Nike (NYSE: NKE) is a prime attire firm, and its iconic model is thought all over the world. Regardless that its merchandise are sometimes costlier than others, the corporate has managed to develop its enterprise considerably for years. As we speak, its market capitalization is round $130 billion.

However recently, traders have grown fearful in regards to the firm’s progress prospects. Enterprise has been slowing down, and inflation is not serving to. Whereas the short-term headwinds can ship it decrease this yr (it is already down 22%), that is why I feel the inventory can nonetheless be a winner in the long term.

It has robust model recognition amongst teenagers

Even when you’re not a buyer of Nike’s and suppose its merchandise are too costly, the info suggests that there is nonetheless a whole lot of curiosity from youthful individuals. The corporate’s model ranks excessive amongst teenagers, in response to a report this yr from Piper Sandler.

The report discovered that Nike’s model was far and away the favourite amongst teenagers polled in a latest semi-annual survey, for each clothes and footwear. What’s notably noteworthy is that the hole between first and second is appreciable. In footwear, Nike was the preferred model with 59% of teenagers, with the following closest manufacturers having a mindshare of simply 7%. In clothes, it was a bit nearer, with Nike’s proportion coming in at 34% versus 6% for the second hottest model.

Whereas the corporate’s progress fee could also be displaying indicators of weak point, the model stays robust, which means that it may simply be the poor financial situations weighing down the enterprise versus issues with Nike’s total model.

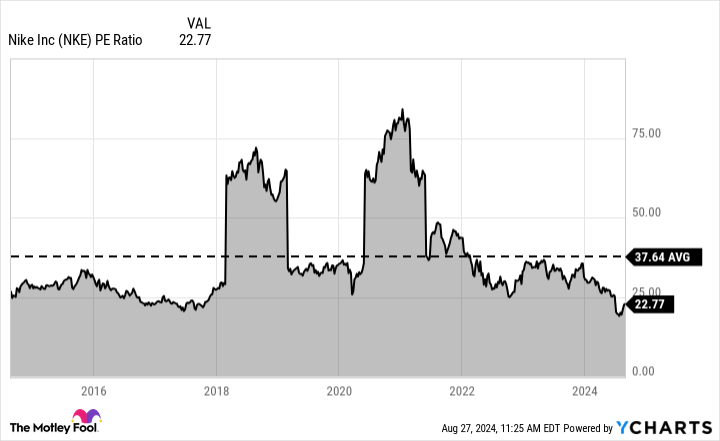

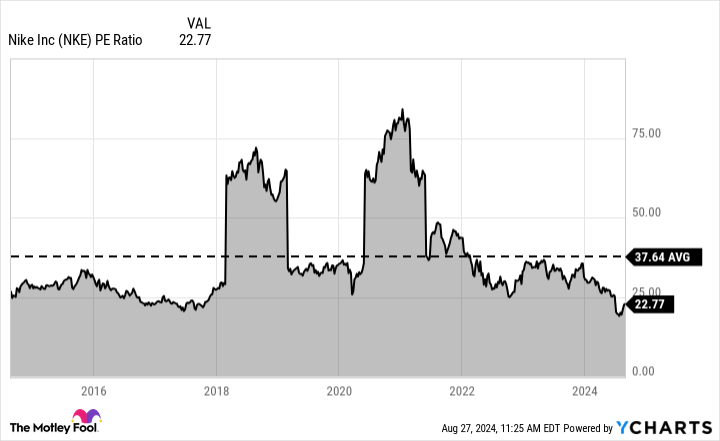

Its low earnings a number of can arrange traders for features down the street

Another excuse to think about shopping for the inventory is that it seems actually low-cost proper now. At simply 22 occasions its trailing earnings, Nike is buying and selling at a a lot decrease a number of than it has previously, and it is nicely under its 10-year common.

The counterpoint, in fact, is that progress traders aren’t going to wish to pay a premium for a enterprise that is struggling to develop. In its most up-to-date earnings report, protecting outcomes till the top of Could, Nike’s quarterly income totaled $12.6 billion — down 2% yr over yr. That is not the kind of inventory traders are going to be eager to pay 30 occasions earnings for proper now.

However at its present a number of, the inventory could possibly be low-cost sufficient that it is sensible to speculate, anyway. The typical inventory on the S&P 500 trades at practically 25 occasions its trailing earnings. And whereas Nike’s progress fee could also be detrimental at the moment, that does not imply it would keep that means. As financial situations enhance and because the firm launches new merchandise, the expansion fee may decide up.

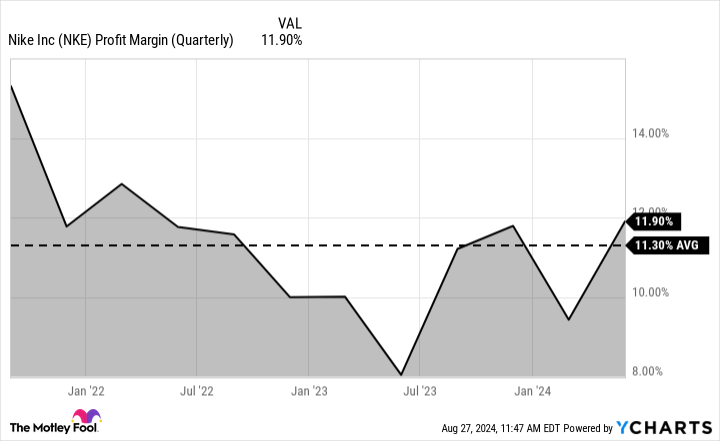

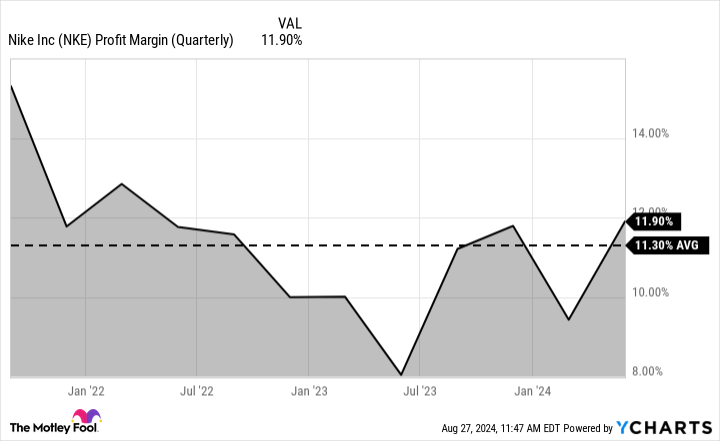

Nike’s revenue margin is strong

What’s promising is that even amid the present adversity out there, Nike’s revenue margins stay robust at practically 12% of income.

That is vital for 2 causes. The primary is {that a} excessive revenue margin may give the corporate room to supply reductions and reduce costs to stimulate some progress, whereas guaranteeing it stays worthwhile in doing so. Second, a double-digit revenue margin implies that as soon as its progress fee does begin to decide up, a whole lot of that incremental income will lead to stronger earnings numbers, which, in flip, will doubtlessly convey down Nike’s earnings multiples and make the attire inventory a greater purchase within the course of.

Should you’re affected person, this may be a wonderful inventory to purchase and maintain

Prior to now, Nike’s inventory did not seem like a superb purchase to me on account of its elevated valuation. However now, at a way more tenable value, the inventory could make for a doubtlessly strong funding for individuals who are keen to be affected person and dangle on for the long run.

There might not be a fast turnaround for Nike’s enterprise, and quite a bit will inevitably depend upon the energy of the financial system, however I am assured it will possibly get again to rising its gross sales. When that occurs, its earnings numbers will enhance, and it may seem like a discount purchase.

Do you have to make investments $1,000 in Nike proper now?

Before you purchase inventory in Nike, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for traders to purchase now… and Nike wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $731,449!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 26, 2024

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nike. The Motley Idiot has a disclosure coverage.

3 Causes Nike Inventory Can Be a Nice Lengthy-Time period Purchase was initially revealed by The Motley Idiot