Shares aren’t lottery tickets or get-rich-quick alternatives, however there are some promising funding alternatives out there that may be transformational forces inside a portfolio. You probably have sufficient threat tolerance, you must take into account just a few shares which can be within the earlier, much less sure levels of their lifecycle but additionally have huge potential and clear aggressive benefits. Generally, these companies can blossom into money stream machines at a a lot bigger scale sooner or later.

These three shares under have a whole lot of potential room for development forward — if all goes proper for them — and getting in early might gasoline returns that may remodel a private monetary plan.

1. Shockwave Medical

Shockwave Medical (NASDAQ: SWAV) is a medical machine firm that is produced a novel therapy referred to as Intravascular Lithotripsy (IVL) to switch calcium buildups within the cardiovascular system. IVL is customized from an efficient therapy for kidney stones involving fast sonic pulses from a specialised catheter that may take away harmful accumulations of calcium in blood vessels.

This strategy is commonly favorable to extra intrusive surgical interventions, and it additionally opens the door to therapy for sufferers who might not have been candidates for current surgical procedures. Shockwave has developed an efficient and promising set of merchandise that ought to expertise stronger demand because the senior inhabitants and prevalence of coronary heart illness rise globally.

Shockwave has encouraging security and efficacy knowledge from scientific trials and a rising physique of handled sufferers. Final 12 months, the Facilities for Medicare & Medicaid Providers (CMS) created a brand new code for hospital reimbursement when procedures utilizing Shockwave’s know-how are used, which is a large step for market acceptance and income technology. It is nonetheless within the comparatively early levels of gaining market traction and educating physicians on the system, which suggests there’s loads of alternative forward.

The corporate reported 41% income development in its most up-to-date quarter,

topping analysts’ earnings forecasts by greater than 30%. The corporate anticipates 25% development for 2024. Such a deceleration is often dangerous information for development shares, however Wall Avenue was really forecasting barely decrease gross sales. Expectations had been already at an attainable degree, which is strictly what development traders ought to wish to see.

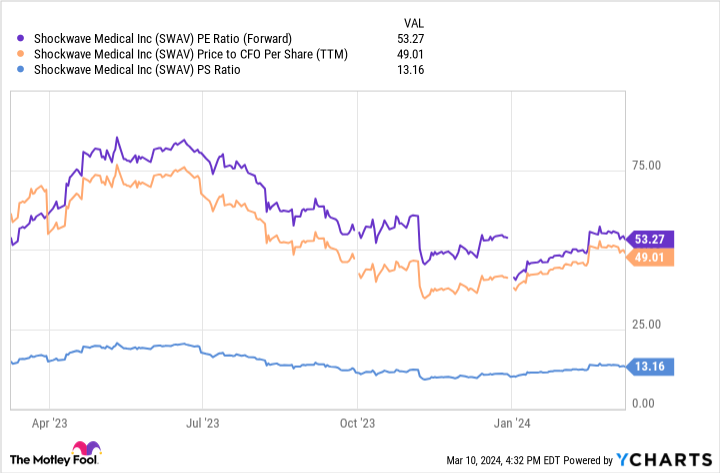

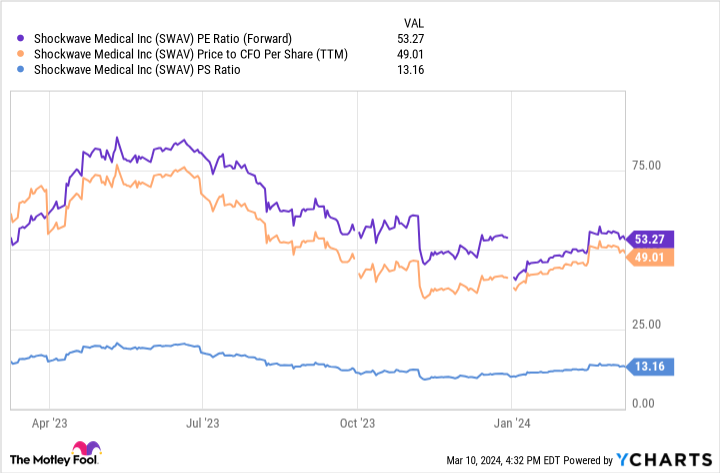

Shockwave inventory seems to be pretty costly, with a price-to-sales ratio over 13 and a ahead price-to-earnings (P/E) ratio over 50. Nevertheless, that 25% development price leads to a PEG ratio of round 2, which signifies that its value pretty displays the anticipated development price. If it does not decelerate in 2024, then the inventory might even be thought-about low cost relative to development.

The shares have a excessive beta of 1.3, so be ready for volatility within the quick time period. Nonetheless, high-beta shares can outpace the market in the event that they’re profitable in the long run. This firm’s market capitalization is slightly below $10 billion, that means it is on the cusp of breaking into large-cap territory. If these therapies develop into commonplace all over the world, there is a ton of room to the upside.

2. Workday

Workday (NASDAQ: WDAY) offers cloud-based software program for organizations to handle monetary features and human capital. These AI-enhanced instruments are helpful for sustaining environment friendly operations, particularly as distributed and international labor forces develop into extra well-liked. Its product suite finally offers higher visibility and insights for administration whereas serving to to maintain staff happier and extra productive. Workday’s platform will get excessive rankings from Gartner, which ranks it among the many leaders in human capital administration software program.

Workday’s potential clients embody non-profits, small and medium-sized companies, and enterprises, so its addressable market is broad. Roughly half of the S&P 500 corporations are Workday subscribers, which is encouraging. Broad adoption signifies robust important demand and buyer traction, however there are nonetheless a whole lot of untapped potential clients on the market.

Analysts take into account Workday a wide-moat inventory, that means that it has a sustainable aggressive benefit. That is pushed by excessive switching prices and its high-quality providing of mission-critical merchandise. Its excessive web greenback retention price presents convincing statistical proof of that moat.

Workday is forecasting 17% to 18% gross sales development subsequent 12 months, roughly in line with its most up-to-date quarter. Subscriptions account for 92% of whole gross sales, which makes money flows extremely predictable relative to different income fashions. That is a useful attribute for a corporation that is not too long ago achieved profitability. Workday’s price-to-cash-flow ratio is just round 32. That is a lovely valuation if it meets its development targets.

At a $70 billion market worth, Workday is not some under-the-radar firm with explosive development forward. It is a longtime firm with good development prospects and an inexpensive valuation that would conceivably ship 5 occasions your funding over the long run.

3. ServiceNow

ServiceNow (NYSE: NOW) broke onto the scene with workflow automation software program for IT providers, which is essential for managing tech groups which can be important for each main enterprise. The corporate has since expanded its providing to incorporate instruments supporting features, together with finance and customer support. ServiceNow is leaning closely into the disruptive energy of AI as its clients look to make use of these capabilities to usher within the subsequent wave of tech transformation.

The corporate boasts robust marks from Gartner, inserting it amongst trade leaders. Its management place is corroborated by glorious retention knowledge — the corporate stories buyer renewal charges which have constantly been 98% and better, and it has constantly expanded buyer relationships over time.

ServiceNow’s income grew 26% in the latest quarter, and it expects gross sales to increase by slightly below 25% subsequent 12 months. It is forecasting a roughly steady adjusted working margin in 2024, so its money flows ought to transfer kind of in proportion to the highest line. The inventory’s price-to-cash-flow ratio is about 45, and its ahead P/E ratio is approaching 60. These are each on the costly aspect however affordable when in comparison with the expansion outlook.

There’s volatility threat inherent in shares with this kind of valuation, however the firm’s mixture of aggressive power and development potential make it a candidate to increase into certainly one of tomorrow’s tech giants.

Do you have to make investments $1,000 in Shockwave Medical proper now?

Before you purchase inventory in Shockwave Medical, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Shockwave Medical wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 11, 2024

Ryan Downie has no place in any of the shares talked about. The Motley Idiot has positions in and recommends ServiceNow, Shockwave Medical, and Workday. The Motley Idiot has a disclosure coverage.

3 Shares That Might Create Lasting Generational Wealth was initially printed by The Motley Idiot