The inventory market has set a number of new all-time highs this yr. Due to that, most shares are up sharply, which is leaving fewer bargains.

Nonetheless, there are just a few shares that also appear like nice offers. American Water Works (NYSE: AWK), Enbridge (NYSE: ENB), and Clearway Power (NYSE: CWEN)(NYSE: CWEN.A) stand out to 3 Idiot.com contributors proper now due to their compelling funding potential. Nonetheless, that may not final, which is why traders would possibly wish to scoop up these phenomenal dividend shares earlier than it is too late.

A strong dividend progress inventory

Neha Chamaria (American Water Works): American Water Works inventory yields just a bit over 2%. That dividend yield could underwhelm revenue traders, however even low-yield shares will be nice investments in the event that they’re paying common and steadily rising dividends backed by earnings and cash-flow progress. You would be stunned to know that with reinvested dividends, American Water Works inventory has greater than tripled traders’ cash in simply 10 years!

That is how highly effective dividend progress shares will be. And, with American Water Works inventory’s one-year efficiency flat as of this writing, it’s possible you’ll wish to decide up some shares earlier than it is too late. In any case, its steady enterprise mannequin and engaging long-term monetary objectives are too compelling to disregard.

American Water Works has been round for greater than 135 years and is the biggest regulated water and wastewater utility in North America at present. It serves practically 14 million individuals throughout 14 states and on 18 navy installations. Since it is a regulated enterprise, American Water Works can generate steady and predictable money flows. And to develop its money flows, all it has to do is commonly put money into its infrastructure to get fee hike approvals whereas grabbing acquisition alternatives on the go. As an illustration, the utility expects to take a position $3.1 billion in infrastructure enhancements this yr and has impending acquisitions value practically $483 million.

Backed by regular fee progress and acquisitions, American Water Works expects to develop its earnings per share (EPS) by a compound annual progress fee of seven% to 9% in the long run. Here is the most effective half: the water inventory additionally goals to develop its dividend according to EPS, or by 7% to 9% per share yearly. Now that is strong dividend progress, and coming from a utility, needs to be protected and bankable. too.

Enbridge is offering the vitality that is wanted

Reuben Gregg Brewer (Enbridge): Enbridge is normally lumped in with midstream firms. That is completely applicable since 75% of its earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) comes from oil and pure gasoline pipelines. Nonetheless, that does not actually do the enterprise justice, as a result of Enbridge’s purpose is to supply the world with the facility it wants.

In truth, the remaining 25% of EBITDA is derived from pure gasoline utilities (22%) and renewable energy (3%). Pure gasoline is anticipated to be a transition gasoline because the world shifts away from dirtier types of vitality, like coal and oil. Renewable energy, like photo voltaic and wind, is clearly the long-term path of the vitality sector, although it’s nonetheless a comparatively modest contributor to the worldwide grid at present. The plan is to maintain shifting the combination towards cleaner alternate options as demand will increase.

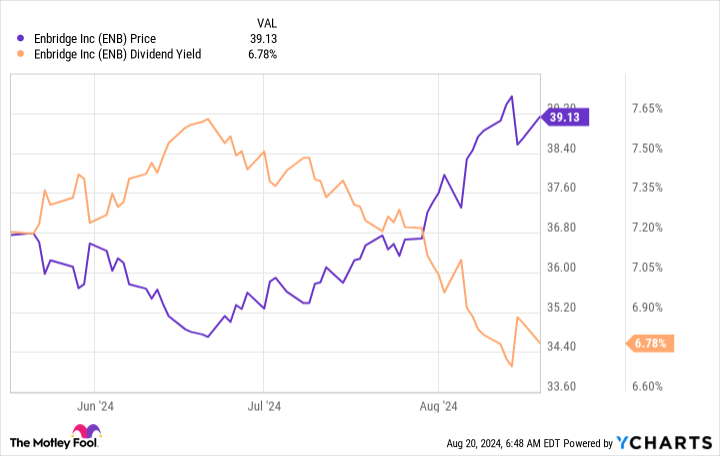

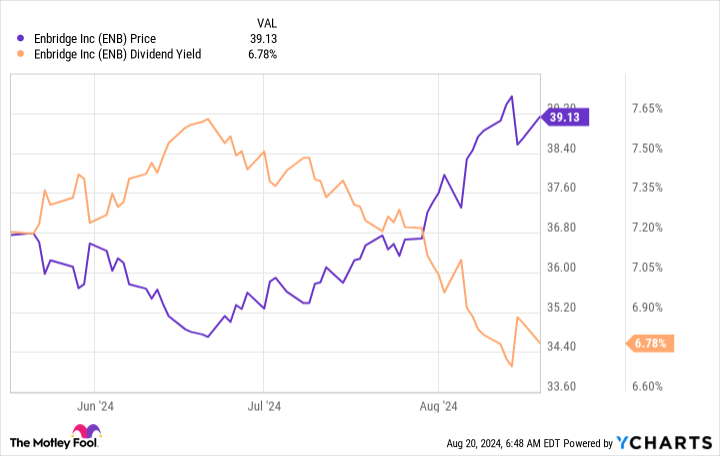

That is the enterprise that backs Enbridge’s dividend, at the moment yielding 6.8% and underpinned by an investment-grade-rated stability sheet and a distributable cash-flow payout ratio that’s comfortably inside administration’s goal vary. The enterprise mannequin has supported the 29 annual dividend will increase the corporate has racked up. Here is the factor, Enbridge’s yield had been over 7.5% simply a short time in the past, earlier than the inventory began to rally. Mainly, traders are beginning to respect Enbridge’s enterprise method a bit of extra. If that continues, the nonetheless attractively excessive yield right here may not final for much longer.

This sale might be about to finish

Matt DiLallo (Clearway Power): Shares of Clearway Power at the moment sit about 30% under their excessive from early 2022, proper earlier than the Federal Reserve began boosting rates of interest. Larger charges have made it dearer for firms to borrow cash, which has slowed progress. Rising charges have additionally weighed on the worth of higher-yielding dividend shares like Clearway. Their inventory costs decline to make their dividend yields rise so that they are extra attractive investments in comparison with lower-risk choices like bonds. In Clearway’s case, its sell-off has pushed its dividend yield as much as practically 6%.

That top yield would possibly not final a lot longer. The Federal Reserve seems poised to start out decreasing rates of interest. Because it does, the share costs of high-yielding shares like Clearway ought to rise as they acquire investor favor, inflicting their yields to fall.

That catalyst provides to Clearway’s compelling long-term complete return potential. The clear energy producer plans to develop its dividend towards the higher finish of its 5% to eight% annual goal vary via 2026, an outstanding progress fee for such a high-yielding inventory. Powering that plan is its capital recycling technique. It offered its district thermal enterprise just a few years in the past and has been redeploying the proceeds into higher-returning renewable vitality investments. It not too long ago signed offers to deploy the remaining proceeds from that sale, giving it clear visibility to realize its present dividend progress goal.

The corporate is already working towards extending its progress visibility into 2027 and past. Latest contract renewals for its pure gasoline energy crops are coming in at a degree that would energy dividend progress towards the low finish of its goal for 2027. As well as, the corporate has made provides to accumulate extra renewable vitality belongings that it might probably fund with its present monetary capability. In the meantime, if rates of interest fall, it might probably externally fund acquisitions once more, which may allow it to develop sooner sooner or later.

Traders at the moment have the chance to lock in Clearway’s excessive dividend yield whereas rates of interest stay excessive. On high of that, Clearway provides excessive upside potential from a future restoration in its inventory value as charges fall, and it might probably speed up its progress fee.

Must you make investments $1,000 in Enbridge proper now?

Before you purchase inventory in Enbridge, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Enbridge wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $758,227!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 22, 2024

Matt DiLallo has positions in Clearway Power and Enbridge. Neha Chamaria has no place in any of the shares talked about. Reuben Gregg Brewer has positions in Enbridge. The Motley Idiot has positions in and recommends Enbridge. The Motley Idiot has a disclosure coverage.

3 Phenomenal Dividend Shares to Purchase Earlier than It is Too Late was initially revealed by The Motley Idiot