Corporations world wide paid a document $606.1 billion in dividends to their shareholders throughout the second quarter — 8.2% greater than the prior-year interval. Almost 90% of dividend-paying corporations have both held their funds regular or raised them over the previous 12 months.

This information means that proper now is a superb time for dividends. Nevertheless, that is not at all times the case. Downturns and recessions can severely influence the flexibility of some corporations to proceed making these funds.

Whereas some corporations would possibly sooner or later be unable to take care of their dividends, Enterprise Merchandise Companions (NYSE: EPD), Enbridge (NYSE: ENB), and American States Water (NYSE: AWR) are fashions of dividend sturdiness. They’ve continued doling out these funds to traders over time it doesn’t matter what. Due to that, they stand out to some Idiot.com contributors as nice shares to purchase for these searching for dependable dividend funds.

Enterprise is able to pay you (effectively)

Reuben Gregg Brewer (Enterprise Merchandise Companions): The trustworthy fact is that almost all traders will in all probability discover Enterprise Merchandise Companions’ 7.2% distribution yield to be the primary attraction of its inventory. Given the S&P 500‘s miserly present yield of simply 1.2%, that is not surprising. However relating to making a passive revenue stream, there’s much more than that to love about Enterprise Merchandise Companions.

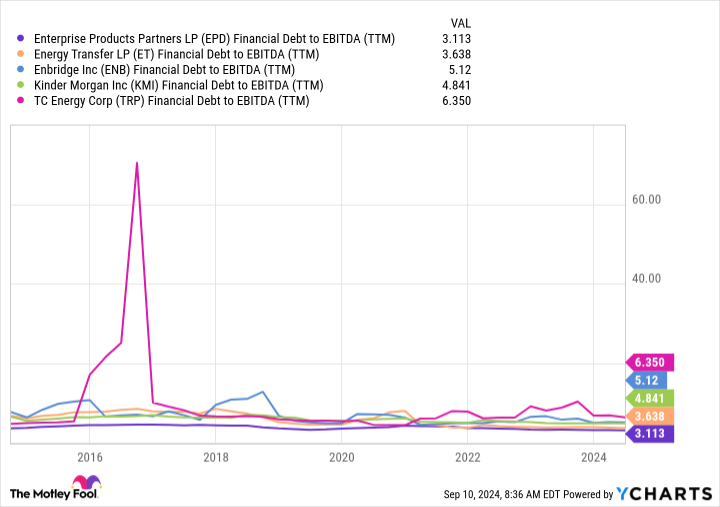

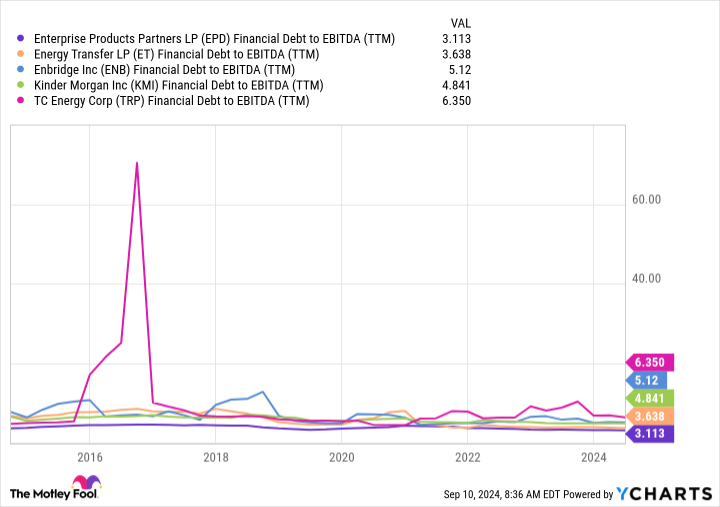

For starters, there’s its place as one of many largest midstream power companies in North America. It owns a nearly unduplicatable community of power infrastructure property — pipelines, storage amenities, processing amenities, and extra — that produces dependable payment revenue over time. That’s what helps the dividend, and its distributable money stream covers its distribution by a protected 1.7 occasions. On high of that, Enterprise’s steadiness sheet is investment-grade rated, so there’s little purpose to fret about it needing to chop its distribution. Additionally notable is the truth that Enterprise is likely one of the most financially conservative gamers in its peer group, and has been for years. So what you see at the moment is actually what you will be getting for the long run.

That each one leads as much as the subsequent huge quantity on the distribution entrance, which is 26. That is the variety of consecutive years that the power firm has elevated its distribution. If you’re in search of a dependable high-yield revenue inventory, Enterprise Merchandise Companions must be in your quick listing.

Confirmed dividend sturdiness

Matt DiLallo (Enbridge): Enbridge pays probably the most dependable dividends within the power sector. The Canadian pipeline and utility firm has made dividend funds for greater than 69 years, and elevated these funds for 29 straight years. That streak ought to proceed regardless of the market circumstances.

Driving that view is the general sturdiness and predictability of Enbridge’s earnings. The corporate has met its annual monetary steerage for 18 straight years. That interval included two main recessions and two different intervals of oil market turbulence. Enbridge has an especially steady earnings profile, with 98% of its revenue coming from cost-of-service or contracted property. It additionally will get greater than 95% of its earnings from investment-grade rated clients. In the meantime, about 80% of its earnings come from contracts with inflation protections in place.

Enbridge’s goal is to pay out 60% to 70% of its steady earnings in dividends. That permits it to retain a significant share of its money stream to fund enlargement tasks. The corporate additionally has a stable investment-grade steadiness sheet. Its leverage ratio was 4.7 on the finish of the second quarter, and is on tempo to slip towards the low finish of its 4.5 to five.0 goal vary by subsequent 12 months as the corporate captures the total good thing about its current pure fuel utility acquisitions.

These offers will assist it develop its earnings over a number of years. As well as, the corporate has an in depth backlog of capital tasks. These assist assist administration’s view that it will possibly develop its earnings at an annual price of round 5% over the medium time period.

With a robust monetary profile and visual progress coming down the pipeline, Enbridge ought to have loads of gasoline to proceed rising its dividend, which yields greater than 6.5% lately. These options make Enbridge a superb choice for these searching for a dividend they’ll financial institution on.

70 years of dividend raises and counting

Neha Chamaria (American States Water): With regards to dividends, American States Water has achieved one thing no different publicly listed inventory within the U.S. has — it has elevated its dividend yearly for the previous 70 consecutive years. That makes American States Water inventory the Dividend King with the longest energetic streak of dividend will increase. Sure, that is one inventory that does not simply pay you a dividend, but in addition sends ever-fatter checks your method yearly, it doesn’t matter what.

It would not take a lot to guess why American States Water has been such a bankable dividend inventory. It is a regulated water utility and generates steady and predictable money flows from its providers. It supplies water providers to greater than 1 million folks throughout 9 states, and likewise has an electrical utility subsidiary. That apart, American States Water’s contracted providers subsidiary supplies water and wastewater providers to 12 army bases within the U.S. below 50-year contracts and one below a 15-year contract.

What’s really outstanding about American States Water’s dividend is its tempo of progress. It has grown its dividend at a compound annual price of 8.8% over the previous 5 years, and eight% over the previous 10. Its newest hike, introduced in August, was an 8.3% enhance. That is rock-solid dividend progress coming from a utility. With American States Water additionally concentrating on no less than 7% payout progress in the long run, this 2.3%-yielding dividend inventory is the sort each revenue investor would wish to personal.

Do you have to make investments $1,000 in Enterprise Merchandise Companions proper now?

Before you purchase inventory in Enterprise Merchandise Companions, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Enterprise Merchandise Companions wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $729,857!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 9, 2024

Matt DiLallo has positions in Enbridge and Enterprise Merchandise Companions. Neha Chamaria has no place in any of the shares talked about. Reuben Gregg Brewer has positions in Enbridge. The Motley Idiot has positions in and recommends Enbridge. The Motley Idiot recommends Enterprise Merchandise Companions. The Motley Idiot has a disclosure coverage.

Rewarding Dividends: 3 Shares That Pay Out No Matter What was initially revealed by The Motley Idiot