviews that these chips may very well be primarily based on a totally completely different type of synthetic intelligence known as inference slightly than the training-oriented structure that is widespread proper now.

It stays to be seen precisely what Apple’s AI future appears like. However, Apple’s acquired an extended historical past of success. Given Priority Analysis’s prediction that the worldwide AI market is ready to develop a mean of 19% via 2032 there’s little doubt the corporate will win a minimum of its justifiable share of the market’s growth.

Must you make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Apple wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $751,670!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 2, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. James Brumley has positions in Warner Bros. Discovery. The Motley Idiot has positions in and recommends Amazon, Apple, Netflix, Nvidia, Walt Disney, and Warner Bros. Discovery. The Motley Idiot recommends Comcast. The Motley Idiot has a disclosure coverage.

3 Unimaginable FAANG Shares You may Need to Think about Including to Your Portfolio in July was initially printed by The Motley Idiot