Down between 19% and 28% from their all-time highs, dividend progress shares Unilever (NYSE: UL), The Hershey Firm (NYSE: HSY), and Lamb Weston (NYSE: LW) presently commerce close to once-in-a-decade valuations.

These magnificent shares have five-year betas effectively under 1, making these discounted costs much more alluring for traders. Betas measure an organization’s share worth volatility in comparison with the broader market. Low betas of lower than 1 typically belong to dependable, steady-Eddie operators match to anchor any investor’s portfolio.

This mix of low share worth volatility and regular dividend progress at a decade-low valuation makes these three shares promising once-in-a-decade alternatives. This is how they might reward traders handsomely over the approaching years.

1. Unilever

Client items juggernaut Unilever owns greater than 400 manufacturers offered in additional than 190 nations. Because of highly effective labels reminiscent of Dove cleaning soap, Axe physique spray, Tresemme shampoo and conditioner, Vaseline, and Ben & Jerry’s, roughly 3.4 billion individuals use its merchandise every day.

Regardless of this world attain and widespread buyer adoption, there are two important causes for traders to stay excited concerning the firm’s long-term prospects — particularly with the behemoth buying and selling practically 20% under its all-time excessive share worth.

First, Unilever generates 59% of its gross sales from rising markets. Because it’s increasing its presence in high-growth-potential nations like India, Brazil, China, and Indonesia, the corporate’s progress story ought to have loads of chapters left. It elevated 2023 gross sales by 15% in Latin America and seven% in Asia Pacific and Africa. Unilever is well-positioned to see robust progress as the center class continues increasing globally.

Second, the corporate just lately introduced the upcoming separation of the smallest and least worthwhile unit, its ice cream operations. The ice cream unit weighs on the corporate’s cash-generating potential, because the chilly storage provide chain infrastructure wanted is capital-intensive and dissimilar from the remainder of Unilever’s operations.

Greatest but for traders, even after the corporate’s share worth rose 8% following its first-quarter leads to April, its price-to-earnings (P/E) ratio of 19 and dividend yield of three.6% stay extra enticing than the S&P 500 index’s 25 and 1.4% averages.

2. The Hershey Firm

With its share worth down 29% during the last yr, confectioner Hershey continues to battle in opposition to an array of points, reminiscent of:

-

Cocoa costs greater than tripling since 2023.

-

Capital expenditures (capex) hovering to all-time highs as the corporate implements a brand new enterprise useful resource planning (ERP) system.

-

The specter of GLP-1 weight problems medication and their impact on snacking.

-

YouTuber Jimmy Donaldson’s (Mr. Beast) entrance into the trade with rapidly rising Feastables candies.

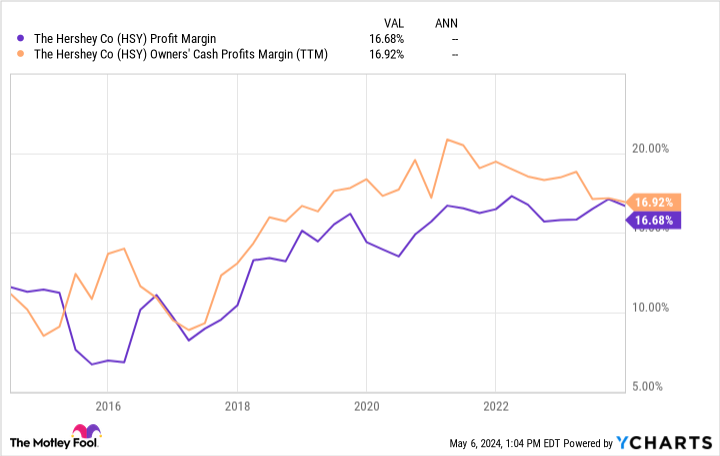

Regardless of these doubtlessly crippling circumstances, Hershey has maintained a strong 17% internet revenue and free money movement (FCF) margin.

Moreover, the corporate’s KitKat, Hershey’s, and Reese’s manufacturers ranked first amongst Gen Z snackers, based on a research from Segmanta, highlighting sustained reputation throughout generations.

With this unwavering reputation and profitability — whereas working in a recession-resilient trade — Hershey makes for an intriguing turnaround candidate as cocoa costs and the corporate’s capex revert to “regular” ranges.

Greatest but, buying and selling at simply 21 instances earnings and with a 2.5% dividend yield, Hershey trades at a reduction to the broader market and its personal 10-year averages. Because of this low cost, Hershey’s model energy, and its longer-term rebound potential, the corporate seems like a wonderful holding, which is why I am excited so as to add it to my daughter’s portfolio.

3. Lamb Weston

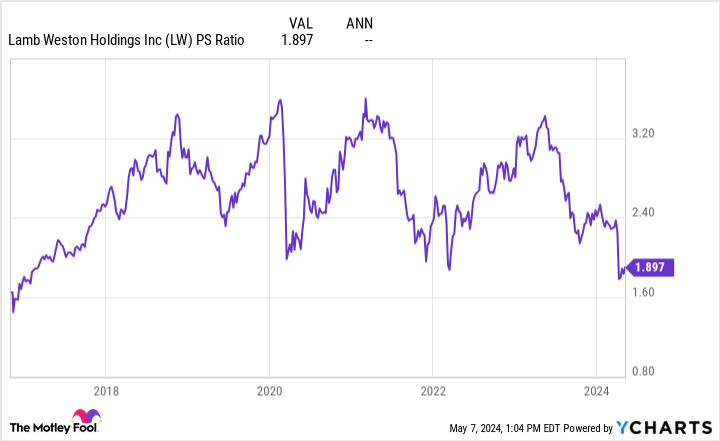

Whereas the frozen potato trade could not elicit ideas of turmoil, Lamb Weston’s share worth drop of 21% yr thus far reveals in any other case. Like our different steady-Eddie funding concept, Hershey, Lamb Weston has launched into a mission to deploy a brand new ERP system.

Nonetheless, this has not been a clean course of for the frozen potato juggernaut. In the course of the firm’s third-quarter earnings name, administration estimated that the ERP transition brought on gross sales quantity to say no by 8% attributable to unfavorable impacts on order achievement charges.

Making issues worse, elevated capex used to spice up manufacturing capability within the Netherlands, Argentina, and China has quickly brought on Lamb Weston’s free money movement (FCF) to show unfavorable. Whereas this short-term ache is hard to abdomen, administration estimates will probably be capable of develop worldwide gross sales from 15% of gross sales in 2022 to 34% in 2024 — all whereas giving it beneficial publicity to higher-growth markets.

With a decade-low price-to-sales (P/S) ratio of 1.9, Lamb Weston might be a steal at at this time’s low cost as soon as capex normalizes and its progress investments begin to pay dividends.

If the corporate can return to the common FCF margin of 11% it noticed between 2016 and 2022, it might commerce at simply 17 instances FCF.

In case you plug this right into a reverse discounted money movement mannequin, Lamb Weston would solely have to ship 5% progress to match the market’s common efficiency of 10% yearly. With world potato demand anticipated to develop by 3% yearly over the long run and Lamb Weston poised for worldwide progress, I feel it might simply exceed this 5% progress charge and beat the market.

This outperformance potential, paired with the corporate’s rising dividend that yields 1.5% and solely makes use of 15% of internet revenue, makes for a wonderful once-in-a-decade alternative.

Must you make investments $1,000 in Unilever proper now?

Before you purchase inventory in Unilever, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Unilever wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $550,688!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Might 6, 2024

Josh Kohn-Lindquist has positions in Hershey. The Motley Idiot recommends Hershey and Unilever Plc. The Motley Idiot has a disclosure coverage.

A As soon as-in-a-Decade Alternative: 3 Magnificent Dividend Shares Down Between 19% and 28% to Purchase Now and Maintain Perpetually was initially revealed by The Motley Idiot