Given the selection, most buyers favor shopping for shares on a dip slightly than throughout (or after) a rally. Why pay extra when you may pay much less? Paying much less means extra eventual earnings.

Typically, although, it is price leaping right into a inventory whereas it is on the way in which up. There will not be a pullback coming anytime quickly. Ready may find yourself being expensive as an alternative of useful.

With that because the backdrop, this is a better take a look at three such hovering shares to think about getting into now regardless of their present energy. There’s too good of an opportunity for extra instant upside.

MercadoLibre

In case you’ve by no means heard of MercadoLibre (NASDAQ: MELI), do not sweat it. Loads of individuals have not. That is as a result of it solely operates its enterprise in Latin America. However what a enterprise it operates!

MercadoLibre is also known as the Amazon of Latin America, and it isn’t an unfair description. It is incomplete, although. Along with its on-line malls in addition to devoted, company-specific procuring carts, this firm additionally affords on-line and cellular cost companies, plus logistics companies to assist these on-line operations. In some ways, the corporate’s simply as very like Shopify, PayPal, and eBay. In truth, it was extra of an eBay clone in its early days.

Extra essential to present and potential shareholders, MercadoLibre could be very a lot in the best place on the proper time with the best lineup of companies.

How so? In some ways, South America is now the place North America was 20 years in the past. Though the area has definitely had high-speed web and cell phones for a few years, this stuff are solely simply starting to develop into frequent within the area. Atlantico stories that between 2012 and 2022, the continent’s web penetration charge grew from 42% to 74%. That is an enormous change in only one decade.

But, entry to the net nonetheless is not common. S&P World Market Intelligence says that solely somewhat over half of Latin America’s houses have entry to broadband service, whereas market analysis agency Phocuswright suggests Latin America’s cell phone penetration charge will solely attain 75% by 2025.

The purpose is, whereas South America’s e-commerce trade might not but evaluate to North America’s, the stage is ready for large development because the trade matures there. A forecast from Funds and Commerce Market Intelligence signifies the area’s e-commerce market is prone to swell to the tune of 24% this yr, and broaden by 21% subsequent yr after which once more the yr after that. For its half, MercadoLibre is predicted to develop its prime line by 33% this yr, after which one other 24% in 2025.

Join the dots. All of the items of MercadoLibre’s puzzle are lastly falling into place. That is why the inventory’s making ahead progress. And there is far more progress to be made forward.

DraftKings

DraftKings (NASDAQ: DKNG) shares are up greater than 300% because the finish of 2022, and nonetheless nearby of the 52-week excessive hit in March. A transfer of that dimension can definitely be intimidating to would-be patrons.

Do not be intimidated, although. This rally is prone to persist for a protracted whereas.

As chances are you’ll already know, DraftKings is a sports-betting inventory. Whereas its roots are within the fantasy sports activities enterprise, 2018’s raise of the federal ban on sports-based wagering began a wave of state-level legalization. As of the newest rely, betting on sports activities is authorized in a technique or one other in 38 U.S. states.

However that does not imply most of DraftKings’ income and earnings development is within the rearview mirror, for a few causes.

First, two of the nation’s largest states, Texas and California, do not but allow sports activities betting. Legalization measures proceed surfacing in each states, although, and it appears affordable that it ought to occur eventually.

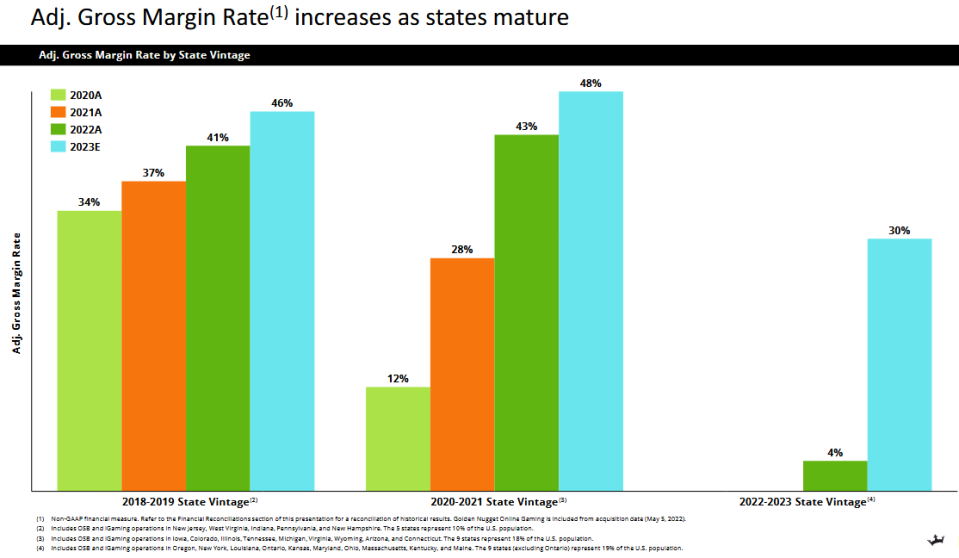

Second (and maybe extra essential), it takes time for DraftKings’ enterprise to achieve its most potential even when a state legalizes its presence, simply because it takes time for a bettor to develop into worthwhile as soon as they develop into a DraftKings app consumer. The corporate stories the typical buyer would not develop into gross worthwhile till the third yr after they’re acquired, after they have been betting some time and have a tendency to wager extra.

That is noteworthy for one overarching motive: A lot of DraftKings’ purchasers are simply now nearing or have solely just lately handed their third yr of being clients. That is why final yr’s per-share lack of $1.73 is predicted to swing — dramatically — to a revenue of $0.85 per share subsequent yr. The corporate is in fact additionally bringing in additional new customers within the meantime, establishing much more revenue development three years after they’re garnered. This can be a margin-expansion cycle that would final for years.

Walmart

Final however not least, add Walmart (NYSE: WMT) to your checklist of shares you may nonetheless be ok with shopping for although they’re flying.

The world’s largest retailer is simply coming off of an unbelievable quarter. Income of $161.5 billion wasn’t simply up almost 6% yr over yr, however handily topped estimates of $159.5 billion. Earnings of $0.60 per share additionally beat estimates of solely $0.52, rising 22% from the year-earlier comparability of $0.49 per share. Similar-store gross sales within the U.S. improved by 3.8%, whereas its e-commerce enterprise grew a hefty 21%.

Briefly, Walmart is firing on all cylinders. That is why the inventory jumped 7% on the day the report was launched, pushing its manner deeper into record-high territory. It is now 63% above its mid-2022 low.

Do not be too intimidated to dive in, although, at the least after letting this previous Thursday’s post-earnings mud settle. Extra bullishness could be within the playing cards regardless of the inventory’s trailing-12-month price-to-earnings valuation of over 27 (which is loads by total market requirements). You are paying the premium you may anticipate to pay for reliability, high quality, and consistency.

See, though the corporate wasn’t ready to take action only a few years prior, in some ways the COVID-19 pandemic — after which the post-pandemic fallout — has confirmed a business-building boon for the retailer. Walmart is without doubt one of the few retailers that is been in a position to preserve the provision of a large assortment of merchandise nonetheless bought at fairly low costs. That is largely the results of sheer scale, and the leverage it is used when coping with its distributors.

A yr in the past, as an illustration, the corporate flat-out informed its packaged shopper items suppliers that it will not be paying their ever-rising costs. They wanted to discover a manner of culling their very own prices, or Walmart would start working with various manufacturers.

Since 2020, Walmart has additionally attracted a lot of clients dwelling in households incomes in extra of $100,000. In spite of everything, with total shopper costs now 22% greater than they have been 4 years in the past, everybody’s feeling the pinch.

In fact, this tailwind may ease if the economic system returns to regular. Thus far, although, the underlying thought of value-minded comfort appears to be the brand new norm, simply as excessive costs seem right here to remain. This clearly works in Walmart’s favor.

Must you make investments $1,000 in MercadoLibre proper now?

Before you purchase inventory in MercadoLibre, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and MercadoLibre wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $580,722!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Could 13, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. James Brumley has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, MercadoLibre, PayPal, Shopify, and Walmart. The Motley Idiot recommends eBay and recommends the next choices: brief July 2024 $52.50 calls on eBay and brief June 2024 $67.50 calls on PayPal. The Motley Idiot has a disclosure coverage.

3 Hovering Shares I would Purchase Now With No Hesitation was initially printed by The Motley Idiot